Several other decentralized exchanges have started since then, but Uniswap is now the most well-known by a wide margin.

In this article, we’ll closely take a look at the following topics: What is Uniswap, and how it works?

What is Uniswap?

To make the long story short, we can say that Uniswap is both a decentralized exchange and a cryptocurrency, which we are going to explain one by one. Uniswap is the fourth largest decentralized finance (DeFi) platform that enables users to trade or market any ERC-20 token without involvement from an intermediary

It is very important to note that Uniswap is a different type of exchange. It doesn’t charge fees to list new coins as centralized exchanges do. This also means that users always have control of their funds and don’t have to give up control of their private keys like they would on a regular exchange. This reduces the risk of losing assets in the event of a hack.

How Does Uniswap Work?

The Uniswap platform uses smart contracts that run on the Ethereum blockchain. Those programs allow blockchain to execute more advanced transactions than simply sending cryptocurrency from one person to another. Thus, people can trade a wide range of digital assets.

Uniswap platform also employs Liquidity pools for exchanging different pairs of digital assets.

A liquidity pool is a user-generated pool of cryptocurrencies or tokens locked in a smart contract and used to help trades between assets on a decentralized exchange.

The Uniswap blockchain is always updated with the latest trade information from users. And, of course, it is an automated market maker because it doesn’t need any help from a central authority.

Proof-of-work requires vast computing and energy resources, which support transaction processes and generate new cryptocurrency.

Users of Uniswap have numerous options for taking part in the decentralized exchange:

- Create new markets: You can use smart contracts to create new markets for exchanging new pairs of digital assets.

- Swap assets via existing markets: You can use the Uniswap platform to swap digital assets via decentralized markets that have already been created.

- Provide liquidity and earn rewards: You can provide liquidity by staking—agreeing not to trade or sell—your digital assets. Those who stake their digital currencies on the Uniswap platform are rewarded with UNI tokens. We will review Uniswap staking in a separate article. Don’t miss it!

- Participate in Uniswap governance: UNI token holders are empowered to govern the Uniswap platform.

IMPORTANT! You need to connect a suitable digital wallet to use the Uniswap network. Users of Uniswap also need ether (ETH) to pay any transaction fees. They may add up because the Ethereum platform charges a fee for Uniswap transactions.

In the “ Uniswap review” article, we in-depth analyze and evaluate the various processes underlying the work of Uniswap.

What Is Uni Coin?

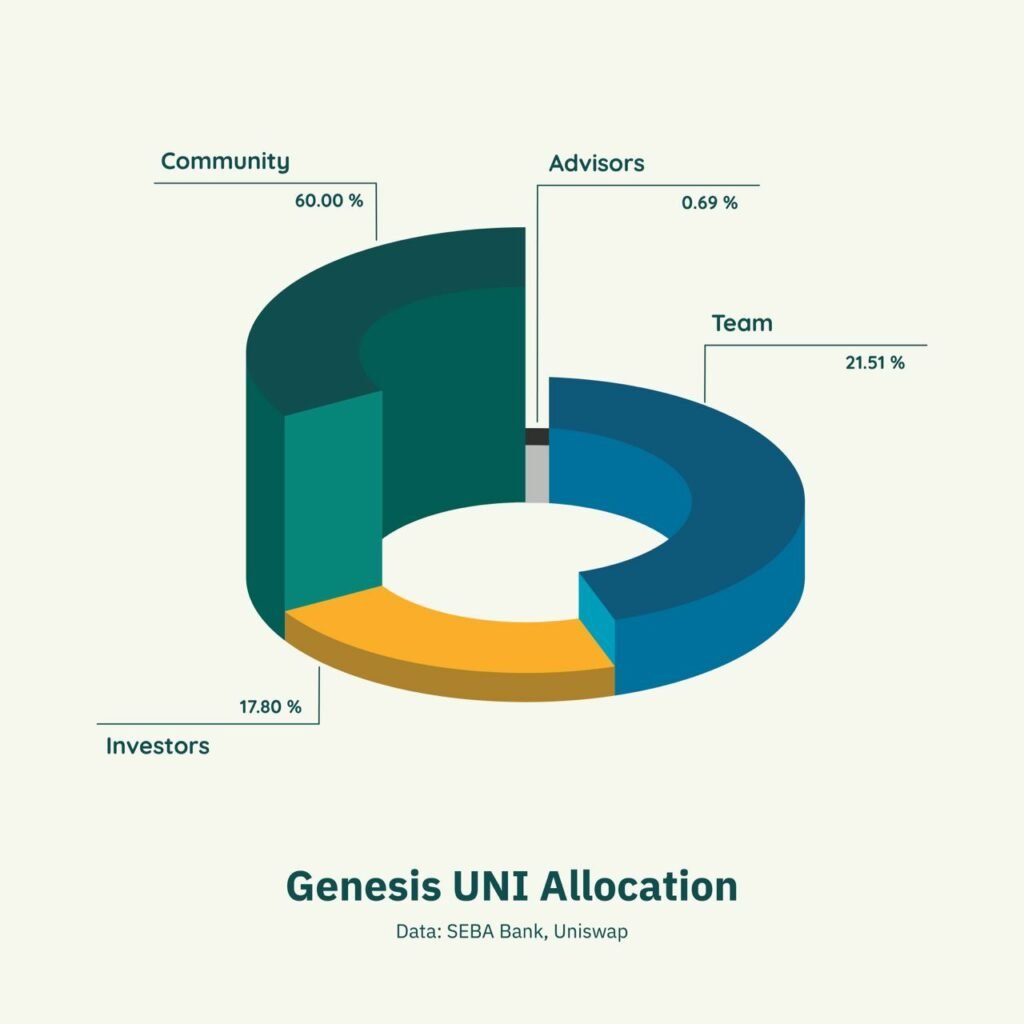

In order to provide community ownership over the network, Uniswap launched the UNI token. This enables stakeholders to vote on essential protocol modifications and development efforts. When Uniswap launched the token in September 2020, it used a novel distribution method by “airdropping” 400 UNI tokens to any Ethereum address that has ever used the protocol. The airdrop, valued at the time at about $1,400, was sent to over 250,000 Ethereum addresses.

Airdrops have recently gained popularity as a means for DeFi applications to thank loyal customers; Uniswap has said that it intends to give away a total of 1 billion UNI over a four-year period.

What The UNI Coin Is Used For?

As you can already guess: UNI, the native token of Uniswaps, is a governance token. This allows holders to decide how the platform should grow going forward, including how newly produced tokens should be allocated to the community and developers and any adjustments to fee structures.

UNI is a new sort of token that grants users control powers over the protocol as well as a percentage of all transaction fees paid to the platform.

One of the main reasons for creating the UNI coin was an attempt to keep users from switching to the competing DEX SushiSwap.

Check out the comparison between Uniswap and Sushiswap to discover which one is a better investment.

Advantages And Disadvantages Of Uniswap

Many cryptocurrency professionals and analysts predicted a promising future for UNI. This makes UNI an attractive investment option for traders and investors. We also covered this topic in the “Is Uniswap a good investment?” article. It will help you in making an investment decision.

But now let’s see which advantages make Uniswap attractive, and on the contrary, what are the disadvantages of that system.

Uniswap Pros

✅Smart contracts allow asset trading that may be cheaper and more efficient.

✅Allows the decentralized exchange of many digital assets

✅Uniswap users can earn UNI by agreeing not to sell or trade their cryptocurrency.

✅The decentralized control of the Uniswap platform lets anyone join.

Uniswap Cons

❌Uniswap only allows the exchange of cryptocurrencies that are compatible with Ethereum.

❌Proof of work is a time- and energy-consuming process.

❌Users must have ETH to pay transaction processing fees

❌To use a decentralized exchange, you need a compatible, self-hosted wallet.

History Of Uniswap

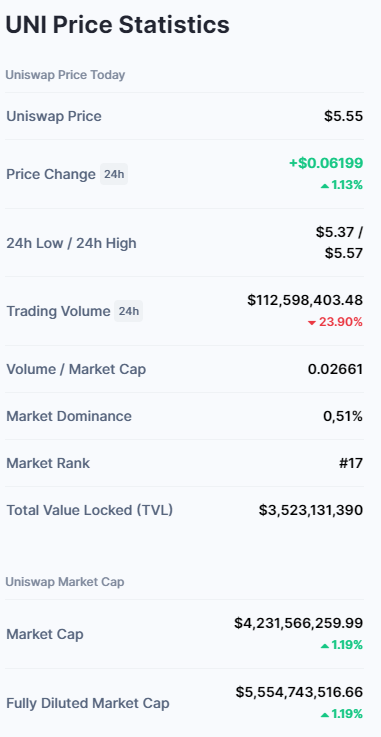

Uniswap is one of the biggest Ethereum blockchain-based decentralized exchanges (or DEX). It enables users anywhere in the globe to exchange cryptocurrencies directly. As of the end-2022, UNI, the governance token of Uniswap, is the 20th biggest cryptocurrency by market capitalization, with a total value of approximately $4.4 billion.

How UNISWAP got started

So, some new approaches were needed!

And that is when Hayden Adams, the creator of Uniswap, presented the revolutionary Uniswap around the second half of 2018. Ethereum co-founder Vitalik Buterin’s Reddit post on AMM (Automated Market Makers) inspired him to create Unipug, which was eventually renamed Uniswap.

AMM lets people trade without brokers and centralized control. In such a system, there is no need for a central authority to match buyers and sellers. Instead, buyers and sellers are matched automatically by smart contracts. These smart contracts take into account the supply and demand of each token to determine the price.

Such a great solution!

Uniswap V1

Introducing AMMs

Between October and November of 2017, Adams created proof-of-concept AMMs, including a website and a smart contract. If you don’t know what is the smart contract, let me remind you. So basically, It is a program that allows blockchain to run more advanced transactions than simply sending cryptocurrency from one person to another.

Then Adams began working on five main things:

- Complete smart contracts so they can be used.

- Make a trader interface that is responsive and easy to use.

- Check the security of the smart contract.

- Get the white paper done.

- Make the documents for developers.

After passing all the required technical tests, it was decided to make the first version of Uniswap available to the public.

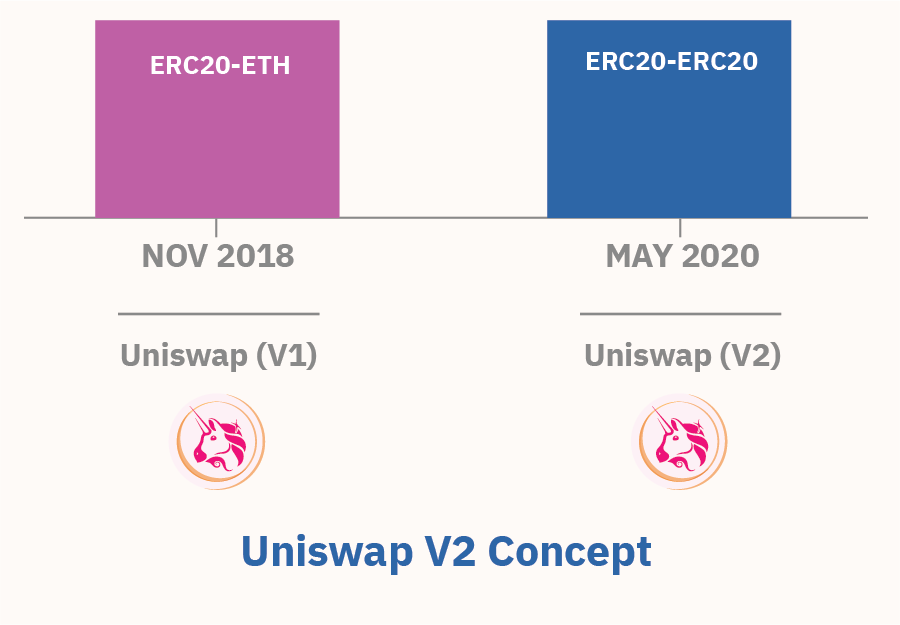

Uniswap V2

Optimization, Decentralization, and Security

In May 2020, Uniswap released Uniswap V2, the second protocol version.

The ERC20/ERC20 liquidity pools were the most critical changes. Before V2, one of the currencies in each liquidity pool had to be ETH. With the introduction of ERC20 token/ERC20 token pools in Uniswap V2, any ERC20 token can be pooled directly with any other ERC20 token.

“ERC20” refers to a scripting standard used within the Ethereum blockchain. This technical standard dictates a number of rules and actions that an Ethereum token or smart contract must follow and steps to be able to implement it.

This change made it advantageous for liquidity providers who can keep a wider variety of ERC20 token equivalent holdings without being forced to own ETH.

For example, if a user wanted to trade USDC for DAI, they had to trade USDC for ETH and then ETH for DAI. This usually led to higher gas fees and more slippage.

Introduction of UNI Token

Besides that, the protocol’s liquidity providers were compensated with additional UNI tokens.

The distribution of a total of 1 billion UNI tokens went as follows:

Uniswap v3: What Are the Newest Features

Efficiency, Security, and License

On May 4, 2021, Uniswap launched its third version, Uniswap v3, which introduced some new features and improvements, such as:

- Concentrated liquidity, which allows liquidity providers to specify price ranges for their capital, optimizing their returns and offering more control.

- Multiple fee tiers, which allow liquidity providers to choose different levels of fees based on the expected volatility of the pair, balancing their risks and rewards.

- Customizable pools, which allow liquidity providers to create their own pools with their own rules and parameters, enabling more innovation and diversity.

- Non-Fungible Liquidity

- Flexible Fees

- Advanced Oracles

- License

NOTE: Since its establishment, Uniswap has dominated the DEX market and ranked among the top DeFi platforms globally. With each subsequent iteration, they introduced innovation.

Understanding Uni Coin’s Value

UNI coin is a relatively new cryptocurrency that joined the market in 2020. It is backed by Ethereum and it’s doing much better than its competitors. The total value locked (TVL) of UNI on the market is over $5 billion, which is incredible for a newcomer and has left many crypto analysts speechless.

But what factors underlie the formation of the UNI’s value?

You can learn more about UNI coin price predictions in our separate article. Here we will present only two main factors that affect the predictions:

- UniSwap – Highest TVL (Total Value Locked)

Uniswap’s decentralized exchange has a total value of $5 billion locked up in it. This makes it the fourth-largest DEX in the crypto industry.

This greatly affects where the UNI coin will go in the future. - UniSwap – Developer’s Favorite DEX

Good statistics make Uniswap a profitable venue for developers to contribute code. According to cryptanalysis, Uniswap has broken Solana’s daily GitHub code contributions record by receiving 1,000 uploads. GitHub is a host platform where over 83 million developers shape the future of software. This shows that Uniswap is establishing a foothold in the development sector, where programmers can discover and use what the platform offers. Uniswap might succeed.

More than anything else, UNI crypto price predictions are based on how popular, transparent, and easy to get the UNI coin is. The reputation of UniSwap has also helped it gain the trust of liquidity providers.

How Do You Make Money On Uniswap?

On any DEX, there are essentially two methods to profit:

1. First and foremost, buying and selling crypto-assets. A successful transaction often needs traders to have vital timing and insight.

2. The second way to make money on DEX is to become a liquidity provider.

When you put money into a liquidity pool on Uniswap, you must put an equal value of the two tokens. Then you will get a liquidity provider fee. This fee is based on how much liquidity you have given. It is usually 0.3%, but it can go as high as 1% for trading pairs that don’t happen very often.

When you provide liquidity on Uniswap, you will get a liquidity pool token in return, which is also an ERC20 token. The value of these liquidity pool tokens goes up when transaction fees in the pool go up. So, when you want to get your transaction fees, you’ll exchange your liquidity pool token(s), which will be burned, and you will get your original capital back along with your accumulated fees.

Setting this aside, how can decentralized exchanges generate revenue?

The picture below illustrates the process.

The answer is straightforward: every time a transaction is done on that DEX, a trading fee is charged. The liquidity providers are subsequently given a portion of the trading charge to maintain the ecosystem.

What is the Gas Fee on Uniswap?

A network fee is a fee you pay to the miners of the network you are using to send or receive cryptocurrency. A gas fee is just another name that many use instead of a Gas fee.

A network fee must be paid for every transaction on the blockchain. This is because miners don’t trust a central authority to check and process transactions. Instead, they use their own computers to do this. In exchange, network fees pay miners for their work. Network fees also give miners a reason to keep bad users off the network.

Even if your transaction fails, you can’t get your money back for these fees. Miners still have to use their tools to figure out that your transaction didn’t go through.

Your network fee will depend on which network you use.

The Ethereum blockchain pays miners in ether (ETH) and is called Gwei for network fees. But on the Polygon network, the network fees are paid in MATIC.

According to Uniswap’s official website, Uniswap does not receive payment from network fees.

Uniswap Taxes

So now that everything is clear with fees and prices, what kind of taxes are there in Uniswap?

Most tax offices worldwide haven’t embraced DeFi. They haven’t offered clear tax instructions for DeFi platforms like Uniswap. However, crypto tax is well-documented.

We just have to apply crypto tax regulations to DeFi.

Cryptocurrency is taxable. Let’s look at each transaction to determine the tax you will pay.

Yes. In most countries, trading one token for another is subject to Capital Gains Tax.

For example, if you traded UNI for ETH, you would pay tax on any gain you’d made on your UNI. That’s the difference in value from when you got your UNI to when you traded it.

NOTE: So far, only the HMRC in the UK has given clear instructions on this. They say that they see these transactions as taxable events and charge Capital Gains Tax on them.

Flash swaps work just like any other trade, even though you don’t put up any capital at first. At the end of the transaction, you’ll have traded one token for another, so any profit you made will be subject to Capital Gains Tax.

Yes. But the type of tax you’ll pay on staking depends on where you live and how the DeFi protocol you are using works.

How To Use Uniswap?

Although getting started with Uniswap is relatively simple, you must first ensure that your wallet is set up to handle ERC-20, such as MetaMask, WalletConnect, Coinbase wallet, Portis, or Fortmatic.

Once you have one of those wallets, you must add ether to it before you can trade on Uniswap or pay for gas, which are the Ethereum transaction costs.

Depending on how many individuals are utilizing the network, gas fees change in price. When making a payment via the Ethereum blockchain, the majority of ERC-20-compliant wallet providers offer you three options:

- Slow

- Medium

- Fast

The most affordable choice is slow, the most expensive is fast, and the middle option is medium. This affects how fast Ethereum network miners execute your transaction.

In the “Is Uniswap safe?” article, we cover both the security concerns on Uniswap and some issues regarding connecting your wallet to the Uniswap network.

Final Thoughts: How Can I Invest in Uniswap (UNI)?

And the final question: How to invest in Uniswap, and is it worth it?

We have answered this question extensively in the corresponding article, “Is Uniswap a good investment?”. But in any case, we will also briefly do it here.

So, you can invest in Uniswap by purchasing the UNI token. Using a centralized cryptocurrency exchange like Coinbase or Kraken is the simplest method to purchase UNI.

Additionally, You may also purchase UNI through the Uniswap platform using another cryptocurrency, such as Ethereum.

But is it worth it?

If you trust the price estimates of analysts and specialists at crypto news and prediction sites, Uniswap might be a wise investment. With That being said, you should be aware that most investments in the crypto finance field are based on two factors: risks vs. returns.

FAQs

Your chosen online broker will determine the minimum amount that you can put into UNI tokens.

UNI had a price of $1.10 per coin on its first day, September 17, 2020

Uniswap has a maximum supply of 1 billion

Like any ERC20 token, you can store your Uniswap(UNI) on reputable Ethereum wallets like MetaMask, WalletConnect, Coinbase, Portis, or Fortmatic.

The cryptocurrency experts have analyzed the prices of Uniswap and their fluctuations during the previous years. It is assumed that in 2025, the minimum UNI price might drop to $17.53825, while its maximum can reach $21.46785.

By 2030, the suggestion was that UNI could potentially have grown to $40.95.