In this article, we are going to take a look at What Is Cardano (ADA) And How It Works? so make sure to stay till the end as we explore this topic and give you some tips and tricks for it.

What Is Cardano?

Cardano is an open-source and decentralized public blockchain and one of the biggest cryptocurrencies by market cap. It is defined as the third generation of digital currencies. To make it clearer, let’s take a look at the previous two digital currencies generations.

Bitcoin was the first generation of digital currencies. Ethereum is the second generation that added smart contracts to digital currencies. And now Cardano and IOTA are considered the third generation of digital currencies, which are going to solve the two main problems that the previous generations had:

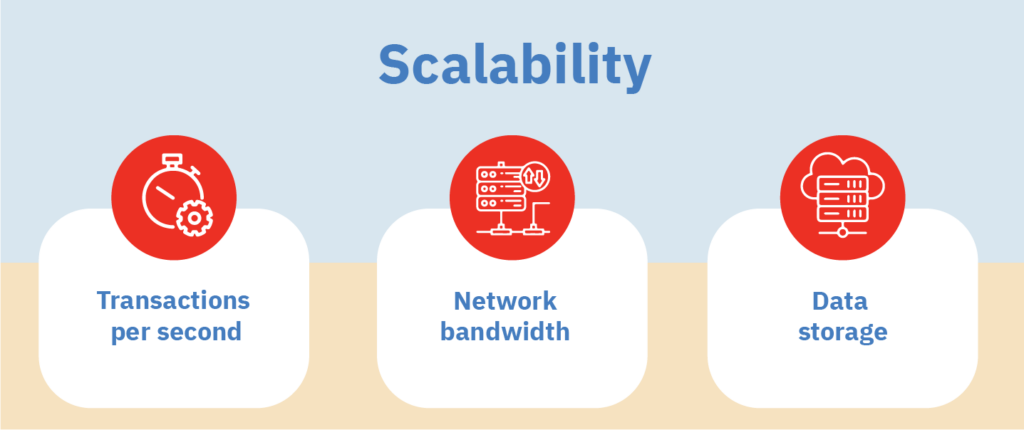

1. Scalability

The first problem that the two previous cryptocurrency generations had was scalability. When we talk about scalability in the world of cryptocurrencies, we are talking about these three concepts:

- Transactions per second: to become universal, a payment system must handle many transactions per second. Ourobarus system of Cardano solves this problem with a proof-of-stake consensus mechanism.

- Network bandwidth: blockchains are peer-to-peer networks (called P2P). Everyone receives a copy of transactions. Since thousands of transactions are done on this network, the bandwidth becomes an issue. Cardano makes it more scalable by creating sub-networks under the main network. So every process is divided into separate bandwidths.

- Data storage: Cardano uses distributed systems — all data and records of transactions are encrypted and stored not in one server but in a system of interconnected, independent nodes and terminals. This ensures independence from centralized entities, transparency, and security.

Proof of Stake vs. Proof of Work

Proof of Stake (PoS) and Proof of Work (PoW) are two primary consensus mechanisms that cryptocurrencies use to verify transactions.

The image below shows the main differences between the two։

Bitcoin uses the PoW algorithm and lets everyone extract new blocks, known as the mining process. However, it requires high processing power, consumes a lot of energy, and takes time because the process is slow.

In contrast, Cardano uses a PoS algorithm. It doesn’t let everyone extract new blocks; only the slot leaders can mine. Therefore, the number of people who mine is less than the PoW algorithm, so they can participate in accepting transactions and creating new blocks. The process is affordable because no extra equipment is required for mining, no energy is consumed to run the equipment, and the most important part is that this process is completely eco-friendly.

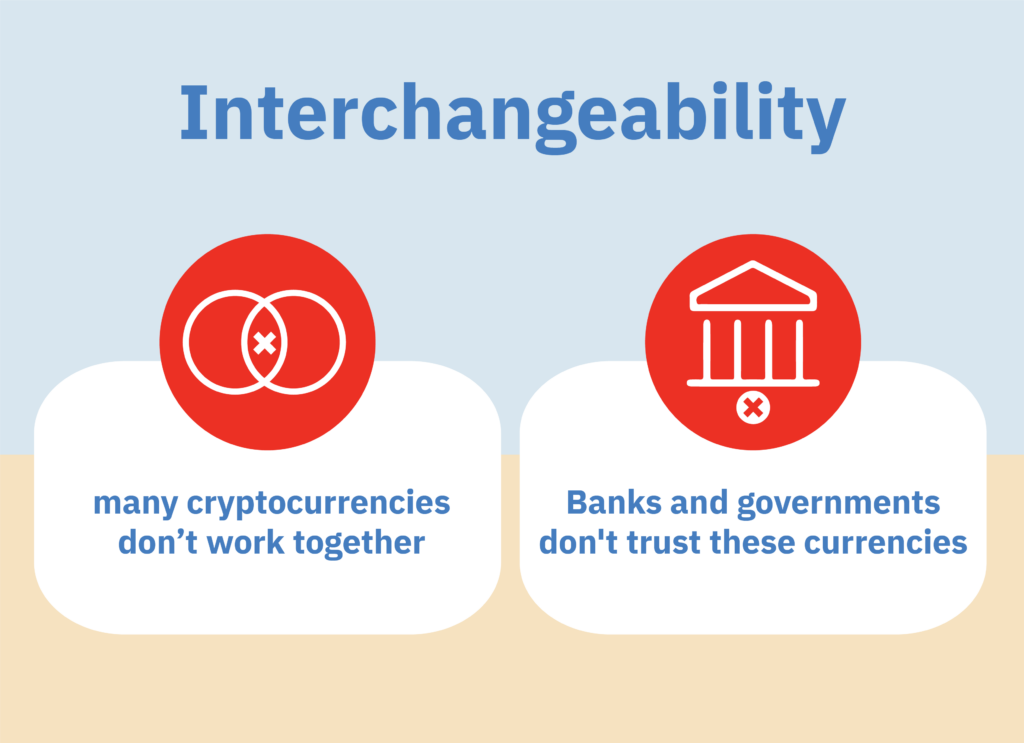

2. Interchangeability

The second problem that Cardano solves is interchangeability. What is the problem with interchangeability?

- There are many cryptocurrencies out there, but most don’t work together.

- Banks and governments don’t trust these currencies.

Since, in the future, the number of new crypto coins will rise with their own protocol and rules, there should be a way for these coins to be interchangeable. Cardano’s goal is to become the Internet of blockchains. It means the blockchain that can see inside the other blockchains. The main mediator that makes it possible for the owners of coin A to transfer it to coin B.

Furthermore, banks and governments don’t accept cryptocurrencies because everything is hidden in the world of these currencies. So it needs to be made clear who has done the transaction for which reason! So now Cardano allows users to share their information if they want so banks can accept their transactions.

A Brief History of Cardano

It was in 2015 when Charles Hoskinson, the co-founder of Ethereum, decided to develop a new blockchain that could overcome the problems and issues of the previous ones. Therefore, Cardano was founded in 2015. However, it was created entirely in 2017 when Charles and his team officially launched it as an alternative to Ethereum.

Charles wanted Cardano to be an updated version of Ethereum. The main characteristic of this new platform was an environmentally sustainable blockchain.

Cardano’s Roadmap

Cardano is developed in five separate phases, described as Cardano’s roadmap. Each phase added some features and functionality to this protocol.

Phase 1- Byron Phase: Byron is the first phase of Cardano’s roadmap, which started in September 2017. It was the first time that users could buy and sell Cardano’s native coin called ADA. In addition, this phase debuted two wallets for ADA coins called Daedalus and Yoroi ADA.

Phase 2- Shelley Phase: The second phase of the development roadmap is called Shelly, named after Mary Shelley, an author. In this phase, more focus was on communicating and participating with decentralized networks. Furthermore, it was during this phase that Cardano staking pools were introduced.

Phase 3- Goguen Phase: The third phase of Cardano’s development roadmap is named after a computer scientist called Joseph Goguen. The main goal of this phase was to enable users to create smart contracts and decentralized apps (dApps). Cardano was in this phase until Q4 2021, and the goal was achieved in September 2021.

Phase 4- Bashō Phase: This phase, which is named after the Japanese poet “Matsuo Basho,” is the optimization phase in which the scalability and interoperability are improved. Furthermore, in this phase, the parallel account models were introduced.

Phase 5- Voltaire Phase: The last phase is named after the French writer. The goal of this phase is to focus on integrating decentralized governance.

What Is ADA?

Like any other blockchain, Cardano has a native cryptocurrency called ADA. It was released in 2017 on the first phase of the Cardano roadmap. Ada’s name is taken from a 19th-century mathematician, “Ada Lovelace,” who was the world’s first computer programmer. Like any other coin in the world of cryptocurrencies, ADA has several uses too. The minimum amount of staking is 1 ADA.

ADA is a pre-loaded coin, which means there is an exact number of this coin out there to buy. The total supply is almost 45 billion coins.

How Does Cardano Work?

So, we have already discovered Proof-of-Stake and that Cardano works using this mechanism. Let’s now briefly touch on the layers. They are the basis of the Cardano network.

NOTE: Blockchain technology consists of five layers—the hardware, the data, the network, the consensus, and the application. The second is the division of the blockchain network based on protocol. Protocol refers to the set of rules that govern a network.

The Cardano Settlement Layer (CSL) and the Cardano Computing Layer are the two distinct levels that make up the Cardano blockchain (CCL). The CSL includes the balances and account ledger (and is where the Ouroboros consensus mechanism validates the transactions). Through the use of smart contract operations, all calculations for apps operating on the blockchain are carried out at the CCL layer.

By dividing the blockchain into two levels, the Cardano network can execute up to a million transactions per second.

How to Use Cardano

Because a strong developer and investment community support ADA and the Cardano ecosystem, enthusiasts have progressively started accepting ADA as payment.

Peer-to-peer (P2P) transfers between the sender, and the receiver is the most widely used payment method. No middlemen are involved in this transaction; the sender can deliver pre-existing ADA tokens straight to the recipient’s wallet address. Businesses have begun integrating specific ADA payment gateways due to the currency’s growing popularity, enabling users to use ADA to make online transactions.

Cardano levies a fee of 0.16 ADA on average for each transaction. This calculation is based on the transaction’s size and a standard cost for each transaction. As a result, the transaction fees will rise in proportion to the transaction’s monetary amount.

Additionally, users may get ADA tokens by “staking” or confirming payment transactions on the Cardano network. This entails transferring your current ADA holdings to a staking pool, which the node operators then use to verify and confirm transactions instantly.

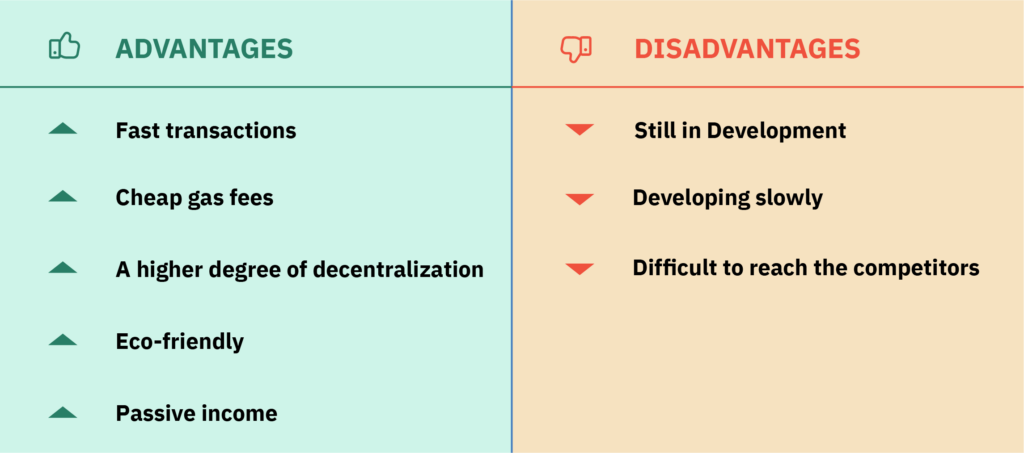

Advantages of Cardano

Cardano has a wide array of advantages. Below are 5 of the most important ones compared to competitors in the crypto sphere.

- Fast transactions – Cardano is created to be highly scalable. Currently, it provides 250+ transactions per second, compared to Ethereum’s 15.

- Cheap gas fees – Additionally, the PoS model allows Cardano to offer nominal transaction fees on its network. The average transaction cost on Cardano costs around 0.1 ADA, equating to a couple of cents. Compare this to the price of Ethereum of $15 per transaction.

- A higher degree of decentralization – The network becomes increasingly decentralized because everyone can become a node validator in Ouroboros. At the moment, there are more than 1500 validator pools in Cardano.

- Eco-friendly – one of the main concerns in the 2021 bull run is the high amount of electricity required by PoW blockchains such as Bitcoin and Ethereum. With its PoS mechanism, Cardano consumes 99% less electricity than either blockchains.

- Passive income – finally, every Cardano holder can gain passive income by staking their ADA coins. The procedure is as simple as purchasing ADA tokens and locking them up in a wallet like Yoroi.

Disadvantages of Cardano

Cardano is the “academic blockchain” that has been reviewed and tested. However, the truth is that Cardano is still developing and is developing slowly.

This is by far the biggest reason to be cautious about Cardano!

Cardano takes time to develop as it tries to keep up with its competitors and technological changes.

Because of this, it has been falling behind Ethereum and EOS for a while because it still hasn’t finished its smart contract and token standards.

Cardano is still primarily working on its scalability, and while cryptocurrencies like Ripple can handle 1,000 transactions per second, Cardano can only handle 257 transactions per second in theory.

This crypto needs to catch up to where it should be, and many delays have pushed back releases in the past.

This image summarizes the advantages and disadvantages of Cardano.

The Future of Cardano

The Cardano Foundation is supported by a strong group of developers led by Hoskinson and investors worldwide. The community’s main goal is to build real-world financial tools to help ADA raise prices based on how people use their goods.

The Cardano sidechains make it possible for developers to make apps that use frameworks and consensus systems that aren’t native to the Cardano ecosystem.

ADA has done better than most other cryptocurrencies in terms of price performance and market capitalization halfway through the plan.

Summarizing all this, it can be assumed that Cardano has a very bright future if it continues to eliminate the shortcomings also present.

Is Cardano a Good Investment?

Up to this point, it is clear that Cardano can present multiple benefits to investors. However, is Cardano a good cryptocurrency investment in 2023?

If you are still in doubt, let’s summarize why you should consider investing in Cardano.

- Cardano has one of the most advanced Proof-of-Stake algorithms that makes it strong on security and decentralization. This makes it hugely attractive to Dapps developers going into 2023 and for many years.

- Cardano transactions are cheap and fast. This makes Cardano perfect for use as a cryptocurrency for regular payments.

- The Cardano team is constantly working on its capabilities, and that’s good for adoption and long-term value growth.

- Cardano is currently trading at a discount of over 70% from its most recent highs.

With all these factors in its favor, the odds are that Cardano is a good cryptocurrency investment in 2023. It has the right fundamentals, and with Blocktrade, you can start investing in Cardano.

Cardano Price Predictions

We have a separate big article on Cardano price predictions. The information posted here will be of benefit to you.

Cardano is currently one of the most famous cryptocurrencies on the market. As a result, Cardano’s price predictions in the double and triple digits are plausible.

However, those high price targets may take longer to materialize. Cardano is already among the top 10 cryptocurrencies by market capitalization. Besides that, it is one of the cheapest cryptocurrencies to purchase for less than $1. At the same time, the total and circulating supplies are crucial variables for understanding token pricing and generating Cardano price predictions. The entire supply of ADA coins is 45 billion, with 33.6 billion in circulation.

Given this and numerous forecasts, purchasing Cardano might be the best option if you’re willing to play the long game. Although a sharp price increase is doubtful, the charts indicate that it is still a wise investment for those willing to hold onto positions for the long term.

How to Buy Cardano (ADA)

Suppose you have decided to engage in multi-faceted Cardano investments (e.g., Cardano staking) and want to make the processes completely manageable. In that case, Cardano’s native wallets, like Daedalus and Yoroi, are the right choice. By the way, check out our guide on How to choose the best wallet for Cardano.

On the other hand, if high security is a vital priority for you, then naturally, hardware wallets are the safest.

Finally, suppose you want to start investing in Cardano in small steps. In that case, you can consider a no-fee software wallet from a third party. Blocktrade Wallet fits this role perfectly as a quality product.

Final Thoughts

Cardano is a decentralized PoS blockchain that Charles Hoskinson found in 2015 and launched in 2017. It has positioned itself as an alternative to PoW blockchain, like Bitcoin, mainly because it is more energy-efficient and does not rely on crypto mining.

The plans behind Cardano’s development are ambitious. Its developers see Cardano as eventually becoming fully decentralized when voting and treasury management of blockchain are added to its capabilities in the future.

FAQ

It is impossible to directly answer this question because it depends on a specific investor’s preferences and strategy.

Perhaps the main difference that can be singled out is Cardano’s strong eco-orientation

ADA is Cardano native token.

Charles Hoskinson, the co-founder of Ethereum, began the development of Cardano in 2015 and launched the platform in 2017.