Staking Ethereum is becoming more popular as an attractive and hassle-free way to make passive income. All you need to do is hold a certain amount of Ether in your wallet, allowing you to become a validator for the network and start earning rewards. In this guide, we’ll explain how to stake Ethereum and get started on your journey.

What is Cryptocurrency Staking?

First of all, there is something you should know about staking cryptocurrency. There are two methods to validate transactions in the crypto world:

- In PoW (Proof-of-Work), the transactions are validated by miners who compete to solve complex mathematical problems and earn rewards for adding new blocks to the blockchain. An example of a cryptocurrency with this validation is Bitcoin. However, this process requires a lot of computing power and energy, which can be costly and inefficient.

- In PoS (Proof-of-Stake), some validators stake their coins instead of miners to participate in the network. Validators are randomly selected to create new blocks or verify transactions, depending on their stake size and duration.

In general, staking is a way of contributing to the security and operation of a blockchain network. Staking is only done with cryptocurrencies that follow the PoS consensus mechanism. For example, if you buy Bitcoin, you can’t use it for staking. However, there are still other ways to make money with Bitcoin.

Can Ethereum be Used for Staking?

The story of Ethereum is different because the Ethereum consensus mechanism was PoW in the past. It was in December 2020 when the team decided to transition Ethereum from PoW to PoS, making its network more secure, scalable, and sustainable.

Therefore, the new version of this cryptocurrency was introduced as Ethereum 2.0. Although it is still in the first phase of transition, staking is now available on this cryptocurrency. So, the Ether owners can use their coins for staking and earning income.

How to Stake Ethereum?

First, you need to decide how much Ethereum you want to stake. Typically, you can start with a deposit of 34 ETH to activate a validator software. As a validator, you will store data, process transactions, and add new blocks to the blockchain. This will keep Ethereum secure for everyone and earn you new ETH in the process. The current annual percentage return (APR) for staking on Ethereum is about 7%, which may vary depending on various factors.

The more ETH you put in, the larger your rewards will be – but remember that staking also comes with some risks (e.g., missing out on potential network rewards); we will get to this part later.

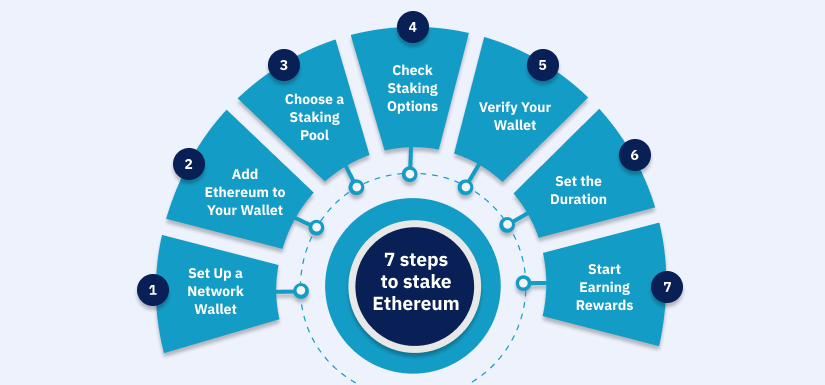

Once you’ve decided, it’s time to set up your wallet. Follow these steps:

1-Set Up a Network Wallet

To start staking Ethereum, you need a network wallet. There are various network wallets you can use for staking Ethereum, including MyEtherWallet and MetaMask or Trust Wallet. You must transfer your Ethereum to the network wallet to start staking. Also, ensure the network wallet supports staking. Some network wallets are only for storage purposes and do not support staking.

2- Add Ethereum to Your Wallet

Once you’ve made your account, you need to add some funds and decide how much to stake. If you already have enough ETH in your wallet, simply send it over (the minimum amount is 0.1 ETH). Alternatively, if you don’t have enough, you can buy Ether from Blocktrade and transfer it to your wallet.

3- Choose a Staking Pool

You can decide to stake Ethereum individually or join a staking pool. Joining a staking pool is more profitable and easier than staking individually. When you stake individually, you will need to have a minimum of 32 ETH and run a node, which is stressful, expensive, and time-consuming. On the other hand, staking pools enable you to pool resources with other investors and increase your chances of earning rewards.

4- Check Staking Options

Next, you need to find the ‘Staking’ tab in your wallet and check out the available staking options. For best results, selecting a reliable platform with good security measures and attractive reward structures is important. Once you’ve decided on the platform, simply click the ‘Stake’ button and follow any onscreen instructions.

5- Verify Your Wallet

After selecting the staking pool you want to join, you will need to verify your wallet and the amount of Ethereum you are contributing to the pool. Usually, the staking pool will have a minimum deposit amount that varies from one pool to another. Once you verify your wallet, your contribution will be added to the staking pool, and you can start earning rewards based on the total pool contribution.

6- Set the Duration

In this step, you need to decide how long you want to leave your stake active. Generally speaking, the longer you stake, the higher rewards you will earn – however, this also comes with increased risk. When you’re ready, click ‘Confirm’ to activate your stake.

7-Start Earning Rewards

The rewards you will earn from staking Ethereum are known as staking rewards. The amount depends on the amount of Ethereum you have staked, the duration you have staked, and the staking pool you have joined. Staking rewards are usually paid in Ethereum and are credited to your network wallet regularly. You can choose to restake your rewards to earn more or withdraw them to your bank account.

That’s it! You’re now an Ethereum staker and ready to start earning rewards. As you can see, it’s effortless to stake Ethereum – all you need is some ETH in your wallet and a reliable platform for staking. So why not get started today?

What are the Risks of Staking Ethereum?

As mentioned, while staking Ethereum can be profitable, it comes with some risks. The major risk is the possibility of losing your investment if the Ethereum network is hacked or encounters a severe problem.

Also, if you stake Ethereum individually, you could be penalized if your node fails to validate transactions consistently. However, joining a staking pool can reduce these risks since the pool operator bears most of the risk. Here are other risks that staking Ethereum may have:

- Liquidity risk: It is not possible to withdraw staked ETH freely, which means you can only access or use your funds once the network allows it. The risk here is that it may take longer than you think, from months to years, depending on the progress and development of the network. You may also miss out on other opportunities or face price fluctuations during this period.

- Technical risk: Staking Ethereum is done via a validator software. Although this software is usually secure, there are still risks of getting hacked or going offline, which may cause you penalties or lose some of your staked ETH.

- Regulatory risk: Every country may have its own cryptocurrency rule. Accordingly, staking Ethereum may have legal or tax implications in some jurisdictions, depending on how the authorities classify and treat it. It is recommended to check out European countries’ crypto regulations framework to ensure you won’t face any regulatory issues.

Conclusion

As can be seen, staking Ethereum can be a great way to earn passive income. However, always remember to do your due diligence before staking Ethereum. Ensure you use a reputable network wallet and join a reliable staking pool. Also, be mindful of the risks involved and only stake Ethereum you can afford to lose. With these in mind, you can earn rewards from staking Ethereum and build your cryptocurrency portfolio.

FAQs

Staking Ethereum is a personal decision that depends on your goals, preferences, and risk tolerance. There are some potential benefits and challenges of staking Ethereum that you should consider before making your choice. Therefore, you should check out all these aspects to decide if it’s the best option for you to earn passive income.

Yes, staking is possible for anyone. However, you should have some ETH to deposit – usually 32 ETH, and a way to run a validator software, which should be a dedicated computer connected to the internet 24/7.

A lock-up period in staking ETH is the time during which you cannot withdraw or use your staked ETH for any other purpose. There is no fixed period for this lock-up; it might be anywhere between several months to a few years.

It is possible to lose your ETH if you stake it, depending on how you stake it and what happens on the network. Although it might be rare, losing your tokens is one of the risks of staking any cryptocurrency.

Since you will receive rewards for staking Ethereum, this process can be profitable for most people. Somehow, it is known as a low-risk method of making money out of cryptocurrencies.