The idea is that 1 stablecoin should always equal $1. This allows crypto investors to hedge against the notorious volatility of the crypto markets. Stablecoins attempt to combine the speed, security, and anonymity of cryptocurrencies with the stability of traditional assets.

This makes them potentially useful for payments, loans, trading, and storing value. However, not all stablecoins are created equal when it comes to safety. Tether (USDT) for instance, the largest stablecoin by market capitalization, has faced questions over the adequacy of its dollar reserves after dropping below its $1 peg at times.

This article will explore what makes a stablecoin secure so you can evaluate the risks.

What Makes a Stablecoin Safe?

When evaluating how safe a stablecoin is, there are a few key factors to consider:

- Sufficient Reserves – The stablecoin should have at least 100% of its circulating supply backed by reserves of the asset it is pegged to. For a USD-backed stablecoin like USDC, this means holding $1 in bank deposits for every 1 USDC token issued. Partial backing creates risk.

- Transparency – The stablecoin issuer should provide frequent attestations of its reserves from reputable third-party auditors. This gives confidence that the backing assets exist. Lack of transparency raises red flags.

- Regulation – Stablecoins that are regulated by government bodies like the SEC provide more protections for users. Regulation typically requires reserve reporting and anti money-laundering compliance. Unregulated stablecoins have more risks.

- Decentralization – Stablecoins that use decentralized smart contracts to manage supply rather than a centralized issuer can enhance security. However, smart contract bugs can also pose risks. There are tradeoffs to decentralization.

So, for a stablecoin to be considered safe, it should have full transparent reserves, comply with regulations, provide confidence in its issuance model, and ideally employ both centralized and decentralized security features. No stablecoin is 100% fool-proof, but assessing these key factors helps determine the level of risk compared to alternatives. Look for stablecoins that score highly across all criteria.

Examining Major Stablecoins and Their Weaknesses

Stablecoins come with different risks associated with their reserves, regulation, centralization, and governance. No option is risk-free. But analyzing their differences allows for an educated choice. In the following, we will take a look at some of the popular stablecoins and the risks involved with them.

1- Tether (USDT)

The first question you may have might be: ‘Is Tether safe?’

With a market capitalization over $80 billion, Tether is the largest and most widely-used stablecoin. However, it has faced ongoing criticism around lack of transparency into its dollar reserves and regulatory compliance.

Tether claims to be 100% backed by dollars yet has provided limited audits to verify this. It also settled with the NY Attorney General in 2021 for misleading statements around reserves. While still dominant, concerns persist around Tether’s reserve adequacy and potential risks from regulators cracking down on its unlicensed status.

With all these concerns, Tether is still among the top three safest stablecoins on the market. You can buy Tether from Blocktrade.

2- Dai (DAI)

Dai takes a different approach as a decentralized stablecoin managed by the MakerDAO protocol. It maintains its dollar peg not through bank reserves but through overcollateralization with crypto assets like Ether. This avoids centralized control over reserves.

However, the complex collateralization system failed under volatile conditions in 2020, causing DAI to unpeg. The reliance on collateral assets also ties Dai’s stability to the crypto market. Decentralization enhances transparency yet introduces other risks.

Despite all the risks, DAI is the third safest stablecoin on the market.

3- Binance USD (BUSD)

BUSD is regulated and fully backed by Paxos-held dollar reserves. However, its affiliation with Binance exchange is a concern for some. Binance faces regulatory uncertainty and allegations of laundering criminal funds.

While BUSD itself is compliant, its connection to Binance poses a credibility risk. Binance could also theoretically freeze or censor addresses. So BUSD offers sound reserves but carries potential issues stemming from Binance’s involvement.

4- USD Coin (USDC)

A question often posed by crypto investors is, ‘Is USDC safe?’

USDC has over $50 billion in circulation and is managed by Circle, a regulated financial services company. It publishes monthly attestations of its dollar reserves held in partner banks like US Bancorp. This level of transparency is reassuring.

However, the reliance on traditional banking partners for its reserves still presents counterparty risks. For example, a bank failure could put reserves in jeopardy. Recent banking troubles caused USDC to briefly lose its dollar peg. So while more secure than Tether, USDC has some centralized points of failure.

However, USDC is considered the safest stablecoin on the market. You can buy USDC on Blocktrade.

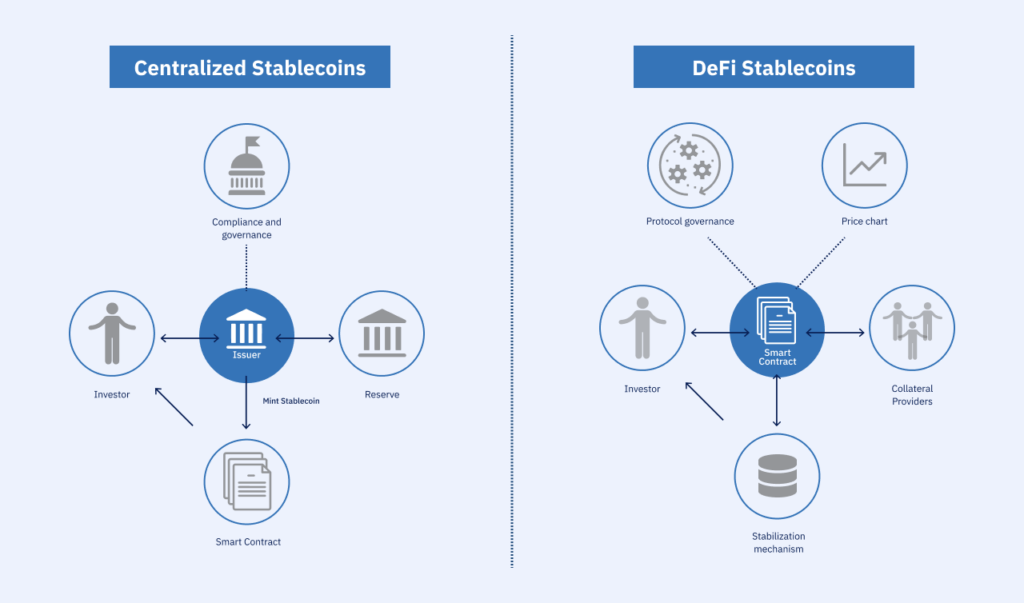

Centralized vs Decentralized Stablecoins: A Tradeoff in Risks

Stablecoins come in two broad forms – centralized and decentralized. Each model has advantages and disadvantages when it comes to stability and security.

Centralized stablecoins are issued by a single entity that controls the supply and reserves. Examples include fiat-backed stablecoins like USDC and USDT. The central issuer manages the 1:1 fiat collateral held in bank accounts. This allows for efficient scaling and coordination with financial partners. However, it also concentrates risk in the issuer itself. Reserves can be mismanaged or subject to counterparty risk.

Decentralized stablecoins use smart contracts and crypto assets to programmatically control supply. DAI is an example, collateralized by a basket of cryptocurrencies. No central party is in charge. This avoids concentrated risk and provides transparency via the blockchain. But the reliance on collateral assets ties stability to crypto market fluctuations. Code vulnerabilities also pose risks.

In terms of stability, centralized models more seamlessly reflect fiat currencies and monetary policy. But decentralization means no single failure point for a breakdown in the peg. For security, centralized stablecoins offer efficiency at the cost of placing trust in the issuer. Decentralization spreads out trust across code and community governance.

There is no definitively superior model – both have tradeoffs. But a prudent approach for users is to assess the specific pros and cons of a stablecoin’s design rather than assume centralized or decentralized is universally better. Examining the collateralization method, supply controls, and governance structure allows for evaluating risks in context. And combining centralized and decentralized elements may ultimately prove the most balanced approach.

How New Regulations Could Impact Stablecoins

At the moment, stablecoins are functioning in an unclear regulatory environment with very little oversight. However, governments are moving to establish clearer guidelines and licensing schemes. Recent examples include the EU’s Markets in Crypto-Assets (MiCA) framework and pending stablecoin legislation in the U.S. Congress.

Increased regulation has potential benefits for stablecoin safety and adoption. Requiring issuers to meet capital and reserve requirements and undergo routine auditing would enhance stability. Conditioning exchange listings on compliance could help avoid situations like TerraUSD’s collapse. Explicit approval processes would also provide more legal clarity to businesses and investors seeking to use stablecoins.

However, regulation poses risks to non-compliant stablecoins. Those unable or unwilling to satisfy regulatory licensing rules could face being barred from operating in major jurisdictions. Tether for instance may struggle to prove its reserves if required by new laws. Compliance costs could also concentrate the stablecoin market in fewer major players.

While regulation has tradeoffs, increased oversight would arguably improve stability and accountability across the board. It would help mature stablecoins as a legitimate payments instrument. Users stand to benefit from the increased transparency, auditing, and financial standards that regulation could introduce. Though some unstable and unaudited stablecoins would likely disappear, improved overall stability and optionality would outweigh this downside for most.

Choosing the Safest Stablecoin

When selecting a stablecoin, key factors to evaluate include:

- Reserves – Full transparent reserves of the underlying asset instill confidence.

- Regulation – Oversight improves protections and recourse.

- Audits – Frequent attestations from reputable auditors provide assurance.

- Decentralization – Smart contract controls can enhance security.

- Track record – Stability through major market events demonstrates resilience.

Based on these criteria, two safer options for new cryptocurrency investors are USD Coin (USDC) and Dai (DAI).

USDC is fully backed with regular attestations, compliant with US money transmission laws, and managed by trusted fintech Circle. This makes it very low risk, though still centralized.

DAI offers transparency via its smart contract system decentralized across many users. However, it carries risks tied to crypto collateral.

No stablecoin is perfect or risk-free. But USDC and DAI score well across key factors compared to alternatives. As investors become more comfortable, other options can be considered.

Above all, researching the strengths and weaknesses of any stablecoin is advised before investing sizable funds. But USDC and DAI present newcomers with a more prudent starting point.

Concluding Thoughts on Stablecoin Safety

In summary, there are no riskless stablecoins, only trade offs across qualities like reserves, regulation, decentralization, and auditing. Stability emerges from balancing these factors. Fiat backing provides an anchor but sensible controls and distribution of trust act as ballast.

Centralized models offer efficiency but introduce counterparty risks. Decentralized designs have vulnerabilities too when relying on complex incentives and imperfect code. And regulatory compliance likely improves protections at the cost of reduced options.

There is no one-size-fits-all solution. But applying careful analysis allows users to determine the stablecoins aligned with their risk tolerance. Caution is still warranted – cryptocurrencies remain subject to glitches and black swan events. However, an informed understanding of the strengths and weaknesses of various stablecoins offers a pathway for mitigating uncertainties. With reasoned evaluation, these instruments can responsibly provide cryptocurrency users with much needed stability.

After exploring the individual merits and risks of Tether and USD Coin, you might be interested in a direct comparison to make an informed decision. Dive deeper into the distinctions between these two prominent stablecoins by reading our detailed comparison: Tether vs. USDC.

Whether you value the extensive use of Tether or the regulatory compliance of USD Coin, now is your chance to invest. Buy USDT or Buy USDC and step into the stablecoin market. Choosing between Tether and USD Coin? Why not get a taste of both? Buy Tether with Google Pay for a seamless purchase or Buy USDC with Credit Card for a secure and regulated option.

FAQs

They are designed to be, but in practice some fluctuate slightly or even lose their peg due to various risks. The more safely managed stablecoins tend to maintain stability.

It should in theory quickly recover back to $1. But a sustained broken peg undermines confidence and may require redemptions to be suspended until stability returns.

In a worst case scenario like insolvency of the issuer, stablecoin value can drop to zero. Diversification across stablecoins reduces this risk. However, you should also note that stablecoins are not good options for investment because in the best case, their price stays stable equal to $1.

Oversight is still developing. In the US, the SEC, FinCEN, and state agencies are starting to assert authority. New legislation will clarify regulation.