Numbers alone are not enough to understand the behavior of this promising cryptocurrency. That’s why we have done this comprehensive and deep research.

Note: The cryptocurrency world is so volatile, and no one can guarantee that a cryptocurrency will be profitable in the future. Therefore, it is essential to do more research about XRP to ensure you are buying it at the right time.

Is XRP The Right Investment?

So, to better understand if XRP is still a viable investment and if you should pursue it, let’s look in detail at its background in the last years. But we also recommend that you definitely read our big What is XRP article, where we fully cover the functionality, history, and potential of XRP.

Now, let’s take a look at XRP’s performance in recent years.

How XRP Performed In 2022?

As of end-2022, Ripple holds 7th place on CoinMarketCap with a live market capitalization of $18.3 billion.

The chart below shows that the price of XRP is relatively stable between $0.3 and $0.4 after May’s sharp decline. As of the end of 2022, XRP trades at $0.36. However, no one knew if this stable floating would continue into 2023 or it may change.

The main reason XRP can hit new highs and likely surpass its current “all-time high” price is that Ripple’s case against the SEC is drawing to a close. Not only is it coming to an end, but it looks more and more likely that Ripple will get a good settlement. For example, Judge Torres agreed to Ripple’s request to present two amicus briefs that will likely help its case. This was done despite the fact that the SEC had already given the court its own arguments.

I am happy to announce that I was 100% absolutely wrong as to what Judge Torres would (should) do as she grants both requests to file Amicus Briefs.

— Jeremy Hogan (@attorneyjeremy1) October 11, 2022

And both motions were granted without comment as to the SEC's objections.

P.S. Where is @FilanLaw ? https://t.co/8Nzvo45itN

What Was the Story of the Ripple Lawsuit?

The Ripple vs. SEC lawsuit started in late 2020 with a complaint from SEC (Securities and Exchange Commission), that Ripple had conducted illegal security offering from one of the XRP digital assets. SEC lawsuit against Ripple claims that XRP is known as a security in the cryptocurrency market and is not a cryptocurrency. This creates the main issue in the Ripple vs. SEC lawsuit. The Ripple lawsuit consists of reclaiming that XRP is a currency as a part of XRP digital assets. The main aim is to conduct cross-border payments with a small fee to crypto investors.

The final verdict of Ripple vs. SEC is yet to come and is continuously lagging because the court has denied important motions from both the Ripple and the SEC lawsuits. The motion of SEC has been denied to reject the fair notice defense of Ripple as well as the motion of Ripple claimed that there is no fair notice to show the illegal coin distribution in the highly volatile cryptocurrency market.

On September 19, 2022, it was published that both parties had filed separate motions, both calling out for a summary judgment. A summary judgment is a legal term that means that a party involved in the matter believes they have enough evidence at hand to try and reach a conclusion without the need to proceed to a trial.

The process is still ongoing and will continue in 2023. Only one thing is clear: this trial can play a fatal role for Ripple. We have discussed Ripple vs. SEC case in more detail in our Why can’t I buy article.

Note: The case is almost over as of July 13, 2023, the court announced that XRP is not a security.

How Did XRP Perform in 2023?

When we look at XRP’s performance in 2023, it is like a roller-coaster ride! Showing some signs of recovery and growth, but also facing some setbacks and volatility.

The first changes happened in the first quarter of the year when the court declared that XRP is not a security, aligning it with other established cryptocurrencies like BTC. Although it wasn’t the end of the SEC vs Ripple lawsuit, it still could affect its market.

It was when XRP’s price rose from $0.34 to $0.42. Therefore, people who were unsure about XRP being a good investment in 2022, now could have increased their assets by %25!

In the second quarter of the year, XRP could reach its all-time high price of $0.96. This growth was not only the result of the XRP winning the lawsuit but also it was fueled by the launch of xRapid, a product that uses XRP to enable faster and cheaper international transactions.

XRP’s trading volume dropped by 18.5% in the third quarter of the year, which was mostly due to the multiple instances of protocol hacks, rug pulls, and scams that dominated headlines. Ultimately, the fourth quarter was somehow better for XRP investors because it showed some signs of recovery, bouncing back to $0.55 as of 27 October 2023.

What will happen in 2024? Nothing is predictable for cryptocurrency. If you want to buy XRP as an investment, we recommend you compare it with other cryptocurrencies like XRP vs Ethereum and XRP vs XLM. It would be better if you do the research right at the time of buying to ensure you access the updated information.

The Future Of XRP And Its Potential

XRP has some unique features that promise a very successful future for this cryptocurrency. If, of course, it will manage to overcome the existing obstacles on the way. We will talk about them later. Now, about the future-making advantages.

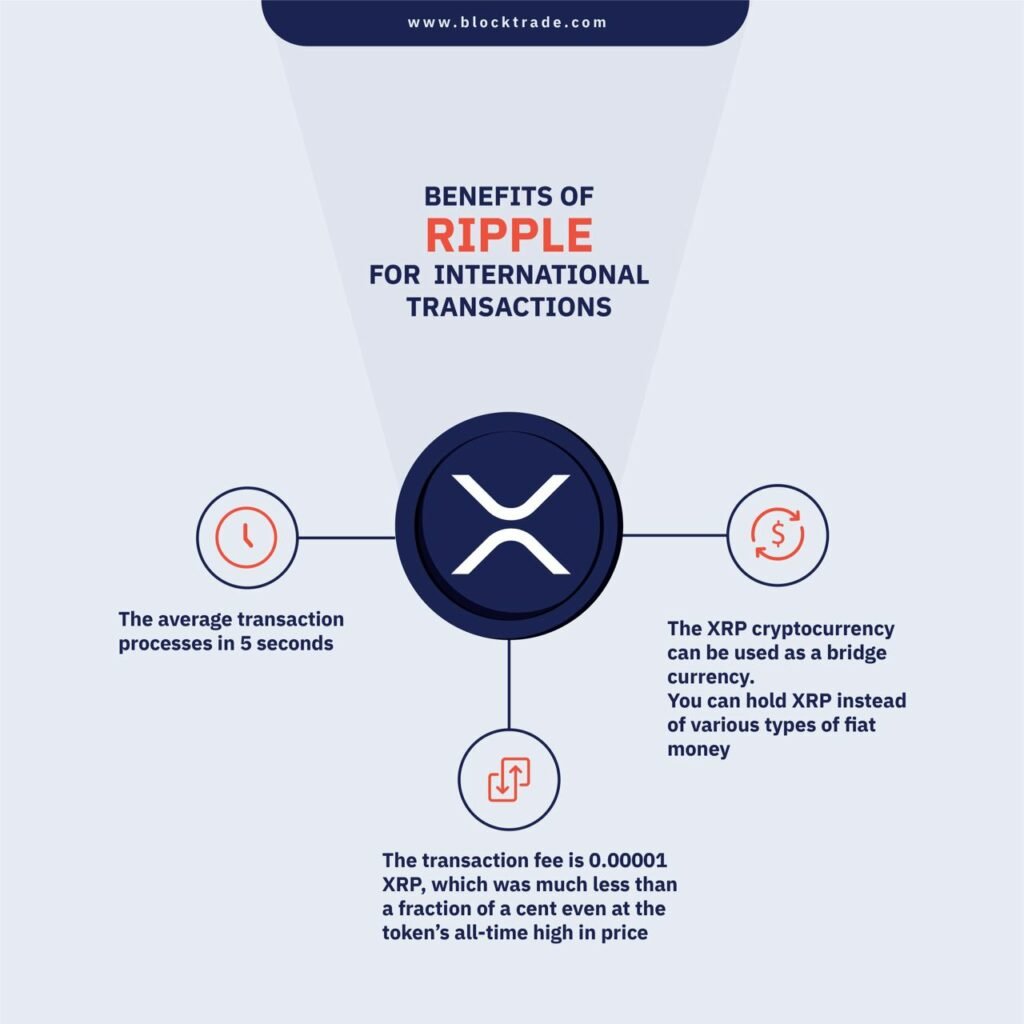

First of all, the XRP transactions are fast. Very fast! Why? All because of Ripple Net.

What is it?

Ripple Net is a platform where banks and financial institutions transfer XRP quickly and internationally at a lower price. Merchants, payees, and banks can transfer their local currency to XRP, send coins to a local gateway, and transfer back the XRP to the merchant’s accepted currency.

This shortens transfer times and reduces fees for banks that may not have a direct relationship with a foreign institution, as long as they are both on the Ripple network.

Thus, XRP is moving towards a bright future. It has a lot of advantages over many other cryptocurrency projects, as well as an already established community and platform. The Ripple team seems to be extremely dedicated to their project and actively works on making it better and regularly upgrading it. All this can prompt you once again: Is XRP a Good Investment or not?

Is XRP A Good Investment For Long Term?

XRP has a lot working in its favor. Ripple already has many innovative financial services that enable cross-platform and cross-blockchain payments.

Multiple financial institutions, including MoneyGram, have piloted XRP for transborder payments.

Indeed, all of these services bode well for the future value of XRP. But what do the experts say about XRP prices as far out as 2030? Read the complete XRP price predictions from 2023 to 2030.

Trading-education.com, for instance, which is bullish on XRP’s long-term future growth, likens the platform to a Visa competitor by the end of the decade. The site predicts that XRP could reach a high of $31.81 by the end of 2030. If this turns out to be true and you can ride the waves and hold onto your cryptocurrency, a $100 investment today could yield $9,638.43 in a little less than ten years.

Factors Affecting XRP’s Price

Now let’s take a look at what can potentially affect the XRP price.

The technology that fuels XRP is one of the most popular aspects that affect its price. Apart from how it works, you need to understand that the creators of XRP have a specific goal that they want to achieve. Ripple Labs wants to make international payments much easier and more convenient. Until the creation of the RippleNet, there was SWIFT. It was a system for international payments that was used by all the banks in order to transfer money. It was the only way until Ripple arrived.

The almighty hype – something that makes people and things famous in a matter of seconds. Things are no different in the crypto industry. If you talk about crypto and the media write about it, the price of that crypto will change – it has become a proven relationship.

There are people who hold vast amounts of certain cryptos – so much that they can actually affect the price of crypto with their actions. These people are called “whales.” The nickname resembles how the whales affect a lot of other small fish with their movement in the ocean, a behavior that nicely depicts how things work in the crypto industry with the big players.

But there are also parts of the world such as South Korea or Malta, where a lot of XRP is located at the moment, and their exchanges, as well as the users of those exchanges, who can affect the price a lot. These two states are the leading traders of XRP at the moment and they can significantly affect the market.

There is nothing absolute in the world of cryptocurrency and such is the case with XRP as well. It is inevitable that they are on a very good path and work continuously on becoming better. Their technology is becoming more accepted worldwide, and they are very proud of it.

However, there is one small factor – other cryptocurrencies. Currently, XRP is facing a lot of competition, and the outcome of such rivalry is never certain.

And again, that ever-present lawsuit. Yes, there is no doubt that its outcome will dramatically impact the future of XRP. If Ripple wins, we will most likely see tremendous price growth and long-term reputational blossom.

How Much to Invest In XRP?

DISCLAIMER: We do not provide any financial advice. We simply summarize existing expert opinions based on historical and technical analysis.

And again, please remember, that all current and future financial decisions are yours and yours alone. We only present examples from real life.

EXAMPLE: Six years ago, XRP price was a little more than half a penny. At that low price, you could have bought about 173,000 XRPs for $1,000.

In the end-2022 XRP costs $0.36. Because of that increase, your previous investment of $1,000 is now worth more than $60,000. That’s a rise of more than 6,000%, which shows how much money you can make with the right cryptocurrency.

Although this example shows how an investment made at the right time can yield impressive results, it should not be forgotten that any investment depends on individual factors:

- Risk tolerance

- Financial capacity

- Time factor

And as a result, not everyone is ready to invest a large sum of money at once. But, don’t get confused: minor investments are acceptable too!

Blocktrade allows you to buy XRP with the smallest possible money and risk. Furthermore, there are several payment methods available for buying XRP on Blocktrade. You can buy XRP with credit cards, or buy XRP with PayPal. It is also possible to buy XRP with ApplePay or GooglePay.

Additionally, never forget to select the best wallet to keep your XRP tokens safe and secure. The list of the best XRP wallets can help you find the right wallet to store XRP.

How Is XRP Different From Other Cryptocurrencies?

When it comes to Ripple investment, it is essential to know what makes this cryptocurrency different from others. While Bitcoin, Ethereum, and other top coins strive for decentralization, XRP is wholly owned by Ripple.

Being an altcoin, XRP is fundamentally different from LTC, ETH, XLM, and other cryptos.

Let’s look at the key conceptual and technological factors that drive that difference:

XRP is Centralized

There is a debate about whether or not XRP is centralized, but either way, XRP is essentially decentralized. Ripple uses a decentralized peer-to-peer concept, relying on nodes to process transactions through a voting system. Although it does not run on a blockchain, the consensus protocol is similar. But the nature of the consensus system uses a negligible amount of energy compared to Bitcoin.

XRP Doesn’t Use a Blockchain

Unlike Bitcoin and other cryptocurrencies, XRP does not run on a blockchain. Instead, Ripple uses its own unique technology, the Ripple Protocol Consensus Algorithm (RPCA). Its distributed consensus mechanism verifies transactions on the network.

For example, a participating node can verify the authenticity of a transaction using a poll without a central authority. It works like a blockchain, however, there needs to be consensus for transactions to be verified on the network.

You Can’t Mine XRP

You just can’t mine any XRP no matter how much you want to. XRP is not created through the actions of miners, nor staking is possible for XRP. Instead, it is pre-extracted. XRP currently has over 45 billion tokens in circulation, while its total supply counts 100 billion XRP tokens.

PROs and CONs of XRP

Does XRP have any downside? Let’s check out is pros and cons to see what it may lack.

XRP Pros

- Payments are extremely fast (up to 5 sec.), efficient, and transparent. Added liquidity tool helps to streamline the settlement process.

- XRP settlement speed is much faster than Bitcoin’s or Ethereum’s.

- Scalability is constantly improving – the XRP network can handle up to 1,500 transactions per second.

- Ripple’s network involves more than 100 financial institutions, including banks.

XRP Cons

- RippleNet is not entirely decentralized compared with other public blockchains.

- Because its products are tailored for big financial institutions, there is little practical relevance for retail users, although that hasn’t stopped its rabid fans, known as the XRP Army, from pumping the coin on Twitter.

- Because a large majority of XRP is held by Ripple, the token’s price could be easily manipulated or negatively influenced by saturating the market with large sales.

Ways To Invest In Ripple

You can invest in XRP using ATMs or Peer-to-peer exchanges, though the most accessible method for beginners is centralized exchange, which act as a third party overseeing transactions to give customers confidence that they are getting what they pay for. However, the centralized exchanges available on the market are not all the same. Different exchanges have different levels of safety and user convenience.

As a very secure and reliable platform, Blocktrade can be the right choice for you to start investing in XRP.

Final Thoughts

Thus, regardless of the various turbulent conditions that have accompanied XRP in recent years, this cryptocurrency has a promising future. However, no one can still say whether XRP is a good investment or not. Meanwhile, reading expert’s analyses and predictions can help you make a better decision.

FAQ

The minimum amount you have to buy is 20 XRPs (for the first time) to activate the Ripple wallet you are using. Like many cryptocurrencies, XRP doesn’t require a whole-unit purchase. For a good start, you can buy XRP for as little as $10 via the Blocktrade platform.

According to data from CoinMarketCap.com, the lowest price of one XRP token was $0.006396 on January 2, 2017.

There is a maximum supply of 100 billion XRP tokens and the company controls about 60% of them. The organization placed about 55 billion of the XRP coins it owns in a secured escrow account, from which it can release one billion coins every month.

As a crypto asset, XRP can be stored in a number of different wallet types.

The experts in the field of cryptocurrency have analyzed the prices of XRP and their fluctuations during the previous years. It is assumed that in 2025, the minimum XRP price might drop to $1.47, while its maximum can reach $1.76. On average, the trading cost will be around $1.53.

Considering various expert opinions and analyses, the price of XRP may be between $10-$30 by 2030.