In this article, we’ll explore how to transfer FTM via cross-chain bridges and the benefits of doing so. Whether you’re a seasoned crypto investor or just getting started, understanding how to use cross-chain bridges can help you maximize your investments and take advantage of new opportunities in the rapidly changing world of digital currencies.

What Is A Cross-Chain Bridge?

Blockchain’s inability to collaborate was one of its main issues it had. The problem showed when users wanted to transfer assets or data between different blockchains. Each blockchain is constrained by the boundaries of its own area while being flexible and relatively effective as a standalone entity. Most often, this may result in expensive transactions and congestion.

This issue is resolved by blockchain bridges, which allow։

- Transfer of tokens,

- Exchange of data and smart contracts,

As well as other feedback and instructions between two separate platforms.

In general, a blockchain bridge, sometimes called a cross-chain bridge, joins two blockchains and enables users to transfer cryptocurrency from one chain to the other. In essence, if you have Bitcoin but want to spend it like Ethereum, you can do that through the bridge.

While the blockchains mint different coins and operate on different rules, the bridge serves as a neutral zone so users can smoothly switch between one and the other. Access to multiple blockchains through the same network dramatically enhances the crypto experience.

In the Fantom Price Predictions article, we discussed how this release affected FTM’s price.

This guide is completely dedicated to the cross-chain bridge itself. Here you will learn how to transfer FTM via cross-chain bridges.

How Do Blockchain Bridges Work?

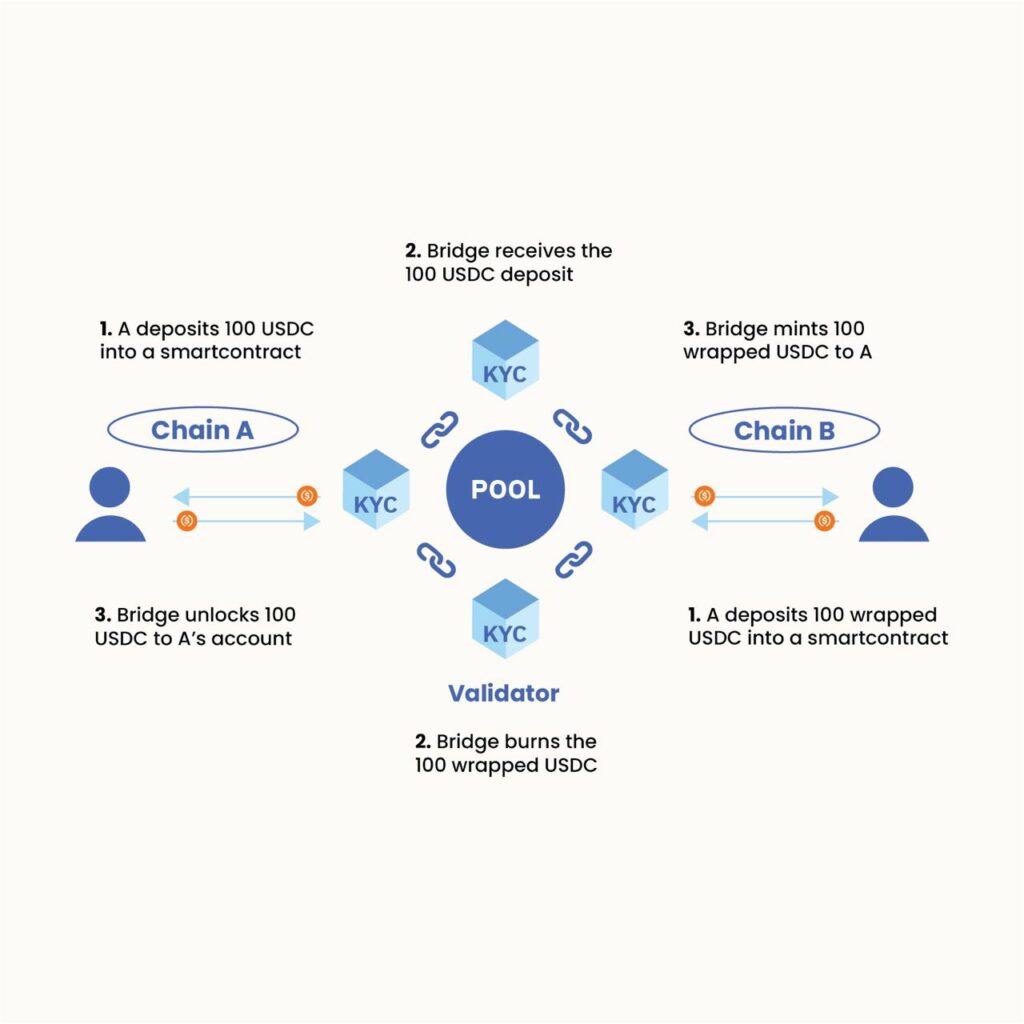

Although blockchain bridges are capable of a huge amount of amazing things, including converting smart contracts and transmitting data, token transfer is by far their most popular use. For instance, the two biggest cryptocurrency networks, Bitcoin and Ethereum, have quite distinct policies and procedures. Users of Bitcoin may move their money to Ethereum over a blockchain bridge and utilize them in ways that would otherwise be impossible on the Bitcoin network. That can include making low-fee payments or buying other Ethereum coins.

The blockchain bridge will keep your Bitcoin and generate equivalents in ETH when you wish to move part of your Bitcoin to Ethereum. In reality, none of the related cryptocurrencies changes hands. Instead, you obtain access to an equivalent quantity of ETH while the amount of BTC you wish to send is locked in a smart contract. The ETH you had, or whatever is left of it, will be burnt when you wish to convert back to BTC, and an equivalent amount of BTC will be returned to your wallet.

IMPORTANT! If you were to do this on a regular basis, you would need to trade bitcoin for ETH on a trading platform, withdraw the money to a wallet, and then deposit it once again on an exchange. By the time it arrives, you will have probably paid more fees than you had initially intended.

Trust-Based vs. Trustless Blockchain Bridges

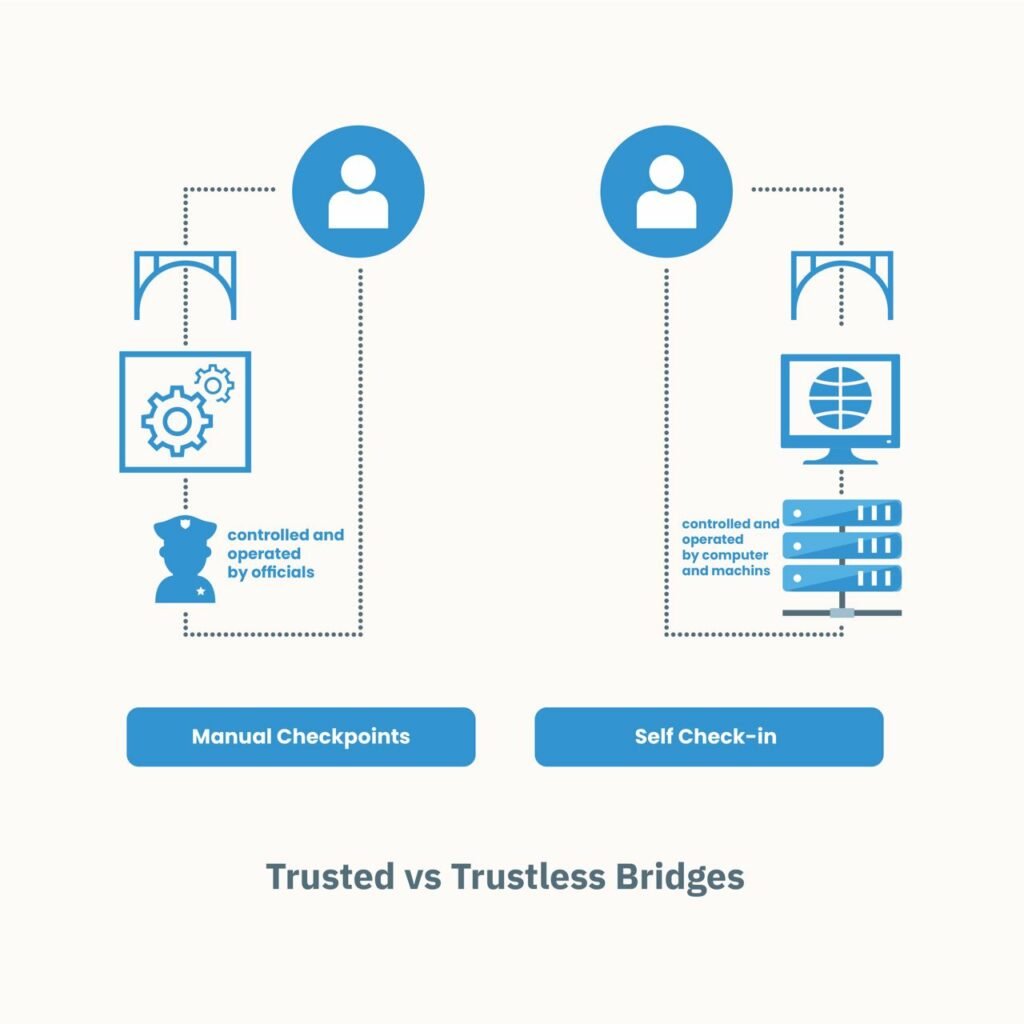

Centralization is a hidden drawback of blockchain bridges. If users want to exchange their coins for other cryptocurrencies, they must give ownership of their money, trusting it in the hands of a third party. This is how wrapped tokens, like wBTC, are created if you’ve ever seen one. The concept is to take your Bitcoin and “wrap” it in an ERC-20 contract so that it behaves like an Ethereum token.

- Trust-based bridges are a quick and affordable choice when you transfer a significant amount of cryptocurrency, but the number of trustworthy providers is fairly limited. Smaller traders find it unappealing to go into the region of lesser-known brands since doing so might raise risks.

- Decentralized blockchain bridges, also known as trustless bridges, exist to enhance user confidence while moving their money. Individual networks contribute to the transaction validation process in these systems, making them function just like a real blockchain. Using a trustless bridge can ease your mind if you’re concerned that your coins may end up in the wrong hands. Decentralized bridges have the drawback of being a freelance-based service. Because they are compensated for fulfilling your request and not for fixing problems, this might become a liability when incidents occur.

How To Exchange FTM Via The Cross-chain Bridge

Now that we have understood what a cross-chain bridge means let’s find out how to use it specifically to transfer tokens to the Fantom chain.

Choosing a Bridge

First of all, you need to choose the bridge you are going to use to make the transfer. The most popular bridges for the FTM exchanges are follows։ AnySwap, SpookySwap, MultiChain, cBridge, xPollinate, Synapse, Allbridge.

All of the bridges are good, but in this particular article, we will only look at AnySwap and SpookySwap bridges. With these two bridges as an example, you will see how tokens can be transferred from a variety of blockchains to the Fantom chain.

1. Multichain (Formerly Anyswap)

Multichain, previously known as Anyswap, is a fully decentralized cross-chain swap protocol. The swap protocol is a peer-to-peer protocol for trading Ethereum tokens (ERC-20). The swap protocol essentially helps in finding 2 parties interested in exchanging the 2 tokens, getting to an exchange value privately, and finally trading the tokens.

To use the Multichain bridge, head over to the Multichain website.

Next, we will demonstrate how to transfer tokens from the Polygon and Avax blockchains to Fantom.

Bridging from Polygon and AVAX to Fantom using Multichain Bridge

Step 1. Connect your wallet.

Here we will use the MetaMask wallet as an example.

How to add Fantom to MetaMask article describes in detail how to use the MetaMask wallet for FTM transactions.

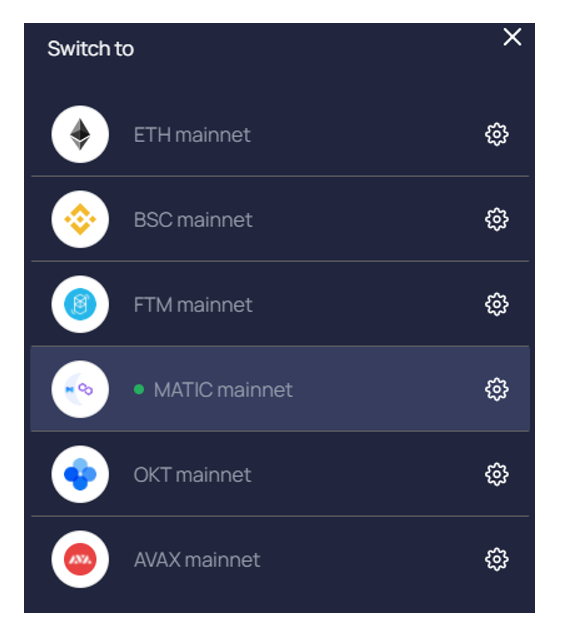

Step 2. Once connected, ensure that you’re on the correct network since Multichain supports multiple blockchain networks.

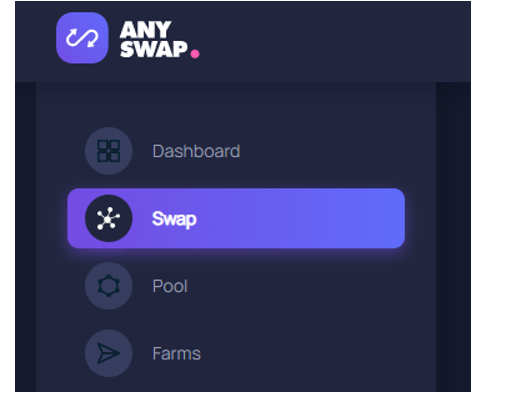

Step 3. Head over to Swap on the left sidebar.

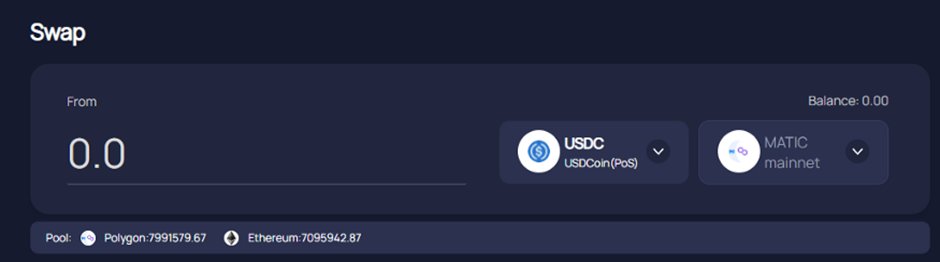

Step 4. Select the token to swap and ensure that the correct network is selected.

On Polygon, DAI, WETH, USDT, EURS, and USDC are supported.

On AVAX, MIM is also supported.

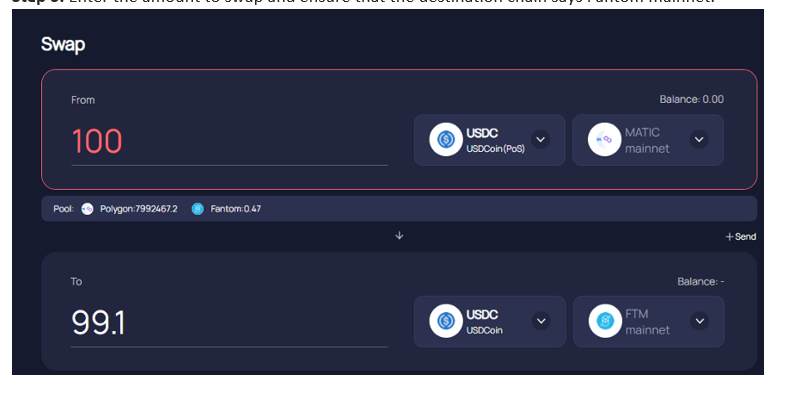

Step 5. Enter the amount to swap and ensure that the destination chain says Fantom mainnet.

Step 6. Approve the contract to spend your tokens, then click Swap.

PRICE:

Anyswap charges a cross-chain swap fee of 0.1%, with some minimum that varies by token being charged.

NOTE:There are some limitations to using the Multichain bridge, depending on the token. For example, in the case of DAI, the minimum cross-chain swap is 24 DAI, and the maximum is 5 million DAI. The estimated time to swap is around 10 to 30 minutes.

2. SpookySwap

SpookySwap is an automated market-making (AMM) decentralized exchange (DEX) on the Fantom Opera network. Our What is Fantom article describes in simple language the basics of the entire Fantom ecosystem and the Opera network in particular. Take the time to read it.

So, SpookySwap offers the lowest swap costs on Fantom for trading cryptocurrencies, as well as a user-friendly interface for bringing liquidity into the platform.

Bridging from Ethereum or Binance Smart Chain to Fantom using Spookyswap Bridge

The Spookyswap bridge can be used to bridge tokens from the Ethereum mainnet or Binance Smart Chain onto Fantom and vice versa.

Behind the scenes, the bridge is powered by Anyswap (see below).

The current ETH-FTM bridge supports: FTM, USDC, wETH, AAVE, BADGER, BAND, COVER, CREAM, CRV, DAI, FRAX, USDT, FXS, GTON, ICE, LINK, MM, SNX, SUSHI, wBTC, WOOFY, YFI.

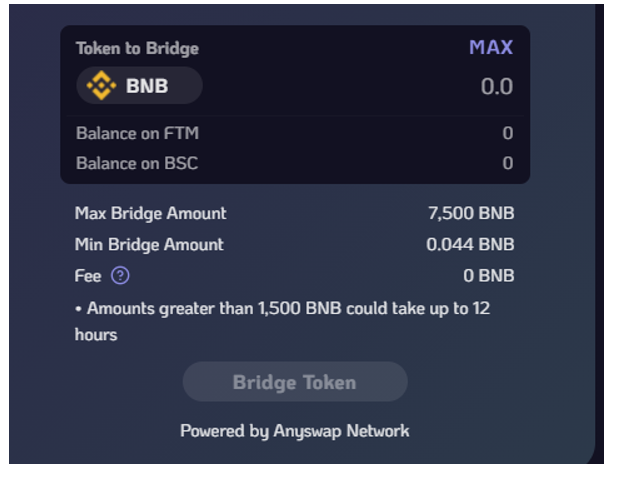

The current BNB-FTM bridge supports: BNB, BIFI.

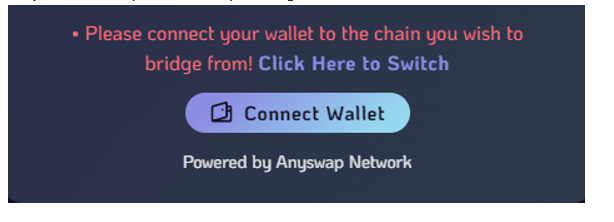

Step 1. Connect your wallet by clicking on the Connect Wallet button.

Step 2. Select your source and destination chains. In the above example, we are transferring from Binance Smart Chain to Fantom.

Step 3. Select the token to bridge across, e.g. BNB.

Step 4. Select how much to bridge across or click MAX to bridge all, then click Bridge token.

PRICE: For the Spookyswap bridge, there are no fees to bridge any tokens to Fantom unless you’re bridging FTM tokens.

Risks Of Blockchain Bridges

Below are some of the risks associated with using blockchain bridges. Of course, they exist:

- Attackers exploited blockchain bridges’ smart contracts. Cross-chain bridges have been hacked for massive crypto thefts.

- Trust-based bridges offer custody issues. A custodial bridge’s centralized organization might take users’ money. Choose well-known brands for Trust-based bridges.

- Transaction bottlenecks are another technological restriction. A chain’s throughput bottleneck might limit blockchain compatibility.

- Moving assets to another chain doesn’t help scalability since consumers won’t always have access to the same dapps and services. Some Ethereum dapps aren’t accessible on Polygon Bridge, limiting its scalability.

- Blockchain bridges might expose underlying protocols to trust issues. Because blockchain bridges connect various blockchains, network security is as strong as its weakest link.

FAQ

We have described in detail how to bridge ETH to Fantom in the article above.

According to Fantom’s official website, it is free to bridge from Ethereum to Fantom.

According to Fantom’s official website, FTM can be transferred in 1 to 2 seconds.

Final Thoughts

Innovations are the driving force behind the growth of the blockchain industry.

There are pioneer protocols like the Bitcoin and Ethereum networks, followed by myriad alternative blockchains. Since they follow different rules and use different technologies, they need blockchain bridges to connect. A blockchain ecosystem connected by bridges is more unified and easy to use. This makes it possible to improve scalability and efficiency. But at the same time, cross-chain bridges have been attacked many times, so people are still looking for a more secure and strong bridge design.

Fantom is no exception!

As we advised in the article about FTM staking, the same in this case: taking into account all the possible risks, you should thoroughly research the subject yourself and only then take financial actions.