What is it Means to Stake Cardano (ADA)?

ADA staking is almost no different from staking other cryptocurrencies. And if you have already read our big article on “What is Cardano,” you will easily understand how to stake Cardano.

So, ADA token owners stake their tokens to actively participate in managing Cardano’s network. Staking is depositing or locking away a large number of tokens. Subsequently, the owners become “validators” (sometimes called “stakers”), whose job it is to suggest and validate new data that is uploaded to the blockchain.

The blockchain is updated by selecting individuals randomly, and those picked are rewarded. Those that lock away more coins have a larger chance of getting chosen, which helps to decrease the number of people spamming the network. Assuming that one ADA is equivalent to one lottery ticket, you can think of it as a lottery system. You have a better chance of being chosen if you invest more in ADA.

Can Cardano (ADA) Be Staked?

Absolutely YES!

Even more, Cardano staking is widespread, much like Ethereum staking. Look, as a Cardano investment, you can keep your ADA tokens on the network. This way, your interest in the network as a whole is based on the number of tokens you own.

And if you assign your tokens to a staking pool, Cardano staking will be more productive. Staking pools are a component of the Cardano blockchain’s security and administration system. In addition, you contribute to the network by executing transactions and validating new blocks when you delegate your tokens to a staking pool.

Thus, in exchange for your contributions to the network, you will be paid as a Cardano staking reward.

Easy peasy!

How to Stake Cardano (ADA)

There’s a choice of two different digital wallets you can download to start staking your ADA tokens: Daedalus and Yoroi.

Let’s look at the Yoroi wallet as an example:

How to Stake Cardano (ADA) in Yoroi

The First Step – Access Your ADA Compatible Wallet

- To stake ADA you will need a Cardano wallet and ADA tokens available. For this guide, we are using the Yoroi light wallet browser extension

- Install the wallet and/or deposit your ADA tokens as needed

- Click the Delegation List tab

- This will take you to the Delegation List

Step 2 – Choose a Blockdaemon ADA Stake Pool

- Enter Blockdaemon in the Search By Id or Name field and click the green search button

- This will display the available Blockdaemon Stake Pools

- Choose a Blockdaemon stake pool (note: you can only delegate to 1 stake pool at a time)

- Click the corresponding Delegate button

- You will see a Processing popup and then the CONFIRM TRANSACTION window

Step 3 – Confirm Your ADA Delegation

- If you’re happy to proceed with the delegation, enter your Spending password and click DELEGATE

- Once the transaction has been completed, you will see the SUCCESSFULLY DELEGATED popup

- Note: With Cardano, you can only delegate your full wallet amount. If you want to delegate less, we recommend that you create additional wallets and split your ADA between them accordingly

Congratulations. You are now participating in the Cardano network

Step 4 – Check Your Cardano Dashboard (optional)

- Click the DASHBOARD PAGE button

- This will take you back to your wallet Dashboard

- Click the refresh icon to update Your Summary

Pros and Cons of Cardano (ADA) Staking

Cardano staking is safe because you won’t lose your ADA tokens.

NOTE: If you already possess ADA for a long time, Cardano staking is a quick way to increase returns. However, it is probably not worthwhile to purchase Cardano to stake it due to the cryptocurrency market’s volatility.

Pros of Cardano Staking

- Staking is much more encouraging if you already have ADA tokens for the long run. You will have a passive source of income, and the yields are frequently higher than those of conventional investments.

- There are no disadvantages to staking all your ADA tokens if you plan to hold them for a while.

- Unlike crypto mining, Cardano staking allows you to make money without the effort, expense, or risk of running a mining rig. Also, with minimum setup and energy use, staking your ADA tokens contributes to the security of crypto networks.

Cons of Cardano Staking

- Staking Cardano carries the same level of risk as keeping it in your wallet. The only real danger is losing the private key to the wallet, which may happen with any cryptocurrency, whether or not staking is included. That is why choosing a reliable wallet to store your tokens is so important. Naturally, hardware wallets are the safest. But if you decide to use a software wallet, you can consider Blocktrade’s wallet a reliable product.

- You will receive different keys for spending and staking if you use a trustworthy wallet. This implies that your ADA tokens won’t leave your wallet if you choose to stake them. Since you can unstake your ADA anytime, you are free to stake as much as you like. Check out our guide on how to choose the best wallet for Cardano.

- Your cryptocurrency asset is always safe, but pool owners could take advantage of you by keeping most or all of the earnings from the pool. So, do your research, and pick the best place to stake Cardano where you feel at ease.

- Unfortunately, ADA’s price is volatile and unpredictable. As a result, the potential losses from cryptocurrency investments could quickly surpass the income from staking if the ADA tokens themselves see a significant value decline.

What Makes Cardano Staking Possible?

Cardano’s blockchain uses the proof-of-stake (PoS) consensus algorithm, making staking on it possible. This mechanism guarantees that all network users act honestly and in the network’s best interests.

It would help if you kept in mind that anyone can join a blockchain network globally. And there is no central authority to ensure that people abide by the regulations.

Instead, the blockchain has consensus methods like proof-of-stake that determine who is chosen to do the crucial duty of adding new data, such as transaction data, to the blockchain.

The picture below illustrates the difference between proof-of-stake (PoS) and proof-of-work(PoW).

Each consensus technique can be seen as a distinct kind of selection test intended to identify people who are honest and deserving of participation.

Is Staking Cardano Profitable?

Coindesk answered this question with a very good example։

Investing $1,000 in Cardano’s native token will get you 1,030 ADA. According to Cardano staking calculators, staking this amount over the course of the year could roughly net you between 46.31 to 59.63 ADA, or between 0.63 to 0.82 ADA per epoch.

Of course, many factors must be considered, such as the costs associated with each staking pool, the number of participants, and the number of blocks successfully suggested by the pool.

Ada Staking Calculator

Yes, you heard that right.

Cardano’s official website has a special staking calculator that predicts an estimate of rewards.

But there is also a disclaimer that warns։.

The actual amount of ADA earned may vary and will depend on several factors, including actual stake pool performance and changes to network parameters.

Therefore, it is probably a good decision to use such calculators before staking, but it is also important to remember that their predictions are not 100% accurate.

Where Can I Stake Cardano?

As we mentioned above, if you want to stake directly from the wallet, there are two options։ Yoroi Wallet and Daedalus Wallet, which support many features that advanced users need.

But Cardano can be staked using cryptocurrency exchanges too:

- Binance is a well-known cryptocurrency exchange and a wise choice for staking in general.

- Kraken offers reasonable stake return rates and has a competitive pricing structure.

- Crypto.com – For beginners, Crypto.com is the best option because it is simple to use and comprehend.

- If you live in the UK, CEX.IO is a reliable cryptocurrency exchange for Cardano staking.

- With kucoin’s ADA fixed rates, your investment is slightly more predictable.

NOTE: We at Blocktrade don’t suggest staking ADA on exchanges.

What Are The Risks of Staking ADA?

There are always risks associated with any investment. However, the token dropping to zero is the first and most evident risk of staking any crypto asset.

We have a very informative article on Cardano price predictions. Don’t forget to read it!

Changes in interest rates are one of the most particular concerns too. A lower interest rate will apply to pools close to capacity than those with fewer participants. This is so that awards can be distributed to a broader number of participants in the pool.

Another problem with staking is that, although the delegated ADA can be moved at any moment, you cannot utilize it while it is locked up. Some centralized exchanges, like Binance, permit staking through their platforms but demand that tokens be locked up for 30, 60, or 90 days.

And finally, staking pools also contain fees.

Cardano Makes Staking Easy Through Delegation

Owners of Cardano can assign “stake pool operators” to the staking task. As the name is known, tokens belonging to “members” are pooled. Anyone who has the required knowledge and equipment can operate a staking pool. Before joining, users can evaluate each pool’s efficiency, availability, and size.

A person must “delegate” their tokens after selecting the appropriate Cardano staking pool to stake them in. Coins can be unstaked and re-staked in as many different pools as desired. After the subsequent time period, your assets are transferred.

Cardano divides time into 432,000 one-second “slots” called “epochs.” Five days pass between epochs.

Each epoch comes to an end with a snapshot. Snapshots record the distribution of staked ADA to the pool’s participants and compute payments.

You will receive a portion of the delegated coin, not its whole value. Therefore, the value of ADA could change while you are staking.

Final Thoughts

Although some risks are associated with the state of the crypto market at any given moment, it is mostly safe to stake Cardano (ADA). As you can see, technically, it’s also a simple process, just a few clicks. And in terms of profiting, many investors choose to stake because it is a way to make money without having to do anything. You also make the blockchain run faster and more reliably.

Do your own research, and if you find this investment strategy suitable for you, make a final decision.

FAQ

If you already hold ADA tokens for the long term, staking is a pretty reasonable idea. You will earn a passive income, and the yields are typically higher than traditional investments.

You can use Cardano’s staking calculator to find out roughly how much profit you can expect

Yes, you can.

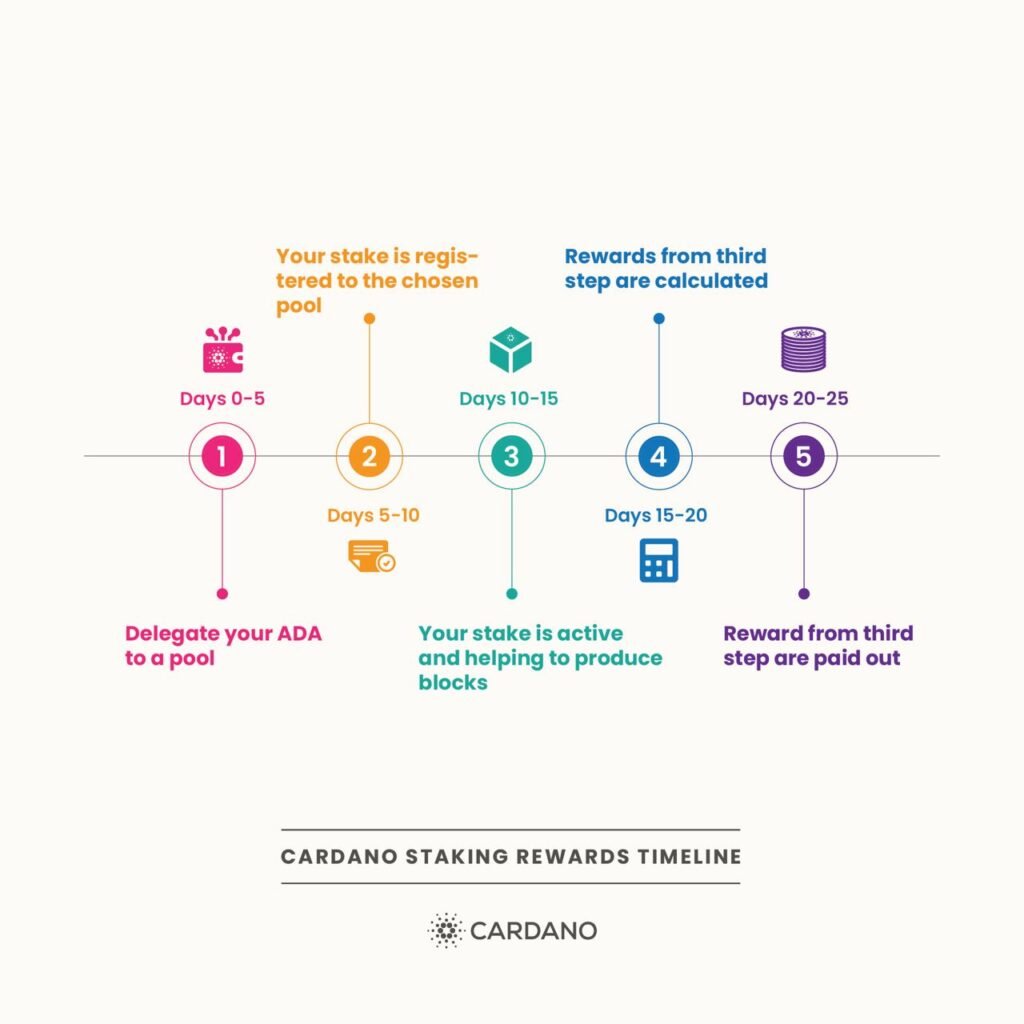

Your rewards are paid with a 25-day delay. From that point, you will earn rewards every five days (1 epoch). However, your reward for each 5-day cycle will be calculated for your ADA balance 25 days ago from the current cycle. Your rewards are paid out two epochs after earning them.

The reward rate can move up or down depending on multiple factors primarily determined by the network’s protocol. The reward rate can also be influenced by factors including, but not limited to, validator performance, the amount staked/stakers, and inflation and savings rates set by the network.