What Is Crypto Staking?

We have already covered in detail “What is Fantom (FTM) and How it Works?”. And with the help of this particular article, you will get answers to two other questions: How to stake Fantom (FTM) and what you will get from staking Fantom (FTM).

But first, let’s find out what staking means in general.

So, many crypto investors mine or trade to earn assets, whereas others stake.

Crypto staking means “locking up” a portion of your cryptocurrency to support a blockchain network for a certain amount of time. In exchange, stakers can earn rewards, which usually come in the form of more coins or tokens.

The concept of staking is similar to putting money in a bank: you lock up your assets and, in exchange, earn rewards or interest.

So, you delegate a certain number of tokens to the blockchain governance model. After that, the blockchain’s network protocol locks your assets (just like the bank does)- agreeing not to withdraw them for a specific period of time. This helps the network in two ways:

- To increase the value of a token by limiting the supply.

- To use the “locked” tokens for governing the blockchain if its network uses a Proof-of-Stake (PoS) system.

Here we should clarify what Proof-of-Stake is. Otherwise, it will be tough to comprehend how staking works, especially for newcomers.

What Is Proof-of-Stake?

As we know, blockchain is a decentralized peer-to-peer system with no central authority figure. While this creates a system that is devoid of corruption from a single source, it still makes a significant problem:

How are any decisions made?

How does anything get done?

Well, think of a standard centralized organization.

A board of decision-makers or a leader is responsible for making all decisions. A blockchain cannot do this since there is no “leader” in a blockchain. For the blockchain to make decisions, they need to come to a consensus using “consensus mechanisms.”

In simpler terms, a consensus is a dynamic way of reaching an agreement in a group.

Proof-of-Stake is a cryptocurrency consensus mechanism for processing transactions and creating new blocks in a blockchain.

With proof of stake, participants referred to as “validators” lock up set amounts of cryptocurrency or crypto tokens—their stake, as it were—in a smart contract on the blockchain. In exchange, they get a chance to validate new transactions and earn a reward.

NOTE: While staking means locking up your tokens, they are still in your wallet, and only you can access them. So you can unlock your funds anytime.

How To Stake Fantom (FTM)

FTM is Fantom’s native utility token. It implies that the Fantom network uses FTM tokens for staking, governance, payments, and fees. As of the end-2022, there is a total supply of 3.175 billion FTM coins, with 2.5 billion in circulation.

By staking Fantom, you contribute to the network’s security and get paid with FTM tokens as a reward. After reading this, you will undoubtedly be curious about the FTM pricing and price dynamics.

Here is the chart of FTM’s yearly price performance as of the end-2022:

- FTM token has been dumping since attaining a high of nearly $3.41 in early January of 2022.

- Since then, it has reached a low of $1.07 in mid-March.

- And from the beginning of the summer, it has lost about half its price and hovered around $0.40 since then.

Our Fantom Price Prediction article will help you better understand what to expect from this cryptocurrency in the coming years.

Now let’s get back to staking.

The good news is that anyone can stake on Fantom if they have at least 1 FTM. There is no need for a specific gadget or hardware; you may stake FTM from your phone or personal computer.

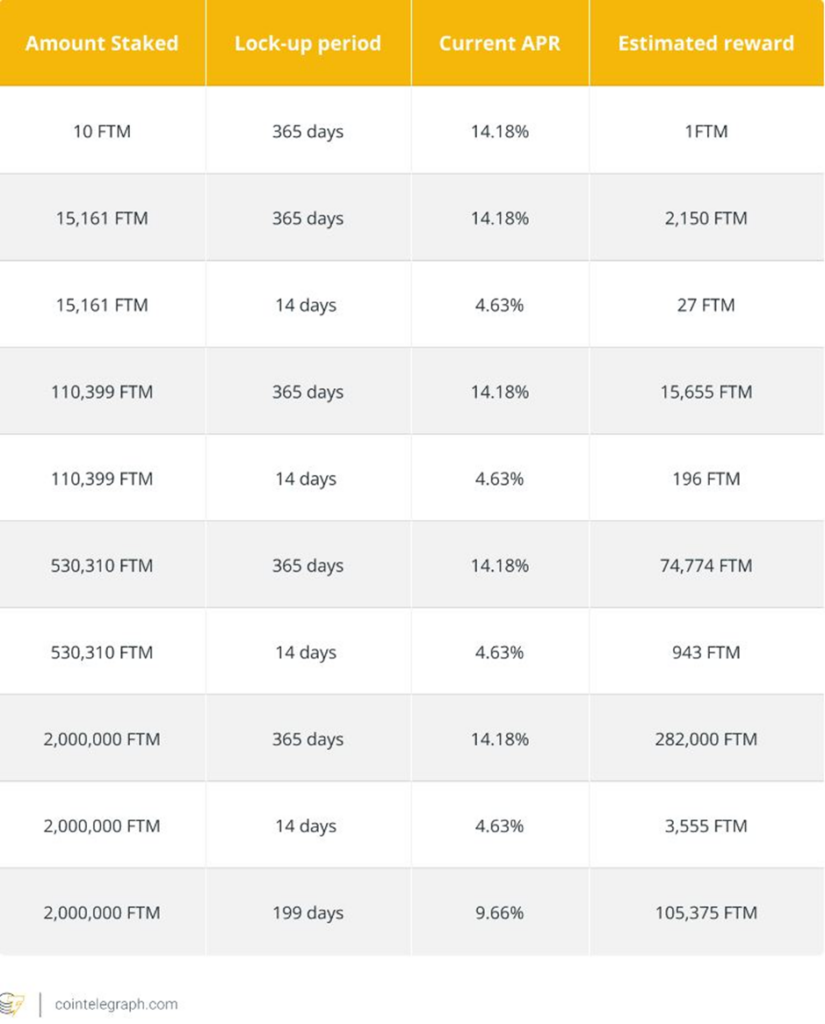

According to Fantom’s website, you can choose to stake a certain number of FTM. Then, you select the duration you want to lock it, with the maximum locking period being one year. Finally, the website shows you the current APR (Annual Percentage Rate) and your estimated rewards.

These are the steps to start staking Fantom:

- Log in or sign up for a wallet that supports FTM.

- Deposit your FTM into your wallet by transferring them from an exchange to the Opera address.

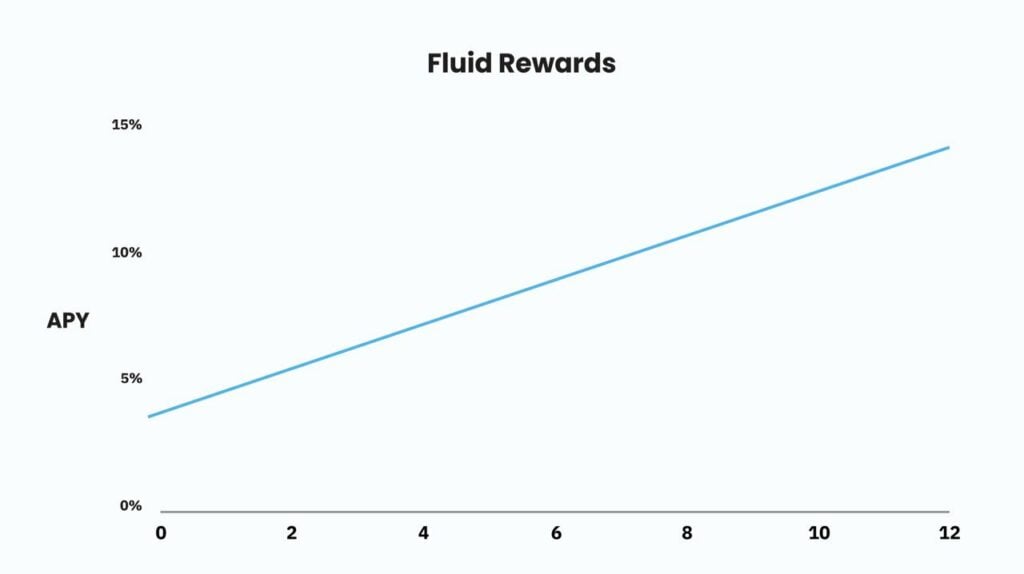

- Choose a validator. You can either lock your FTM (for two weeks or a year) to earn staking rewards from 4.5% to 13.9% or choose the stake-as-you-go model, earning roughly 4% APY.

NOTE: You cannot use your FTM tokens while staking. To withdraw them, you have to unstake them first. Unstaking takes seven days.

How Much Can I Earn Staking Fantom?

As we mentioned above, you can choose to lock-up your tokens for a reward rate proportional to the lock-up period: up to 365 days and 13% APY (Annual Percentage Yield) or just stake with no lock-up for the base rate – 4% APY.

You can estimate your FTM staking rewards here.

Our colleagues from Cointelegraph have done a great job compiling a quick reward list in the table below:

NOTE: You can use the “claim and restake” option if you decide to unstake your FTM holdings and to restake them later again.

What Are The Requirements For Staking Fantom?

Good news again!

There is no minimum required for Fantom staking, which is its main selling point.

With only 1 FTM, you may begin receiving rewards.

And since validator nodes are an essential component of the blockchain network, you may also operate a node. According to Fantom’s official website, the following requirements must be met in order to launch a Fantom node:

- Minimum requirement: 500,000 FTM

- Maximum validator size: 15x the self-stake amount

- Earn staking rewards and a 15% fee on delegators rewards

- Minimum hardware requirements: AWS T2.large EC2 (or equivalent) and at least 800GB of Amazon EBS General Purpose SSD (gp2) storage (or equivalent).

NOTE: Users may earn a greater APY (Annual Percentage Yield) by liquid staking of their FTM assets without having their funds locked up. However, the concept is better understood by advanced users who want to partake in Fantom Finance.

How many Fantom validators are there?

As of the end-2022, Fantom’s PoS blockchain relies on 79 validators, overseeing block creation on behalf of the network stakers.

Is There A Risk To Stake Fantom?

Staking on Fantom is not risk-free. In general, investment or financial operations can only provide returns that partially match your expectations due to the volatility of the crypto market. Consequently, before investing money, carefully research the entire ecosystem and technology you will deal with.

Only invest what you can afford!

FAQ

Yes, it has. By staking Fantom, you contribute to the network’s security and get paid with FTM tokens as a reward.

If you stake to a validator node that acts maliciously, you can lose all your staked tokens. You must choose the validator node wisely and make sure they’re reputable.

Yes. Nobody except you will have access to your tokens. Make sure to keep your mnemonic phrase or private key.

Final Thoughts

Staking on Fantom could be an effective method to increase the return on your FTM tokens. Suppose you have done enough research and believe in the Fantom ecosystem. In that case, you may consider the FTM staking mainly because the APY on Fantom is higher than some of its competitors. However, there are dangers associated with staking; as experience shows, FTM and most ecosystem tokens have had drawdowns of over 90% during a weak market. In addition, your money may become illiquid, and impossible to exit a position if you stake and lock up your tokens.