What Does Price Impact Mean In Crypto?

This guide lists the most likely reasons why you’re getting the problem and how to fix the “Price Impact too high” on Uniswap.

First, let’s understand what Price Impact means in crypto.

By using the Price Impact Mechanism, “whales” cannot manipulate the price of cryptocurrency tokens using blockchain technology. The “whales” buy or sell a lot of tokens or coins, which affects the price of the coin on the market.

The Price impact mechanism has been implemented to stop this from happening.

So, if a “whale” tends to buy or sell a large number of shares of a coin currently in circulation on the market, then the price of buying or selling the coin, plus any fees, becomes too high for most people to afford. So, the whale has to back out of the deal.

This is how the Price impact Mechanism controls the prices of crypto tokens on decentralized exchanges.

EXAMPLE: Imagine going to the market to purchase ten apples and seeing that each apple seller asks $1 for them. That’s a simple $10 expense. But what if it suddenly became known that apples could cure COVID-19, causing the price to soar to $100 per apple? Now, for the identical ten apples, you’re out $1,000.

When trading cryptocurrencies, price volatility may result in a scenario where the actual price differs from the stated and planned price. This very phenomenon is called Price Impact or Price Slippage.

What Is The Difference Between Price Impact And Price Slippage?

Although Price impact and Price slippage are extremely similar, there is a tiny difference.

Price impact is the price change directly brought on by your own transaction, while price slippage is the change in price brought on by external, wide market movements (unrelated to your trade).

Slippage is very reliant on the liquidity of a pool, much as Price impact is. If the token pair has little liquidity, it takes fewer market moves to significantly alter the pool’s rate.

What Does Price Impact On Uniswap Mean?

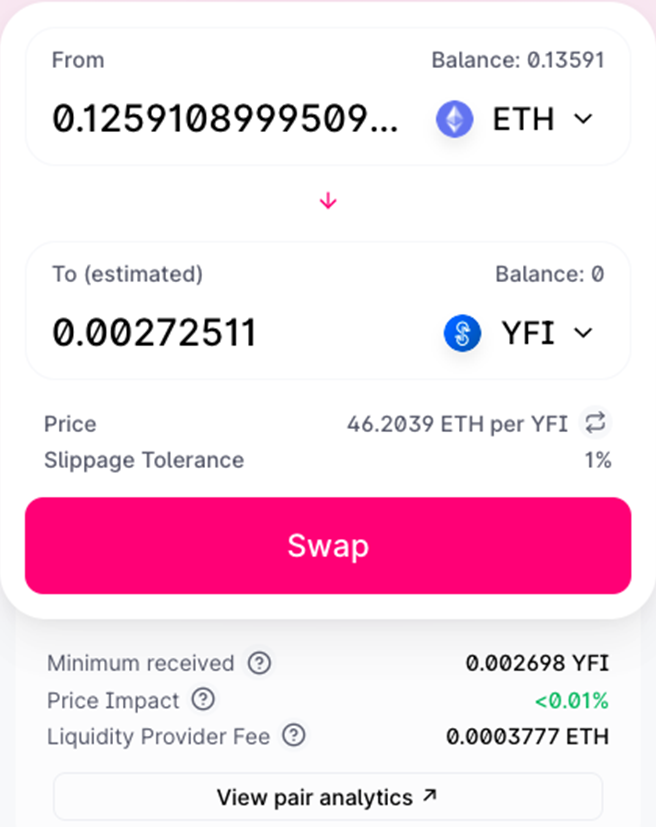

Ok, now let’s move particularly to Uniswap. This is the interface you will see when using Uniswap.

Please, take a look at Price Impact and Slippage Tolerance settings. The maximum percentage of price swings you can tolerate may be specified using the Slippage Tolerance feature. Your order won’t execute if it is higher than that. The Uniswap default is 0.5%, but you may change it to any other percentage you choose.

Price impact tells you how much slippage to expect based on the size of your order and what’s happening in the market. This gives you an idea of how many of the desired tokens you are likely to get when the trade goes through.

The Minimum Received number tells you how many tokens you will get, at the very least, based on your slippage tolerance. If you get less than this number, the transaction is automatically canceled.

How To Solve An “Price Impact Too High” Problem on Uniswap?

Now that we know what Price Impact and Price Slippage mean let’s look at two ways to solve the Price Impact too high problem on Uniswap.

- Increasing Slippage Tolerance: you raise the slippage tolerance when processing the transaction to fix the problem.

- Breaking Down Transactions into small quantities: reducing the amount of buying and selling of crypto tokens.

IMPORTANT! The most popular tactic to keep Price impact low is to divide your order into small manageable portions and watch for any counter transactions. However, the following peculiarities should be taken into account:

- There is a gas fee for each transaction. Especially if the gas fee is high and you do a lot of micro-trades, you could lose more money on gas than you would save by stopping price slippage.

- Keep in mind that every trade changes the price of both of the tokens that are being traded. This change might not mean much for assets with a high liquidity/market capitalization and/or trades that rarely happen. But if you put in a big swap order for a token with a small market cap or low liquidity, you can move the price by a lot. In practice, you make each micro-swap between these two assets more expensive.

What Happens If Slippage Is Too High?

Slippage is more than just the difference between the planned and market prices. Slippage is also divided into two types: positive and negative. These two types can have a significant effect on your trading and strategies.

- Slippage is positive for a buy order when the actual price is lower than expected, giving traders a better rate to buy. Slippage is negative (high) when the actual price is higher than what traders thought it would be. This gives traders a bad buying rate.

- Slippage is positive for a sell order when the actual price is higher than expected. This lets traders make more money from a sale. Slippage is negative (high) when the actual price is lower than what traders expected, which causes them to lose money.

Slippage can happen in any market, whether it’s stocks, forex, or crypto, but the high volatility of crypto makes it the most dangerous. In other words, slippage in crypto can lead to either a significant gain or a big loss for traders, depending on how the market moves.

And now let’s go back to the term “slippage tolerance” because, as a crypto trader, you will hear it often.

How Can I Adjust My Slippage Tolerance?

On most crypto trading platforms, you can set the amount of slippage you’re willing to pay as a percentage of the value of your order. This number is your “slippage tolerance.” If the trade’s actual value is more than your slippage tolerance, the trade will not be made.

Slippage in trading is a very important part of your strategies. Let’s say you want to buy a crypto order for $20.00, which the broker interface says you can do. You place your order, but when it’s done, you find that it was filed at a higher price of $20.50.

To reduce the chance of negative slippage, you should do a slippage calculation and write down the cost of slippage. Taking your allowed slippage into account when you place market orders can help you figure out the best time to buy or sell cryptocurrency.

Slippage In Uniswap

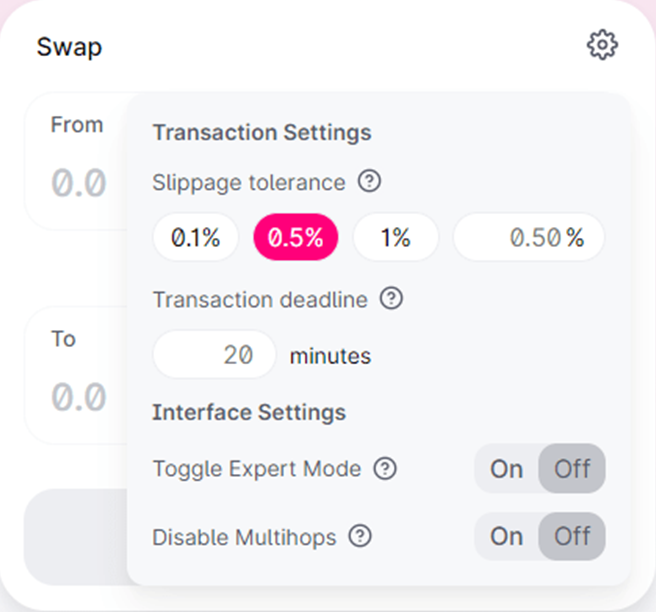

As we already mentioned, the slippage in Uniswap is set to 0.5% by default, which may not be the best number for your trading strategy. So, you can either decrease or increase your slippage tolerance in Uniswap.

A tiny box will open when you click the gear or settings icon in the browser’s top-right corner. In this window, you may define the ideal slippage tolerance for Uniswap based on your trading strategy and customize your slippage tolerance while trading.

Final Thoughts: How To Avoid Slippage On Uniswap?

And now the most important question is how to avoid extreme slippage and various problems arising from it, including “Price Impact too high”?

- Avoid trading during volatile markets.

Big news and events in the crypto market can greatly affect price movements, which can lead to slippage.

A meeting of the Federal Reserve is an important event because it affects the interest rate, which can change the prices of assets in the investment markets. Slippage will be less likely if you don’t trade when these things are happening.

Be careful when important announcements are made! - Stay alert when important announcements are made.

When big news comes out, the market tends to be more unstable. Investors should consider whether they want to invest more before doing so now. For example, when projects like Ethereum, Bitcoin Cash, and Cardano announce upgrades like The Merge, Bitcoin Cash’s hard fork, or Cardano’s hard fork, the price can change a lot. - Invest in popular assets that are easy to sell.

Slippage can be partially reduced by investing in popular assets with high liquidity. Investors shouldn’t enter the market before or after the company releases its financial statement. This is especially true of cryptocurrencies.

With that in mind, there is no 100% “right” way to avoid or approach slippage! Also, you can check out: Is Uniswap a good investment?