Here, we go into the backstories of both Cardano and Solana to see where they overlap, where they differ, and which is more fitting for the “Ethereum killer” title.

Overview Of The Main Differences And Similarities: Cardano vs. Solana

To start the “Cardano vs. Solana 2023” battle, of course, you must first examine their similarities and differences.

So, Cardano and Solana have a lot in common. Both projects give their communities access to many features in their Decentralized Finance (DeFi) ecosystems. And what is more important, both Cardano and Solana have solved the scalability problem, making them direct competitors to Ethereum. However, Ethereum has a head start because it launched earlier.

A comparison of Solana and Cardano will show the pros and cons of each project and help you decide which one is better to buy. In general:

- Solana is popular because it has a fast transaction speed that neither Cardano nor Ethereum can beat.

- On the other hand, Cardano is different because of its unique validation system.

But is it enough to choose between Cardano and Solana? Of course not. Let’s see what are they.

What Parameters Should You Consider When Comparing Two Coins?

Comparing two cryptocurrencies is not that easy, especially if they are competing with each other on the market. Each digital currency has a particular advantage over the other, making it difficult to choose between them.

That’s why you should consider different parameters to compare two coins. Although evaluating these aspects may be challenging for beginners, understanding them can provide a better grasp of the crypto world.

When deciding between two cryptocurrencies, it is important to consider the following parameters.

1- Technical Factors

Cryptocurrency technical factors are the aspects of a cryptocurrency that can be measured or analyzed using mathematical indicators, historical data, and charts. Therefore, if you want to compare two cryptocurrencies by numbers and mathematics, these factors can help.

- Transaction Per Second: In the context of blockchains, transactions per second (TPS) is the number of transactions that a network can handle each second. It demonstrates the speed of the blockchain.

- Average Fee Per Transaction: A transaction fee is paid when a certain amount of cryptocurrency is transferred from one wallet to another.

- Transaction Latency: The time that the transaction was submitted to the network.

- Number of Validators: A ‘Validator’ on a Blockchain is like a banker who verifies every incoming transaction. A transaction will only be completed on the blockchain when it has been verified by the validator. A higher number of validators can improve the security of the blockchain. On the other hand, it may lead to a slower consensus process.

- Total Transactions to Date: This shows the number of transactions already completed.

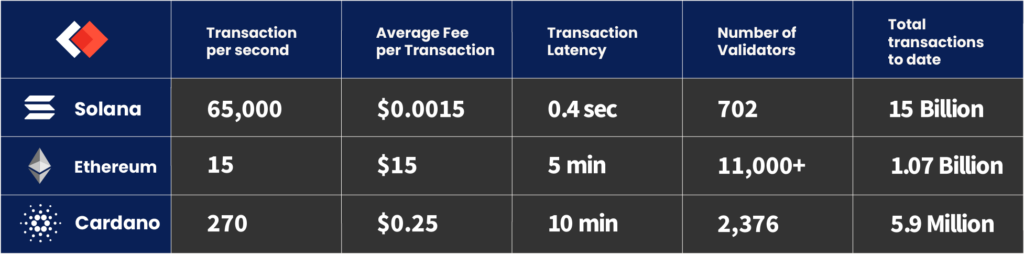

In the following example, we have compared Solana, Cardano, and Ethereum based on the listed factors. Let’s see what the following data can tell us:

Sum Up

As you can see, Solana can do 65,000 transactions per second. Compared to the other two, Solana is the fastest blockchain.

Being the oldest cryptocurrency on this list, Ethereum has the highest number of validators, indicating it can be more secure or trusted than the others.

If you use the Solana blockchain, you should pay the least transaction fee, which is $0.0015 per transaction, making it the most cost-effective option. After that, Cardano can be a great choice.

Note: If you want to choose between Cardano and Ethereum, we recommend you read the guide about Cardano vs Ethereum to discover which one can be a better investment for you.

However, it is important to note that all these numbers might change in the future due to the upgrades to the blockchains. It is essential to check updated data before buying cryptocurrency.

Furthermore, it might be difficult for a beginner to analyze this data. That’s why cryptocurrency experts usually do all these analyses, which are known as technical analyses of each cryptocurrency.

2- Qualitative Factors

Unlike the technical factors, the qualitative factors are not measurable. These factors are non-financial aspects that are important for evaluating the viability and potential of a cryptocurrency project. If you’re considering buying cryptocurrency, it’s crucial to read up on fundamental analysis, which includes qualitative factors such as:

Social Media and the Project Website

According to experts, it’s crucial to consider a first high-level overview of the project. Then, visit the cryptocurrency project’s website and social media pages to learn more about the project, the team, and the community and get a feel of how socially engaged it is.

A strong and active community can contribute to a cryptocurrency’s adoption and success.

The Team

The team’s reputation and expertise can significantly influence a project’s likelihood of success or failure. If the team is not publicly acknowledged, that raises suspicion (Bitcoin is the exception).

White Paper and Road Map

As an investor, you need to look at the project’s white paper and road map to determine how much a coin or token will be worth in the long run. A good cryptocurrency project will have a solid white paper and a clear roadmap.

- A white paper is a document made by a crypto project and released to the public. It gives technical information about the project’s idea to help you decide if it has any value.

- A road map helps set expectations for how a crypto project plans to grow and change if it is successful and widely used.

Major Investors

Find out if there are already investors in the project and, if so, who they are. It’s a good sign if big names or well-known investment firms have already put money into the project. It means they’ve done their research and think the project will work in the long run.

The Community

For many crypto projects, the strength of the community behind the project can make or break its potential. The size and enthusiasm of the community play a significant role in how well the project starts and how well it does over time.

However, it would be best to be careful when judging a coin or token using this factor. Sometimes, hype can be more considerable or essential than a project’s real utility or value. You shouldn’t invest in a coin or token based on hype alone. Instead, it would help if you took the time to learn about the above factors before putting too much stock in its community.

Note: All the mentioned factors (technical and fundamental) are important for investors. Hence, it is crucial to thoroughly read about them and evaluate the opinions of experts to gain a comprehensive understanding.

Cardano vs Solana – Differences

Now let’s discuss the differences between Cardano and Solana in more detail:

Transaction Fees

Both Cardano and Solana have far lower transaction fees than Ethereum. But, their pricing is also very different. In contrast to Solana, which charges an absurdly cheap transaction cost of $0.00015 for every transaction, Cardano sets an average price of $0.25. These numbers show that trading on Cardano is 800 times costlier than trading on Solana.

Blockchain Validation

Cardano and Solana’s platforms work similarly but use different methods to validate the blockchain.

- Cardano uses the Proof of Stake (PoS) system to verify transactions. This system chooses members to make new blocks based on how much they have invested in the network.

- And on the other hand, Solana creates a hybrid system by combining a Proof-of-Stake (PoS) with a Proof-of-History (PoH) approach, which is primarily characterized by its ability to enhance scalability.

Solana vs Cardano Speed

As mentioned earlier, when it comes to speed, the Solana network is unrivaled. Although it typically averages approximately 2500 transactions per second (tps), it claims a potential peak capacity of 65,000 tps, which explains why this blockchain has recently become one of the most well-known. Cardano appears slow in contrast with 270 transactions per second. Therefore, if the blockchain speed matters, Solana definitely wins.

Cardano vs Solana – Similarities

We saw the differences, and now the similarities

These competitors have similarities too:

- Both of them use Proof-of-Stake consensus mechanism. So, both are energy-efficient.

- Both networks have been created to promote smart contract technology and to operate as an environment for ambitious developers’ initiatives.

- Cardano and Solana have both outperformed Ethereum regarding transaction processing speed, which is precisely what they set out to do.

- Compared to the Ethereum platform, both networks have low gas prices and the potential for significant scaling thanks to outstanding and special technological capabilities in Solana’s case. For example, Cardano can handle 250 transactions per second (tps), whereas Solana can handle 2,700 tps on average.

Environmental Impact of Cardano and Solana

Cardano and Solana also have one other fundamental similarity that requires a separate topic.

Due to their strong commitment to minimizing environmental effects and solid emphasis on sustainable systems, Cardano and Solana are known as “green” cryptocurrencies. Furthermore, both employ the Proof of Stake (PoS) method, which consumes less energy than the Proof of Work (PoW) method used by other blockchains like Bitcoin. On their website, Cardano even states that its Ouroboros PoS protocol is far more energy-efficient and enables Cardano to “grow safely, sustainably, and ethically, with up to four million times the energy efficiency of bitcoin.”

The typical Solana transaction requires 2,707 Joules, compared to proof-of-work blockchains like Ethereum (equivalent to 287,305 Solana transactions) and Bitcoin, which claim to be “so efficient that it has an energy effect a fraction of other blockchains and has the figures to back it up” (equal to 2,738,710 Solana transactions). The Solana website offers energy comparison tools and energy impact reports to showcase the network’s efforts at sustainability and efficiency.

Note: Due to the recent changes made to Ethereum, including the introduction of Ethereum 2.0, this cryptocurrency no longer uses the Proof of Work (PoW) mechanism. Accordingly, it is expected that Ethereum will become more energy-efficient in the future.

Cardano or Solana? Which is the better Investment?

This is a really tough question.

Both Cardano and Solana are blockchains that care about the environment, are designed for DApp and smart contract initiatives, and aim to provide speed and scalability to the general public.

Due to the volatility of the crypto market, no one can tell you if a cryptocurrency will definitely be a good investment in the future. However, apart from the mentioned factors, there are other things you can consider while buying a cryptocurrency as an investment, including the historical price, current price, price predictions and use cases of each cryptocurrency.

Well, it’s time to compare the tokens instead of the blockchain. Let’s see what path Solana and Ada have traveled so far.

ADA vs. SOL: Historical Price Action Reviewed

A Cardano vs. Solana comparison can only be considered complete concerning the historical prices of the two.

- Cardano token (ADA) was released to the market on September 1, 2015, with an initial price of $ 0.024 per coin. It reached its all-time high price of $3.10 in September 2021. Currently, ADA is $0.31 in November 2023.

- Solana token (SOL) was released to the market in March 2020, with an initial price of $0.22. It didn’t take a long time until it reached its all-time high price of $260.06, which happened on November 6, 2021. Currently, the price of SOL is $40.55 in November 2023.

Both currencies have fluctuated in value along with the rest of the cryptocurrency market. That’s why we have made a complete guide Cardano price predictions, which can help you have a better overview of its possible future.

Cardano in Popular Culture

As we mentioned above, when analyzing the strength of a cryptocurrency, you also need to examine the buzz surrounding it. In the context of Cardano vs. Solana, let’s see how pop culture has reacted to these two tokens.

Cardano has been in the headlines for all the right reasons over the years and has gained several fascinating collaborations and celebrity fans:

- Samsung and Veritree joined with Cardano to address climate change via land restoration projects.

- New Balance agreed with Cardano to validate the company’s premium range of training sneakers.

- Cardano collaborated closely with the Ethiopian government to develop a blockchain-based system for universal student credentials.

- DISH Network, a TV & Wireless provider, incorporated the Cardano blockchain into its telecom company to offer digital identity services to Dish consumers.

- Cardano collaborated with esports firm Rival to issue and distribute non-fungible tokens (NFTs) for exhibiting Rival’s sports franchises.

- Gene Simmons, leader of Kiss, invested in Cardano in 2021…

Solana in Popular Culture

Since its introduction in 2020, Solana’s network has acquired several prominent partnerships and endorsements despite being a relative newcomer to the cryptocurrency market:

- Michael Jordan, a legend in the NBA, debuted his first NFT collection on the Solana-based platform HEIR.

- In February 2022, Solana debuted Audius, a completely decentralized music platform.

- In January 2022, Bank of America lauded Solana and predicted that blockchain technology would become the “Visa of the digital asset ecosystem.”

- Jason Derulo, an American musician, was unable to resist Solana’s allure…

Where to Buy Solana and Cardano

Both cryptocurrencies are available on Blocktrade. So, if you decide to buy Cardano (ADA), there are several payment methods you can choose from. You can either buy Cardano with credit cards or use debit cards to purchase Cardado. If you like to do most of your transactions using your phone, there are other options, too. Depending on your phone, you can buy Cardano via ApplePay or use GooglePay to buy Cardano (ADA).

The same payment methods are also available to buy Solana (SOL). Apart from the other options, such as buying Solana via credit cards or debit cards, you can use PayPal to buy Solana as well.

Final Thoughts

Based on what investors are looking for, one might conclude which cryptocurrency is better to purchase, Solana or Cardano.

Solana is a new project that has shown promise over the last year but has yet to undergo complete decentralization and is known to face minor technical difficulties occasionally. Nevertheless, investors interested in this project should choose it since it has had significant growth. At the same time, Cardano may be the logical choice for investors who can accept steady growth with an established scientific basis and a clear path. However, being known to miss deadlines often.

Solana and Cardano both want to reach the same place, but they have different ideas about how to get there. For example, Cardano wants scalable, fully decentralized networks run by the community. Solana gives its users fast transactions with a low fee and a semi-decentralized network, which hasn’t been seen elsewhere in the crypto space.

Solana and Cardano are both ambitious projects with growing communities that give users a choice between stable and quick transactions. Investors need to make their choices based on facts and not their feelings.

Ultimately, choosing a cryptocurrency as an investment is risky due to the volatility of this market. Therefore, it is not possible to say if one cryptocurrency will be more profitable than others. That’s why it is important to do your own research to collect updated data about each cryptocurrency.

FAQ

It is impossible to directly answer this question because it depends on a specific investor’s preferences and strategy. Each cryptocurrency has its own benefits and drawbacks. Furthermore, no one can foresee the future of cryptocurrencies to see if they will be profitable. Therefore, check different aspects and factors whenever you decide to buy either of them.

It depends on what you mean by “better.” Various cryptocurrencies are superior to Solana in some parameters but at the same time, inferior to it in some other parameters.

Many experts predict Cardano to have a bright future. But to say that it has a greater potential than other tokens is very relative.

Because Solana runs a deflationary system in which the SOL tokens used to pay transaction fees are burned and taken out of circulation. This helps to reduce the impact of the number of coins and inhibits prices from going down drastically.

It depends on what you mean by “better.” Each cryptocurrency may have some points that make it seem better than another crypto. Furthermore, people buy cryptocurrencies for different reasons, such as long-term investment, trading, or using on different platforms. Therefore, you should decide what you want to do with a cryptocurrency, then compare them to see which one is better.

There are various currencies in the same weight class as Cardano, but perhaps the main competitor remains Ethereum.

Cardano and Solana are already similar in many aspects. The future of none of them is predictable at the moment.

Considering various objective and subjective factors, Cardano and Solana can be considered good investments.