What Is Ripple?

Before discussing what XRP is and how it works, it is crucial to understand who is behind this cryptocurrency.

The Ripple Network and its token XRP launched in 2012. The company Ripple has close ties with banks and other institutions. Their goal is to act as a global settlement network to enhance existing infrastructure and services. Unlike Bitcoin, which is run by a decentralized peer-to-peer network and controlled by no single entity, the cryptocurrency XRP was created by one single company called Ripple.

Ripple’s Digital Currency XRP

XRP is the native cryptocurrency for Ripple Labs products. It means that XRP is a native asset of Ripple’s blockchain network – RippleNet. XRP is a cryptocurrency that may be exchanged, stored, and used as a medium of exchange within RippleNet.

Similar to SWIFT (Society for Worldwide Interbank Financial Telecommunication), a service for international money and security transfers, Ripple uses its products for financial transactions, asset exchange, and payment systems.

The speed of transfers is perhaps the main advantage of Ripple over SWIFT. It takes around 4 seconds to transfer payment whereas in SWIFT usually, the beneficiary would receive payment the next day.

There’s a common misconception that Ripple is a cryptocurrency. No, Ripple is not a cryptocurrency, but it does have a native cryptocurrency called XRP.

Whenever users make a transaction using Ripple’s network, the network deducts a small amount of XRP, a cryptocurrency, as a fee. The standard fee to conduct transactions on Ripple is set at 0.00001 XRP, which is minimal compared to the large fees charged by banks for conducting cross-border payments.

What is XRP?

XRP is a cryptocurrency belonging to the blockchain-based protocol XRP Ledger, which was launched in 2012 by Ripple. Blockchain protocols, also known as enterprise blockchain protocols, control several aspects of blockchain technology. They maintain the decentralized approach, eliminating the central authority nature. Protocols ensure that the data transferred across the network is efficient, secured, and reliable. The security, consensus, and networking components of a blockchain are maintained and controlled by a blockchain protocol.

In the case of XRP, the blockchain-based protocol is called XRP Ledger —an open-source, permissionless, distributed ledger that has the ability to settle transactions in 3 to 5 seconds.

How XRP Works?

When talking about the “work” of any cryptocurrency, perhaps the first word that comes to mind is mining.

“Mining” is the process that most blockchain-based cryptocurrencies use to check if they are correct. It makes transactions easier and is how new currency is added to a blockchain system, usually as a reward for the work that verifiers do to keep the network running. For example, Bitcoin has a maximum supply of 21 million tokens, which are slowly given out as more and more transactions are verified.

XRP, in contrast, was “pre-mined,” meaning the Ledger created 100 billion units that are then periodically released publicly.

XRP Ledger

The XRP Ledger processes transactions in blocks called “ledger versions” or “ledgers” for short. Each ledger version contains three pieces:

- The current state of all balances and objects stored in the ledger.

- The set of transactions applied to the previous ledger to result in this one.

- Metadata about the current ledger version, such as its ledger index, a cryptographic hash that uniquely identifies its contents, and information about the parent ledger that was used as a basis for building this one.

Each version of the ledger has a ledger index and builds on the one before it, all the way back to the first version, which has index 1. This creates a public record of all the transactions, just like Bitcoin and other blockchain technologies. But unlike many blockchain systems, each new “block” in the Ledger shows the whole current state, so you don’t have to collect the whole history to find out what’s going on now.

XRP Properties

The first ledger had 100 billion XRP in it, and no more could be made. XRP can be destroyed by transaction fees or lost if it is sent to an address for which no one has the key. Because of this, this token is a bit weaker than expected by nature. But you don’t have to worry about running out, though. At the current rate of destruction, it would take at least 70,000 years to destroy all XRP.

XRP Is Cheaper and RippleNet is Faster than Bitcoin.

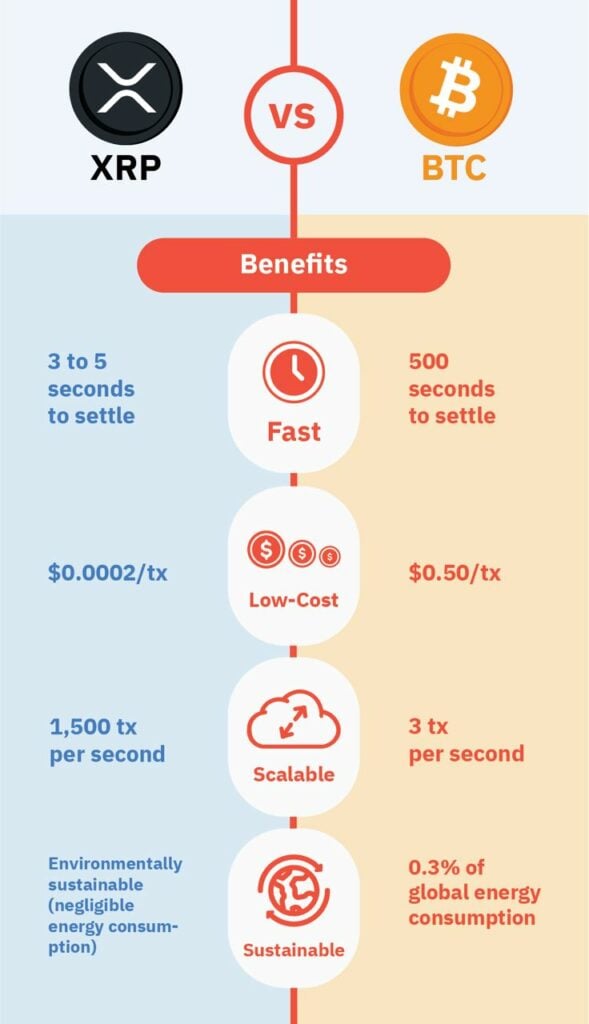

Due to the complicated and intensive nature of mining used in the cryptocurrency, Bitcoin transaction confirmations may take many minutes and are associated with high transaction costs. XRP transactions are confirmed within seconds and generally occur at very low costs.

Bitcoin vs. Ripple

Since we mentioned Bitcoin, let’s take a deeper look at the differences between the two. There are several major differences between Bitcoin and XRP. Here are what separates these two types of cryptocurrency:

1. They use different systems to verify transactions

Bitcoin uses mining to verify transactions and distribute new coins. Participants set up mining devices to solve complex mathematical equations, and the first to solve the equation gets to add a block of transactions to Bitcoin’s blockchain. Participants receive Bitcoin rewards with each block they add in exchange for Bitcoin mining.

2. XRP is faster, cheaper, and more energy-efficient

XRP verifies transactions through its consensus protocol. A majority of the validators who review a transaction must accept it for that transaction to be approved. Because of its consensus protocol, XRP can process transactions in seconds at a low cost and with minimal energy. This makes it one of the more environmentally friendly cryptocurrencies.

Bitcoin transactions, on the other hand, aren’t efficient. They take an average of 10 minutes and have much higher fees than using XRP. Bitcoin mining also requires quite a bit of energy and has faced criticism for its environmental impact.

3. Bitcoin has a much smaller supply

Bitcoin has a maximum supply of 21 million coins, and XRP has a maximum supply of 100 billion tokens. That’s one reason the price of one Bitcoin is much higher than that of one XRP.

4. They have different distribution methods

Bitcoin mining process distributes Bitcoin tokens. New coins are added to the supply as participants mine them until the maximum supply of 21 million is reached. XRP was pre-mined, meaning all 100 billion tokens were minted before it launched. Ripple locked 55 billion XRP into escrow and set up smart contracts to release one billion XRP from escrow on a monthly basis. After releasing new tokens, Ripple can sell as much as it wants to raise funds and put unsold tokens into a new escrow.

5. Ripple is a private company

Although the XRP cryptocurrency is decentralized, it’s still tied to a private company in Ripple. That’s in stark contrast to Bitcoin, which is completely decentralized. While the connection between Ripple and XRP doesn’t matter to many investors, some crypto enthusiasts view it as a negative.

What Makes XRP Unique?

The developers designed XRP to have much quicker and cheaper transactions than other cryptocurrencies, making it more suitable for day-to-day payments. However, very few use it this way, as its developers shift their focus to institutional usage of XRP. Institutional usage means functionality necessary for an organization or corporation (such as a bank or university) type of institution.

The ability to be exchanged to any currency or valuable (such as gold) with a minimal unified commission is a great advantage that XRP offers.

What Gives XRP Value?

XRP gets value from various factors, but mainly from Ripple’s ability to work with institutions and from its ability to quickly and cost-effectively be exchanged for any currency or asset. By the way, our XRP’s Price Prediction from 2022 to 2030 article will help you better understand what to expect from this cryptocurrency in the coming years.

Transactions on the XRP Ledger do not incur traditional transaction fees but instead require the sender to destroy a small amount of XRP per transaction. While this makes XRP a deflationary currency, which means that at the current rate of destruction, it would take at least 70,000 years to destroy all XRP. On top of that, prices and costs are adjustable as the supply of this token changes.

Some investors believe XRP’s use by financial institutions via RippleNet could significantly drive up demand for the cryptocurrency. Proponents say that the price of XRP will continue to go up as demand grows and supply drops slightly.

How XRP Performed in 2022?

As of the end of end-2022, Ripple holds 7th place on CoinMarketCap with a live market capitalization of $18.3 billion.

The chart below shows that the price of XRP is relatively stable between $0.3 and $0.4 after May’s sharp decline. As of the end of 2022, XRP trades at $0.36. The question remains whether this stable floating will continue into 2023.

The main reason XRP can hit new highs and likely surpass its current “all-time high” price is that Ripple’s case against the SEC is drawing to a close. Not only is it coming to an end, but it looks more and more likely that Ripple will get a good settlement. For example, Judge Torres agreed to Ripple’s request to present two amicus briefs that will likely help its case. This was done even though the SEC had already given the court its own arguments.

I am happy to announce that I was 100% absolutely wrong as to what Judge Torres would (should) do as she grants both requests to file Amicus Briefs.

— Jeremy Hogan (@attorneyjeremy1) October 11, 2022

And both motions were granted without comment as to the SEC's objections.

P.S. Where is @FilanLaw ? https://t.co/8Nzvo45itN

XRP/USD Price History

Since 2017, the price dynamics of XRP have been characterized by various ups and downs. Waves of rapid growth were followed by long periods of decline or stagnation. US SEC filed a legal complaint against Ripple in November 2020. This legal action caused the token’s price to plummet from around $0.70. dollars to $0.20. However, after 2021, the situation seems to have stabilized relatively.

The highest price XRP ever reached was $3.37 in early 2018.

The Best XRP Wallets

We have made a comparative review of the best XRP wallets in 2022.

Below you can see a comparison of the main features and fees of the eight best XRP wallets, with our respective ratings.

Understanding The Difference Between Ripple And XRP

As we already mentioned, some stories and articles often refer to Ripple and XRP interchangeably. But are they the same?

It’s important to understand that they are not the same thing: XRP is a cryptocurrency, while Ripple is a for-profit company that helps promote and develops XRP, the software behind it (the XRP Ledger), and numerous other transaction-focused projects. The company is adamant that the two entities are separate.

How does Ripple work?

Ripple Net was created as a platform where banks and financial institutions transfer XRP quickly and internationally at a lower price. Merchants, payees, and banks can transfer their local currency to XRP, send coins to a local gateway, and transfer back the XRP to the merchant’s accepted currency.

- This shortens transfer times

- Reduces fees for banks Benefits of Ripple for international transactions

- The XRP cryptocurrency can be used as a bridge currency. You can hold XRP instead of various types of fiat money

The Ripple network doesn’t use blockchain mining to verify transactions. Instead, it uses a unique distributed consensus mechanism in which participating nodes take a poll to make sure a transaction is real. This enables almost instant confirmations without a central authority.

Ripple’s Advantages

✅ Fast settlement. Transaction confirmations are incredibly fast. They generally take four to five seconds, compared with the days it may take banks to complete a wire transfer or the minutes or potentially hours it takes for Bitcoin transactions to be verified

✅Very low fees. The cost to complete a transaction on the Ripple network is just 0.00001 XRP, a small fraction of a penny at current rates.

✅Versatile exchange network. The Ripple network not only processes transactions using XRP. But it can also be used for other fiat currencies and cryptocurrencies.

✅Used by large financial institutions. Large enterprises can also use Ripple as a transaction platform. Santander and Bank of America are a few using this network, demonstrating it already has larger institutional market adoption than most cryptocurrencies.

Ripple’s Disadvantages

❌Somewhat centralized. One of the reasons that cryptocurrencies became popular is that they were decentralized, taking control away from large banks and governments. The Ripple system can be somewhat centralized because of its default list of validators, which goes against this philosophy.

❌Large pre-mined XRP supply. Though most of the Ripple supply not held in circulation is stored in escrow, it’s possible large quantities may get introduced at inopportune times, which could impact XRP’s value.

❌SEC action against Ripple. In December 2020, the SEC filed a lawsuit against Ripple, saying that since it can decide when to release XRP, the company should have registered it as a security. The company has denied the allegation.

Ripple’s History

Software developer Ryan Fugger came up with the first version of Ripple when he founded RipplePay in 2004. The website allowed people to extend credit to others in their community.

This makes Ripple the rare crypto project that was around in some form before Bitcoin (CRYPTO: BTC), although it wasn’t a cryptocurrency at the time.

Bitcoin’s anonymous creator, who used the pseudonym Satoshi Nakamoto, even mentioned Ripple once in an email.

Programmer Jed McCaleb started developing the XRP cryptocurrency and blockchain in 2011. He recruited a team, found investors, and approached Fugger about using his RipplePay network in 2012. Fugger agreed to hand over control of RipplePay. They launched their company and the XRP cryptocurrency in 2012. The company was initially called NewCoin before changing the name to OpenCoin and then later to Ripple.

Ripple would go on to establish partnerships with financial institutions. In 2019, it announced that more than 300 financial institutions in more than 45 countries were using its RippleNet payment network.

If you’re debating whether this cryptocurrency is a good investment, Ripple’s success so far is one point in its favor.

XRP was initially designed to have much quicker and cheaper transactions than other cryptocurrencies, making it more suitable for day-to-day payments. However, it is rarely used this way, as its developers focus on institutional usage of XRP. Institutional usage means functionality necessary for an organization or corporation (such as a bank or university) type of institution.

The ability to be exchanged for any currency or valuable (such as gold) with a minimal unified commission is a great advantage that XRP offers.

KEY TAKEAWAYS

- Ripple is the company that is behind XRP, the cryptocurrency.

- Bitcoin transaction confirmations may take many minutes with high transaction costs, while XRP transactions are confirmed in seconds with little cost.

- XRP is a technology that is mainly known for its digital payment network and protocol.

- Many major banks use the XRP payment system.

The Legal Battle With The SEC

The SEC sued Ripple Labs CEO Brad Garlinghouse and Chairman Chris Larsen in December 2020 (a day before Jay Clayton resigned) on charges that it generated over $1.3 billion by selling XRP in unregistered securities transactions. Ripple said XRP sales and trading did not fulfill the Howey Test, a U.S. Supreme Court ruling used to evaluate whether something is a security.

Over the last two years, the parties have filed multiple discovery motions without disputing whether Ripple violated securities law by selling XRP. The petitions for summary judgment seek the court to determine whether the SEC or Ripple proved a violation.

Considering the ongoing litigation against the SEC and all the resulting restrictions, we have researched to answer the question Why can’t I buy XRP? In the article, we looked at the possible risks and difficulties associated with XRP investments.

The SWIFT Of The Future?

Blockchain technology is transforming traditional financial systems. The cross-border money remittance industry is in a crossroad being challenged. The traditional SWIFT system is facing newcomers like the Ripple system which is based on the blockchain distributed ledger technology with its own crypto tokens. Ripple has all of the advantages over SWIFT despite some minor issues. In the short term, SWIFT will still take the lead in the remittance market due to the economy of scale. However, in the long term, emerging technology like Ripple will eventually revolutionize the remittance industry or even other financial systems.

FAQ

As of the end-2022, XRP has 45,404 billion tokens in circulation, while its total supply counts 100 billion XRP tokens.

Software developer Ryan Fugger came up with the first version of Ripple when he founded RipplePay in 2004.

Ripple’s consensus protocol is not without some weaknesses, but overall it stands out with a decent level of security.

The company is legit. As of the end-2022, there is no official evidence to the contrary.

Final Thoughts

Now you know what XRP is and how it works!

We think XRP might be a good investment for those who want to start crypto trading at a low cost. We have also discussed the investment potential of XRP in a separate extensive article titled Is XRP a Good Investment,

So, if you are looking for an inexpensive option to invest in cryptocurrency, XRP could be a suitable option due to its growth potential. However, it is essential to note that there are also alternatives.

To buy XRP with the smallest possible price and zero fees, you can use Blocktrade as a very secure and reliable exchange platform.

If you liked this post you can also take a look at, Is XRP A Good Investment?