What is Uniswap (DeFi) staking or Yield Farming?

Yield farming is a means of earning interest on your cryptocurrency, similar to how you’d earn interest on any money in your savings account. And similarly to depositing money in a bank, yield farming involves locking up your cryptocurrency, called “staking,” for a period of time in exchange for interest or other rewards, such as more cryptocurrency.

Also known as liquidity farming, yield farming works by first allowing investors to stake their coins by depositing them into a lending protocol through a decentralized app or dApp.

Other investors can then borrow the coins through dApp for speculation, where they try to profit off of sharp swings they anticipate in the coin’s market price.

Stake on Uniswap and Earn Rewards

One of the biggest decentralized exchanges (DEX) in use today is Uniswap. It is an automated liquidity protocol that lets people trade ERC-20 tokens on Ethereum and create liquidity. In the article “What is Uniswap”, we have explained in detail the working mechanisms of Uniswap. Be sure to read it.

So, the Uniswap exchange operates by offering incentives to liquidity providers to create liquidity pools and provide collateral. Then, users may trade using these liquidity pools instead of searching for a buyer or seller on the spot.

- Liquidity Providers: These are users who are known to lend their cryptocurrency so that people can trade it. In exchange, they earn interest and other rewards. Again, a liquidity provider gets an incentive from fees when other users trade in a liquidity pool.

- Liquidity pools: This pool of two cryptocurrencies lets traders trade in and out of the pool without needing another person on the other side of the trade.

How Does Staking on Uniswap Work?

Users may exchange ERC-tokens using Uniswap, which then pools the traded tokens into smart contracts. The majority of users then trade using the liquidity pools.

Tokens may be added by anyone to a pool that generates fees. On Uniswap, you have the option to swap or list a token.

Each pool, however, is a smart contract that is decentralized and without a trading facilitator. Numerous features of the smart contract allow token trading and assist in increasing liquidity. Each smart contract is a pair that helps manage a liquidity pool of reserves of two ERC-tokens.

Uniswap is mainly powered by smart contracts. They are “Factory” contracts and “Exchange” contracts, respectively. These two are automated computer programs created to do specific tasks when certain requirements are satisfied. Additionally, the factory contracts are utilized to introduce new tokens to the network, while the exchange contract assists with all token trades.

How to Stake on Uniswap

You should know that staking liquidity on Uniswap is easy, unlike on other decentralized exchanges, where you have to deal with many details. Without further ado, here are the steps for staking tokens on Uniswap.

Step 1: Get an Ethereum Wallet

You will need an Ethereum wallet or a wallet that supports Ethereum before you can start staking tokens on Uniswap. This is because Uniswap is built on Ethereum, which is needed for most activities. We are going to use Metamask for this tutorial. The Metamask wallet can be downloaded from Metamask.io. You should know that you can also download Chrome if you use Chrome.

Step 2: Get some Ether

Buy Ethereum in MetaMask!

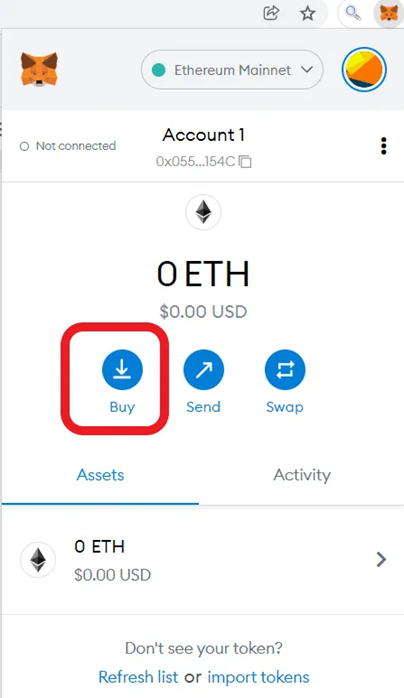

- The second step is to buy Ethereum and send it to your Metamask wallet. When you want to stake the token of your choice, you need ETH tokens to pay the gas fees.

- After you’ve done these things, you need to send the total number of tokens you want to stake into your Metmask wallet.

- Note: You can buy Ethereum from Binance and put it in your Metamask wallet. Go to your app or page for Metamask and click “Buy.”

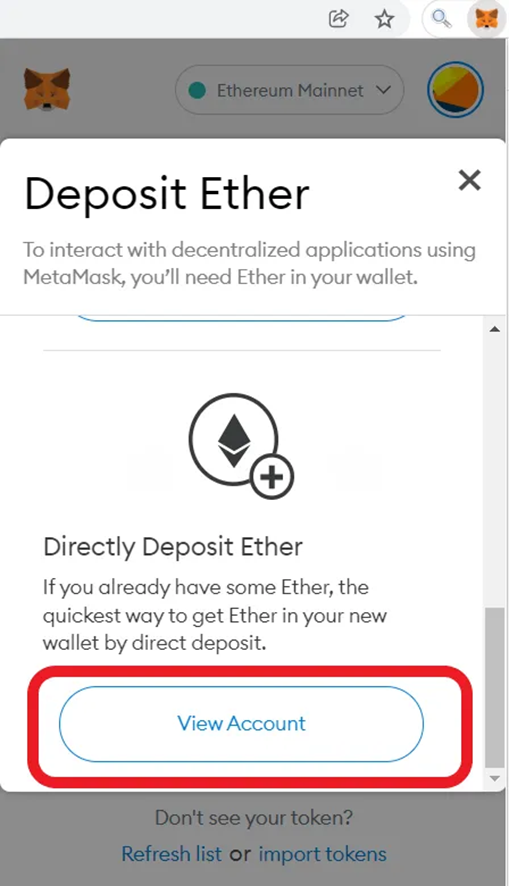

- After you click “Buy,” scroll down until you see the option to “Directly Deposit Ether.” Click on “Account.”

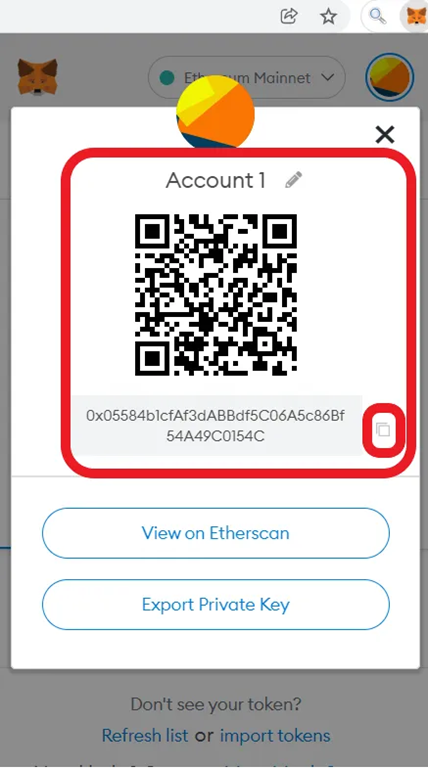

When you click “Directly Deposit Ether,” Metamask will show you the QR code and your wallet address. Binance can either scan your QR code or copy the address of your wallet.

Go to Binance once you’ve copied the wallet address from Metamask. Make sure your Binance account has some ETH tokens.

If that’s checked, go to the send/withdraw option and paste the address you copied from Metamask.

Fill in the required information and click the send button. Then look at your Metamask Wallet.

Step 3: Start staking on Uniswap page

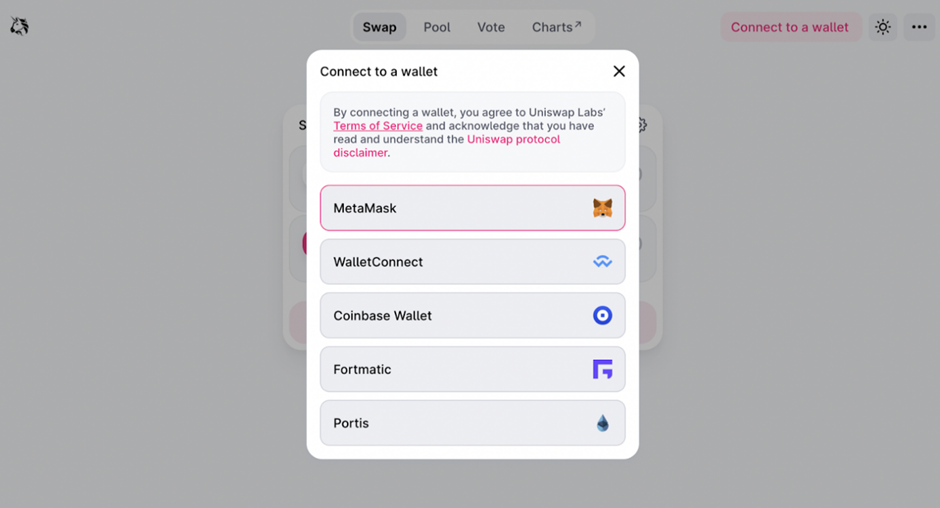

The next step is to go to the Uniswap page and enter the staking portal. Once you’re in, you’ll need to connect your wallet to the portal.

IMPORTANT! Pay attention to the permissions you give when you look at a site with your wallet. Then go ahead and bet as many of your tokens as you want. You will have to pay ETH as a gas fee based on how many tokens you have staked.

How Much Can You Earn by Staking on Uniswap?

Liquidity staking with Uniswap is a one-of-a-kind process that uses an automated protocol for liquidity. You need ETH and an ERC-20 secure wallet to participate in Uniswap liquidity staking. Then, you can swap your ERC-20 tokens by joining Uniswap liquidity pools. Since Uniswap is an Automated Liquidity Protocol, it doesn’t need an order book or a central party.

So, How much money can you make staking on Uniswap?

If you stake $1,000 worth of UNI at a 7% rate for a year, you will end up with $1,070. A crypto staking calculator can be used to figure out the amount. Just put in how much UNI you want to stake, and the calculator will tell you how much you can expect to earn per day, week, month, or in the long run. It’s a great way to get a sense of what you might get if you stake Uniswap.

Find out how much money you can make by staking on Uniswap. The results depend on how much you stake, how long you play, and what type you choose. There are many staking pools with different amounts of rewards, but if you’re starting out, it’s best to go to the Uniswap site.

By default, the validator list is sorted by staked balance, including each validator’s reward, user, balance, balance share, and delegation address.

Learn as much as possible and talk to Uniswap community people before you decide to invest.

What’s good about staking on Uniswap?

- Uniswap is one of the best places to trade cryptocurrency. It is one of the top 10 cryptocurrency exchanges in the world. It’s important because millions worldwide trust these exchanges and hold digital assets for the long term.

- Uniswap is a very valuable asset. Because Uniswap has a lot of capital assets, this is a very important factor in figuring out how stable it is.

- Increased users due to no verification. You don’t need a government-issued verification card to use Uniswap. It’s one reason why the number of users is going up.

Is There a Risk to Stake Uniswap?

- Network speed is an issue. Uniswap is an ERC-20 token, which makes it one of the applications running on the Ethereum network. It makes it a little bit slow compared to other competitors.

- Competition from other decentralized exchange spaces. Uniswap is Facing competition from other decentralized exchanges platform present on Ethereum, and this can affect the future of Uniswap.

- Being susceptible to crypto news in Bullish and Bearish moments. Uniswap, by now, should have achieved some form of independence from mainstream cryptocurrencies as a token behind a decentralized exchange. Sadly, this DeFi platform has not been able to achieve this until now, which can affect Uniswap staking in the future.

FAQ

When a token price rises or falls after you deposit it in a liquidity pool, this is known as crypto liquidity pools’ impermanent loss (IL).

While it’s possible to earn high returns with staking on Uniswap, it is also incredibly risky. A lot can happen while your cryptocurrency is locked up, as is evidenced by the many rapid price swings known to occur in the crypto markets.

Staking is one of the most straightforward ways to generate passive income in the DeFi space.

Final Thoughts

Staking is one of the most straightforward ways to generate passive income in the DeFi space. Traders can also stake tokens on Uniswap via other websites. Still, you must be cautious because hackers and fraudsters are constantly looking for traders to scam, and traders may enter the wrong site if they are not well informed.

Staking Uniswap is unlike any other form of cryptocurrency staking. Still, once you’ve figured out how, you can make a decent passive income from your ERC-20 tokens by placing them in liquidity pools with Uniswap.

Furthermore, before doing anything in the DeFi space, it is critical to conduct research.