What is Crypto Staking?

This article will help you to gain a decent understanding of staking and whether XRP staking is possible or not. To better understand this process and Ripple’s ecosystem in general, we recommend you also read our big article about XRP, titled What is XRP and how it works? (2022 edition).

So, staking generally is a type of strategy that can generate passive income. You deposit coins for a fixed period to earn interest.

- But how does it work

- Who can do it

First of all, let’s get this straight։ staking works similarly to interest accounts with traditional banks.

In the case of banks, everything is much simpler. Banks pay you interest because they use your funds for loans and other investments. With staking, your cryptocurrency is also used, but in a technologically different way. To understand it better, let’s look at how blockchain works and what is consensus mechanism.

A consensus mechanism is a way for distributed processes or multi-agent systems, like cryptocurrencies, to agree on a single data value or a single state of the network. It is a fault-tolerant method that is used in computer and blockchain systems.

There are different consensus mechanisms that cryptocurrencies use. Proof-of-Stake is one of the most popular for its efficiency and because participants can earn rewards on the crypto they stake.

Staking rewards are an incentive that blockchains provide to participants. Each blockchain has a set amount of crypto rewards for validating a block of transactions.

Proof-of-Stake vs. Proof-of-Work

These two concepts are essential to cryptocurrency transactions and security. They are key components of blockchain technology and how it works.

Proof-of-Stake and Proof-of-Work are known as consensus mechanisms. Both, in different ways, help ensure users are honest with transactions by incentivizing good actors and making it extremely difficult and expensive for bad actors. This reduces fraud, such as double-spending.

In Proof-of-Work, verifying cryptocurrency transactions is done through mining.

In Proof-of-Stake, validators are chosen based on a set of rules depending on the “stake” they have in the blockchain.

Advantages of Crypto Staking:

✅This is an easy way to earn interest on your cryptocurrency.

✅Unlike cryptocurrency mining, you don’t need any hardware to do staking.

✅You make the blockchain becomes more secure and efficient.

✅Staking is much more environmentally friendly than mining.

The main advantage of staking is that interest rates can be very generous. Sometimes, you can earn more than 10% or 20% annually. This is a potentially very profitable way to invest your money.

How to Stake Cryptocurrency

There are two ways of staking.

1. Creating your own node and using it independently. This is a very difficult path. It requires a great deal of knowledge about the given cryptocurrency and serious hardware equipment. There is also a staking minimum to become a full validator.

2. The second way is much easier. Simply use existing exchange platforms for staking. You just deposit your coins and agree to stake them.

How to Stake XRP

The Ripple network does not run with a Proof-of-Work (PoW) system like Bitcoin or a Proof-of-stake (PoS) system like Nxt. Instead, transactions rely on a consensus protocol in order to validate account balances and transactions on the system. Because the XRP Ledger is not a Proof-of-Stake, so proper XRP staking is not possible.

XRP Ledger Consensus Protocol

The XRP Ledger uses a consensus protocol unlike any digital asset that came before it. This protocol, known as the XRP Ledger Consensus Protocol, is designed to have the following important properties:

- Everyone who uses the XRP Ledger can agree on the latest state and which transactions have occurred in which order.

- All valid transactions are processed without a central operator or a single point of failure.

- The ledger can make progress even if some participants join, leave, or misbehave.

- If too many participants are unreachable or misbehaving, the network fails to progress rather than diverging or confirming invalid transactions.

- Confirming transactions does not require wasteful or competitive use of resources, unlike most other blockchain systems.

These properties are sometimes summarized as the following principles, in order of priority: Correctness, Agreement, and Forward Progress.

This protocol is still evolving, as is our knowledge of its limits and possible failure cases.

If I Can’t Stake XRP, Is There Any Other Way I Can Earn Interest on My XRP?

If you want to earn interest on your XRP, you’d have to lend it to some central third party, so they can use it to provide liquidity on their platform and/or loan it out to people who want to borrow it. Third parties represent various large and small exchange platforms, which, as a rule, receive certain commissions from your transactions.

IMPORTANT! Please remember that lending your crypto to a third party can be very risky. For this reason, it is mandatory to thoroughly study the previous and current activities of the third party before taking such an action. In case of the slightest suspicious circumstance, it will be right not to lend.

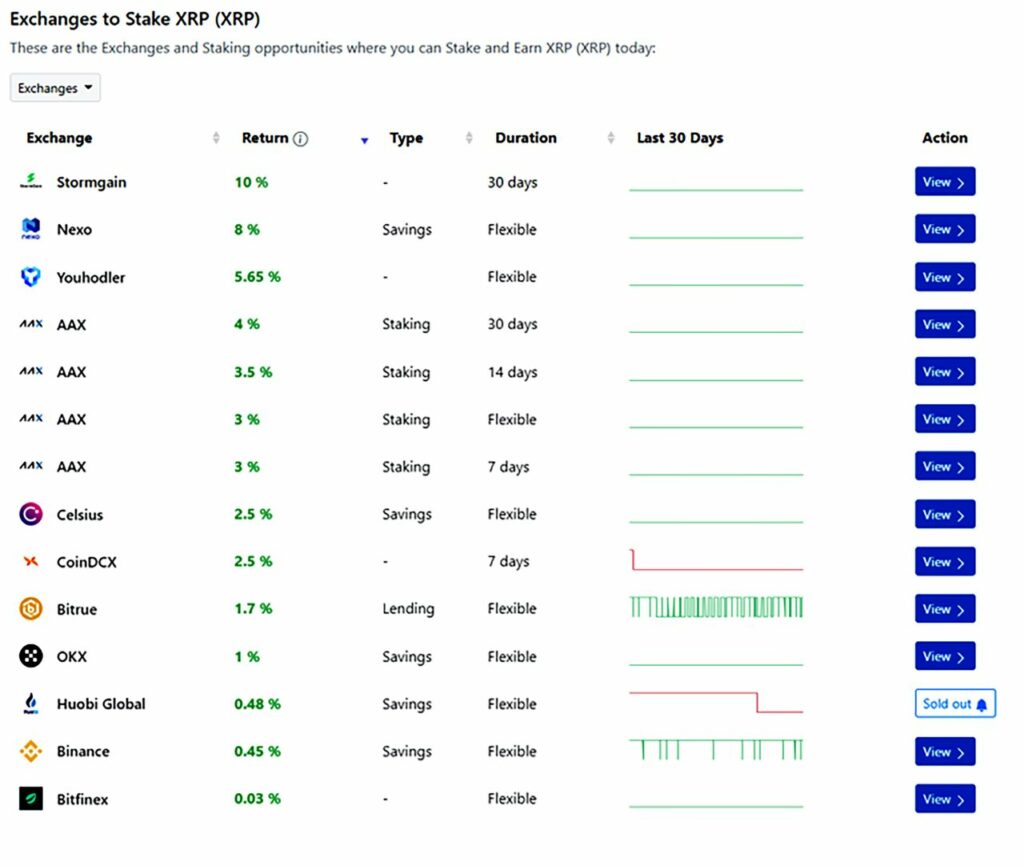

By visiting Stakingcrypto, you can get live updates on where and at what rate you can lend your XRP:

DISCLAIMER: Some platforms use XRP staking terminology instead of lending. The reason is that “staking” is a more prevalent word in marketing.

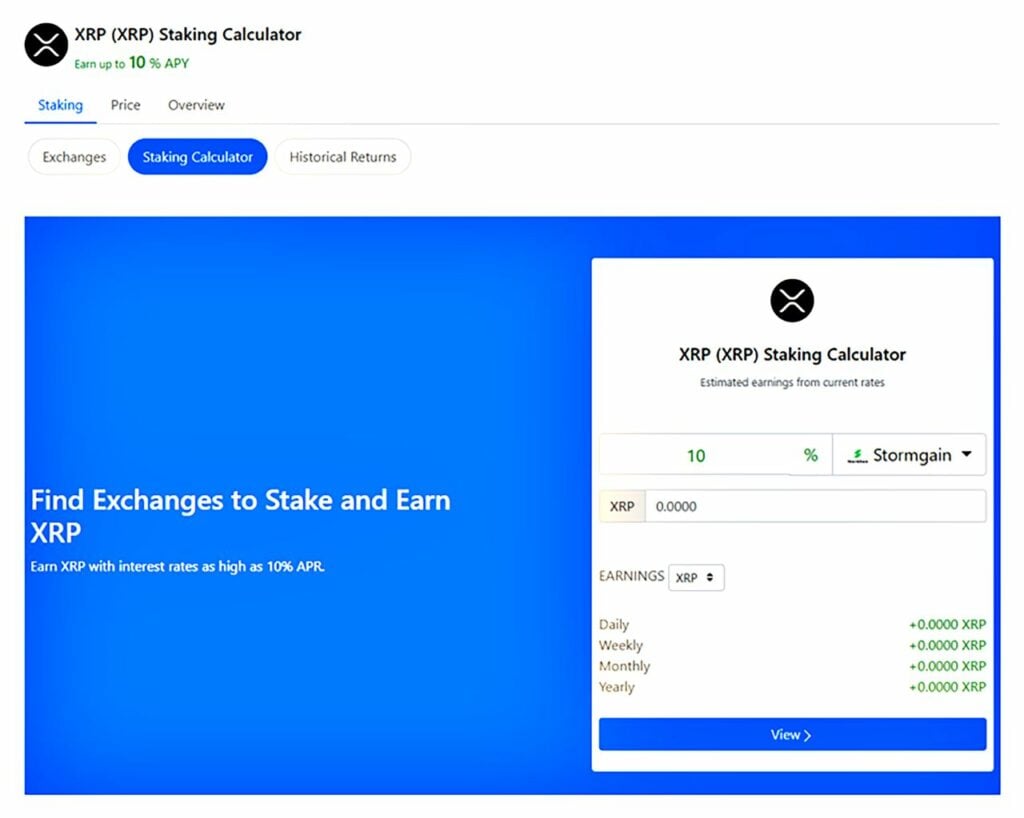

On the same website, there is also a very convenient calculator, with the help of which you can find out how much your earnings will be if you lend XRP at the moment.

Is Staking Crypto Safe?

The ultimate risk that can occur with crypto staking is that the price of the coin goes down. Consider this fact if you find cryptocurrencies that offer incredibly high payout rates.

Cryptocurrency prices are volatile and can fall quickly. If the assets you stake on go down in value, this could outweigh any interest you receive.

For example, many small crypto projects offer high-interest rates to attract investors, but their prices drop. If you are interested in adding cryptocurrencies to your portfolio but prefer less risk, you can choose crypto stocks instead.

FAQ

Because the XRP Ledger is not a proof-of-stake so, proper XRP staking is not possible.

No, XRP Ledger is not a proof-of-stake type of blockchain.

You can earn interest on your XRP by lending it.

By visiting the Stakingcrypto website, you can get live updates on where and at what rate you can lend your XRP.

Final Thoughts

As it turns out, XRP Ledger is not a Proof-of-Stake; therefore, XRP staking is impossible. This, in turn, means that instead of staking, you can lend your XRP, receiving certain interest in return.

How much do you trust this option?

This largely depends on whom you are lending your XRP. As we mentioned above, it is mandatory to thoroughly study the previous and current activities of the third party before taking such an action. In case of the slightest suspicious circumstance, it will be right not to lend. Additionally, it is crucial to properly research the Ripple system itself.