What Is Fantom?

This guide aims to educate you about what Fantom is and how it works.

So, Fantom is an open-source, decentralized, highly scalable platform for creating digital assets (e.g., cryptocurrencies) and smart contracts. Those programs allow blockchains to run more advanced transactions than simply sending cryptocurrency from one person to another. In turn, Fantom provides easier-to-integrate solutions for developing smart contracts, offering an alternative to Ethereum.

You may ask who needs these smart contracts.

Here are the most popular uses for smart contracts:

- They are crucial to decentralized finance (DeFi), financial services that don’t need a central governing body. Developers can create decentralized apps (dApps) that run on DeFi platforms by using smart contracts.

- You can establish the ownership of non-fungible tokens (NFTs) via smart contracts.

Ethereum was the first cryptocurrency to implement smart contracts, and most decentralized applications are built on its platform. However, it has been experiencing congestion problems, which have led to breakdowns and high transaction costs. As a result, several alternatives with faster transaction processing at a cheaper price have been created. Fantom is one of the most successful of those alternatives.

How Does Fantom Work?

Fantom has two technologies backing it: DAG (Directed Acyclic Graph) and Lachesis. Let’s explore these two key technologies one by one in the most straightforward language possible.

What is DAG?

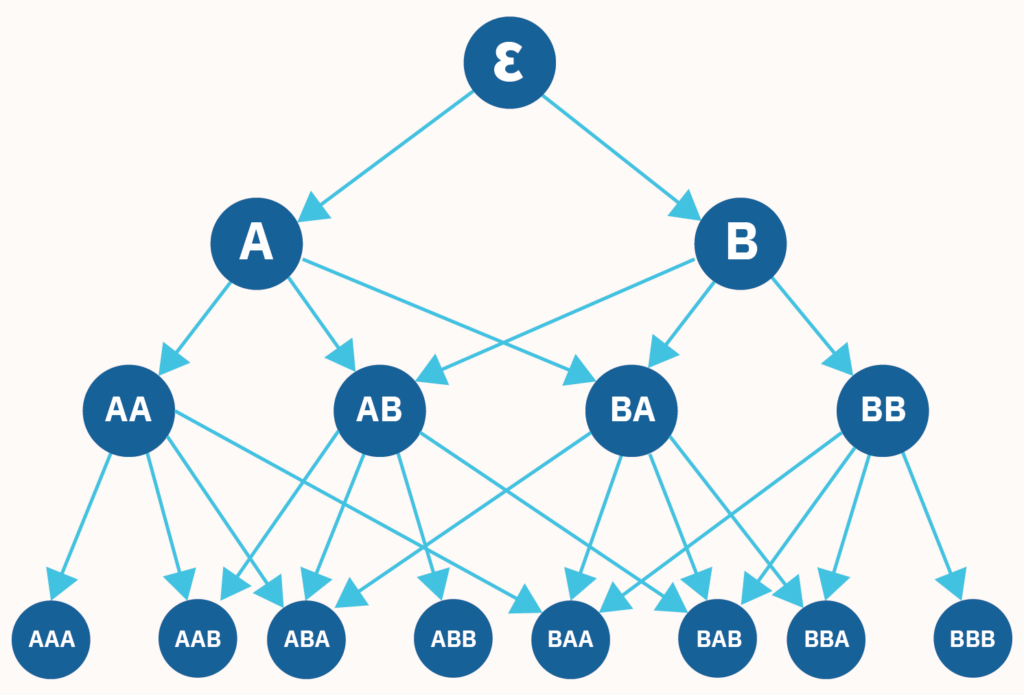

Before we discuss the Directed Acyclic Graph, let’s define “graph” as a network of linked nodes.

Please remember all DAGs have the following:

- Nodes (places to store data)

- Directed edges

The nodes exchange data. The first node is where it begins. Think about ancestry trees: those are DAGs.

And what about cycles?

- The graph is cyclic if the information moves through the network without returning to the same node more than once.

- On the other hand, an acyclic graph doesn’t have any cycles. The information can only get back to the node if you go through the same node more than once.

Individual DAG technology allows many chains of blocks to link and coexist without connecting to the first (parent) node. And as information doesn’t have to flow in a cycle or be validated by the preceding block, latency times can be lowered drastically.

Each Fantom node has its own DAG to monitor transaction and event blocks. These confirmations form Fantom’s final blocks. And this is how Fantom’s DAG architecture makes it so fast at processing transactions.

How Does Lachesis Work In Fantom?

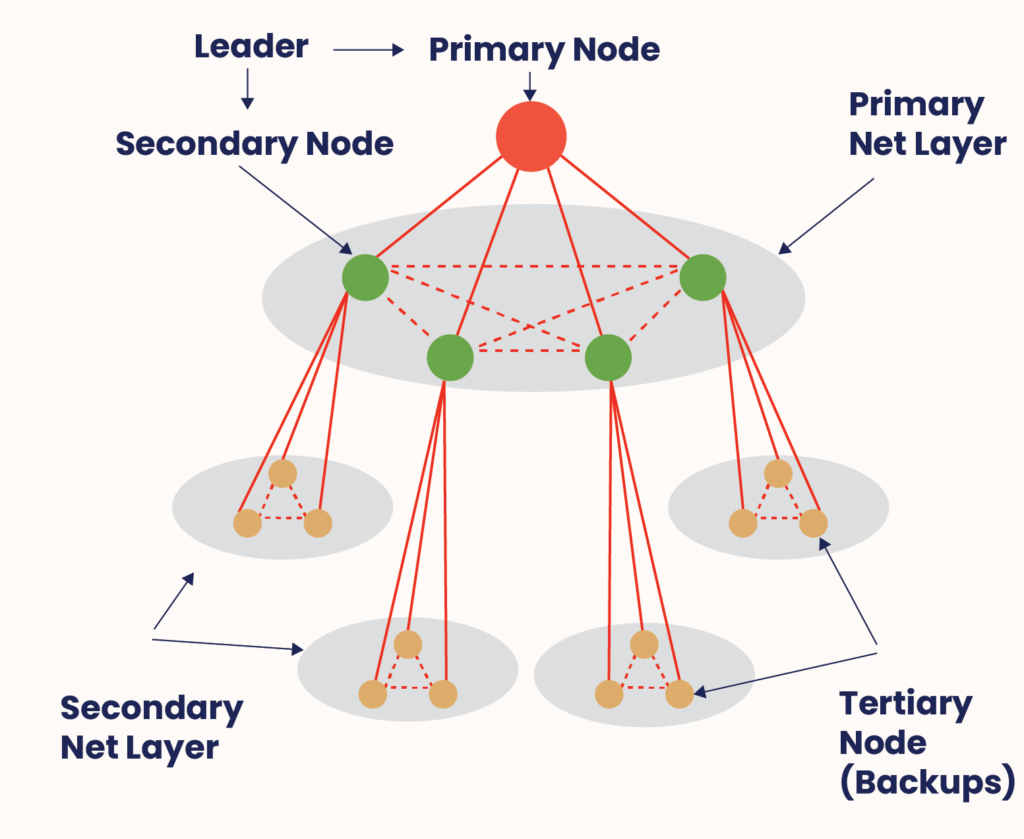

While DAG allows swift validation of transactions, Lachesis provides security to the multiple chains deployed within the ecosystem.

But what is Lachelis?

For processing transactions and creating new blocks, blockchain needs some method to validate entries into a distributed database and keep the database secure. This validation method is called the consensus mechanism.

Fantom blockchain uses a “Lachesis Protocol” to achieve consensus. Lachesis, in turn, uses an Asynchronous Byzantine Fault Tolerant (aBFT) algorithm to attain high-performance data storage.

To better understand this complex terminology, let’s take a marketing team as an example.

Lachesis Protocol Example

- There is a marketing department in the company. The department has four leaders. Each leader has team members. All four want to build a successful campaign for the company. It means: that the goal is the same for all.

- They must send each member to the other company to figure out how to beat their rival. Still, this strategy has a problem: members could be drawn away by a higher salary, which would damage the whole campaign.

- One or two of these team leaders can also decide to change their minds at any time, disrupting the whole strategy.

So, how can you successfully execute this campaign without any compromise?

This example depicts a decentralized network or blockchain, with each team leader representing a node in the network.

Decentralization allows total independence, which might lead to rule-breaking.

And again, how can you secure a stable network and fair consensus among nodes?

The Byzantine Fault Tolerance (BFT) algorithm fixes this. It ensures a transparent, trustless network, even with malicious activities. Network nodes agree on transaction timing and block generation. Byzantine Fault Tolerance allows the network to reach a fair consensus even if a 1/3 of nodes block transactions.

Asynchronous Byzantine Fault Tolerance (aBFT) improves BFT by removing the time limit on delayed messages and allowing them to be lost entirely.

VERDICT: To understand how Fantom works, it is important to note that Fantom has employed Lachesis aBFT consensus protocol that can extend to multiple layers within the system. As a result, you need only 1–2 seconds to confirm a transaction. It’s a highly scalable protocol that ensures fast and high security on the Fantom network.

What Is Fantom Opera?

To fully understand how the Fantom network operates, it is necessary to refer to its mainnet too, which is called Opera.

A mainnet is an independent blockchain with its own network, technology, and protocol. It’s the outcome of a blockchain project, with cryptocurrencies or tokens with monetary value available to the public.

- Opera is an environment to build decentralized applications. It is fully permissionless and open-source. Powered by Fantom’s aBFT consensus algorithm, it leverages its speed and fast finality.

- Finality is the assurance or guarantees that cryptocurrency transactions cannot be altered, reversed, or canceled after they are completed.

The Opera chain was created by the Fantom Foundation to fix the problems of older blockchains.

Earlier, blockchains used mechanisms with probabilistic finality, which meant that transactions took a long time to complete. For example, Bitcoin’s average finality time (when the next block is mined and published) is about 60 minutes. Even though Ethereum is faster, the average time it takes to reach a final state is still 6 minutes. The Opera chain, on the other hand, can conclude in about one to two seconds.

It is a great result!

Is Fantom An Ethereum Killer?

When you read about Fantom’s impressive features and fast speeds, you may wonder: is Fantom an Ethereum killer?

Two main factors might lead to this consequence:

- See, Fantom is faster and can handle more transactions than Ethereum. Its transaction fee is only about a penny, much less than Ethereum’s. On the other hand, Ethereum’s gas fee is notoriously expensive and can quickly reach a hundred pounds at peak times. All of these things suggest that Fantom has a better chance of being used by a large number of people than Ethereum does.

- Fantom is also compatible with the Ethereum Virtual Machine (EVM). You can easily copy and paste things you’ve made on Ethereum and host them on Fantom.

VERDICT: If this trend keeps going in favor of Fantom and Ethereum doesn’t do anything to stop it, then Ethereum could find itself in a bit of a crypto jam.

What Is The Fantom Coin Used For?

Thus, since Fantom has its own independent blockchain, it makes sense that it will also have its own coin.

Very true!

FTM is Fantom’s primary token, and according to the official source, it has the following functions:

- Securing the network

- On-chain governance

- Network fees

Securing the network

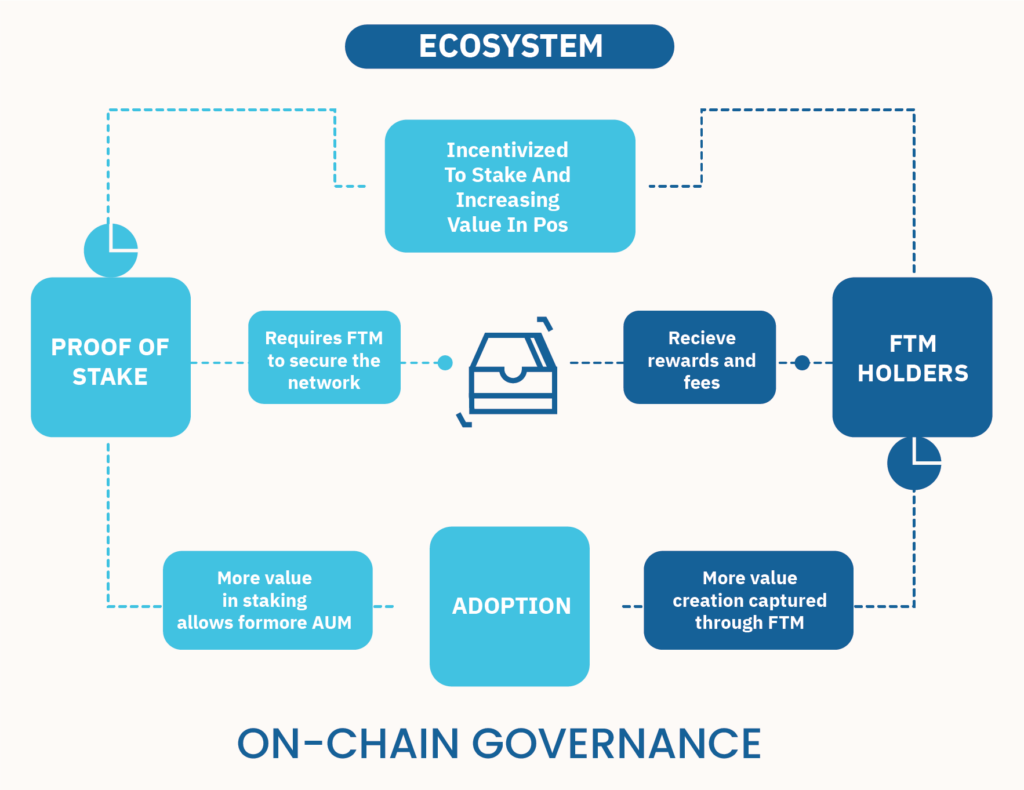

The main use of the FTM token on Fantom is to secure the network with a Proof-of-Stake type consensus mechanism which we have already discussed above.

With Proof-of-Stake, participants called “validators” lock up a certain amount of cryptocurrency or crypto tokens—their “stake”—in a smart contract on the blockchain. In exchange, they get the chance to verify new transactions and get a reward.

So, to join Fantom’s network particularly, validator nodes need to hold at least 3,175,000 FTM, and stakers need to lock up their FTM. In exchange for their work, both the nodes and the stakers get epoch rewards and fees.

Our FTM Staking guide will help you learn the basics of Fantom’s staking.

Payments

The Fantom network’s high bandwidth, fast finality, and low fees make the FTM token a great way to send and receive payments.

On Fantom, sending money costs about $0.0000001 and takes about 1 second.

Network fees

FTM is used for network fees, such as transaction fees and fees to set up smart contracts or create new networks.

Without a minimum barrier, the network would be an easy target for spam, slowing it down and filling the ledger with useless information. On Fantom, fees are very low, but they are high enough to make it very expensive for a bad actor to launch an attack.

On-chain governance

On-chain governance requires FTM. Because Fantom is a fully permissionless and leaderless decentralized ecosystem. On-chain governance is responsible for making all network-related decisions. Stakeholders can suggest changes and improvements and vote on them with governance. FTM is the governance token that is needed to take part in voting.

Fantom Price History

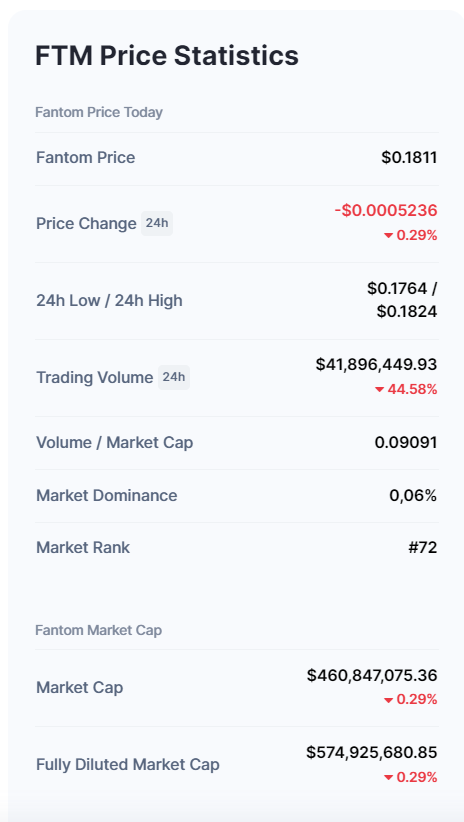

The Fantom token’s price has risen more than 19,500% since its launch in December 2019. Like any crypto, however, its prices are highly volatile.

- FTM token has been dumping since attaining a high of nearly $3.41 in early January 2022.

- Since then, it has reached a low of $1.07 in mid-March.

- And from the beginning of the summer, it has lost about half its price and hovered around $0.40 since then.

Here is the chart of FTM’s yearly price performance as of November 2022:

As of the end-2022, it has a circulating supply of 2,545,006,273 FTM coins and a max. supply of 3,175 000,000 FTM coins.

Our Fantom Price Prediction article will help you better understand what to expect from this cryptocurrency in the coming years.

How Can I Buy Fantom (FTM)?

FTM is available on virtually all the major centralized exchanges.

Who can place a buy order?

Those who already have accounts on apps or exchanges that list FTM. If not, you need to take the following steps.

Step 1: Set up a crypto account.

Choose an exchange that trades FTM and sign up for an account. You can put money into the account with a secure wire transfer or a transfer from a credit or debit card (check with your bank in case of restrictions). However, there may be a fee.

Step 2: Connect a crypto wallet.

In the same way, you might keep cash in a wallet; you can keep cryptocurrencies in digital wallets. Set up a cryptocurrency wallet that can hold FTM coins. We have made a comparative review of the best FTM wallets.

Remember that some crypto exchange accounts come with a custodial wallet, and you may need help to move your crypto off the platform.

Step 3. Trade FTM.

Place a buy order and start trading FTM!

IMPORTANT! Depending on where you buy or sell your crypto, different trading platforms may require different forms of ID.

How to Sell Fantom (FTM)?

Once you’ve concluded to sell FTM, the next step is to decide if you want to cash out for a fiat currency like U.S. dollars (USD) or trade it for another type of cryptocurrency.

Step 1: Get your trade ready.

Choose your trading pair, such as FTM/ETH. If you want to trade FTM for USD, you may have to take different steps than if you tried to buy another cryptocurrency.

Step 2: Find the best price.

Prices for cryptocurrencies change every minute, so do your research ahead of time so you can spot a good deal when you see one.

Step 3: Buy or sell Fantom (FTM).

If you plan to stop trading on the exchange, finish the trade and move your crypto (or cash) to your wallet.

Step 4. Keep taxes in mind.

Remember that you have to pay taxes on gains from cryptocurrency. So consider the tax consequences of selling an FTM coin, and if you need to, talk to a professional.

What Is Building On Fantom?

Here are the most popular projects built on the Fantom platform:

1. SpookySwap (BOO): an Automatic Market Maker on the Fantom Opera network.

2. Multichain: a cross-chain router protocol.

3. Scream (SCREAM): is a lending protocol and Fantom’s second most popular project in terms of total value locked.

4. Beethoven X: an automated portfolio manager and price sensor that enables Fantom token decentralized exchange.

5. Geist Finance: a decentralized lending protocol similar to AAVE but on Fantom.

6. Protofi (PROTO): an innovative Automated Market Maker that allows investors to become owners and earn dividends by owning a piece of the protocol itself.

What Is So Unique About Fantom?

When talking about the uniqueness of Fantom, we should again mention Lachesis: Fantom’s “leaderless” consensus system. It is really a big thing.

- Using aBFT consensus, Lachesis keeps the network safe and speeds up transactions. The best thing about the Lachesis protocol is that it can process network data at different times. It is crucial because nodes are likely in other parts of the world and in different time zones.

- Unlike many other old and new networks, Fantom finalizes everything immediately. On the Fantom platform, transactions are completed and confirmed in just seconds. This is in contrast to the Bitcoin network, where confirming a block takes a long time and is hard to do.

- In fact, Fantom is different from Ethereum too. And again, because it uses Lachesis to reach a consensus. Developers can make peer-to-peer (P2P) apps with Lachesis without making their own networking layer.

The other thing that makes Fantom unique is its Opera mainnet. This network is exceptional because it is self-contained. This means that traffic problems in one area don’t affect other parts of the network.

Taking all this into account, we come to the main question:

Is Fantom A Blockchain?

The short answer is YES.

But one significant thing about the Fantom crypto platform is that users can create and deploy their own independent networks instead of relying only on Fantom’s main consensus layer.

Each application built on Fantom has its own blockchain that it uses.

Every Fantom dApp runs on its own blockchain but also benefits from the security, speed, and finality of the Fantom blockchain as a whole.

Advantages And Disadvantages Of Fantom

As we deeply analyzed the advantages of the Fantom platform, which are:

✅ Speed and Scalability while using the Lachesis aBFT consensus algorithm.

✅ Community governance with transparent on-chain voting.

✅ Opera mainnet is to improve responsiveness and overall performance. This means that the platform doesn’t sacrifice speed to focus on security; instead, it enhances both speed and security.

Now let’s look at some disadvantages of Fantom:

❌ Since Fantom is open source, anyone can run a node, but you need to stake at least 3,125,000 FTM to run a validator node.

❌ Because Fantom doesn’t have a lot of validators, there are worries about security because the platform has become too centralized.

Fantom History

Finally, let’s take a quick look at Fantom’s brief history.

Dr. Ahn Byung Ik, a South Korean computer scientist, started the Fantom Foundation, which is in charge of Fantom’s development. Michael Kong is the company’s chief executive officer. FTM was released at the end of 2018 and started trading for around $0.02. The launch was an initial coin offering (ICO), which helped the project raise $40 million. Since then, the token’s value has increased significantly, reaching a record high of almost $3.50 by the end of 2021.

FAQ

Dr. Ahn Byung Ik, a South Korean computer scientist, started the Fantom Foundation, which is in charge of Fantom’s development.

The main factor that makes FTM coin valuable is the Fantom platform behind it, which is well-known and respected among the crypto community worldwide.

Fantom is an open-source, decentralized, highly scalable platform for creating digital assets (e.g., cryptocurrencies) and smart contracts.

Final Thoughts

To sum up, Fantom is one of the most demanded cryptos used in smart contracts and has a reputation for being a reliable cryptocurrency. Furthermore, the aBFT Lachesis Protocol used by Fantom maximizes speed while ensuring security, allowing transactions to happen in a split second with minimal to no congestion.

Fantom may keep expanding in the DeFi sector if the competitors don’t surpass its market share.

In addition, the FTM coin is versatile and compatible with Ethereum, making it a popular investment for crypto traders.