Introduction

When the ominous Satoshi Nakamoto first introduced his concept of a decentralized peer-to-peer electronic cash system called “Bitcoin” powered by an encrypted chain of blocks containing transactional data on October 31st 2008, very few people took note.

13 years later, in 2021, however, we know that the publication of the Bitcoin whitepaper ushered in a massive disruption and new era in the financial markets. There are now more than 7.000 different cryptocurrencies in existence, the market capitalization of all crypto-assets has surpassed 1tn USD with a daily trading volume of more than 200bn USD. Cryptocurrencies have become an asset class of their own, their global regulation being discussed or called for by the WTO, IMF and new US Secretary of Treasury Janet Yellen. The concept of digital currencies based on blockchain technology is gaining traction as numerous national banks like the Central Bank of China, Federal Reserve or European Central Bank are discussing the issuance of a digital version of their own nation’s currency.

Yet, cryptocurrencies and crypto-assets are only a small part of the breadth of applications blockchain technology and distributed ledger technology (DLT) hold in store. Digital assets like security tokens represent another important field of application. Tokenized securities can be issued to represent any kind of legal rights associated with an asset and may be transferred and traded digitally worldwide. The decentralized nature of the blockchain eliminates the need for middlemen like central- and investment banks, thereby massively reducing transactional costs, speeding up processing times and spurring new use cases and investment opportunities that were heretofore uneconomical or technologically unfeasible.

Indeed, we are at the brink of a financial revolution that will transform and disrupt the entire industry. Through this and beyond that, blockchain technology will be, is and already has had tremendous impact on the global markets and economy overall.

In this article series, we want to offer readers a broader and general overview over how blockchain technology, cryptocurrencies and digital assets are changing the financial world and global economy as we know it. To this end, we first set the scene by introducing the nature and variety of the global financial markets and their functions.

What is a Financial Market?

The term “financial markets” is generally used to refer to any marketplace on which securities are traded, including (but not limited to) the stock market, bond market, foreign exchange market, and derivatives market.

Financial markets play a vital role in facilitating the smooth operation of capitalist economies by allocating resources and creating liquidity for businesses and entrepreneurs. The markets allow for buyers and sellers to exchange their financial holdings. Financial markets create securities products that provide returns to those who have excess funds (investors / lenders) and make these funds available to those who need them (borrowers).

Financial markets play a pivotal role in providing businesses with the capital needed to build, expand and develop their business. This at the same time provides a greater breadth of investment opportunities for those with excess capital, whilst also increasing the number of providers of goods and services, carried out by such businesses. It is therefore clear to see just how important a role efficient financial markets play in the success of an economy.

The mechanism of supply and demand is the fundamental driver of any market. The ability to easily match buyers to sellers and lenders to borrowers at a given time is a powerful tool and a good indicator of how well the overall economy is performing.

In a well-developed and efficient market, transaction costs are always lower, further increasing the accessibility of funds to businesses, and vice-versa. This is because lower transaction costs result in more affordability, meaning a more feasible and safer investment opportunity for investors with a limited budget. An effective financial market provides good opportunity for the creation of wealth and facilitates a pathway between savings and investment that meets short-term and long-term financial needs for anyone with access through efficient mobilization of funds.

The stock market is just one example of a financial market. In fact, there is a financial market for each traded type of financial instrument including equities, bonds, currencies, and derivatives. These markets largely depend on information transparency to ensure that the market sets prices that are efficient and appropriate. Yet, macroeconomic factors such as taxes are the reason that the market prices of securities may not necessarily be indicative of their true value.

Financial markets also differ in their size and level of activity. While the New York Stock Exchange (NYSE) reaches a securities trading volume of trillions of dollars every day, other financial markets may have trading volumes below 1 bn. As the most important and frequently covered, the equities (stock) market is a financial market that enables investors to buy and sell shares of publicly traded companies. The primary stock market is where new issues of stocks, called initial public offerings (IPOs), are sold. Any subsequent trading of stocks occurs in the secondary market, where investors buy and sell securities that they already own.

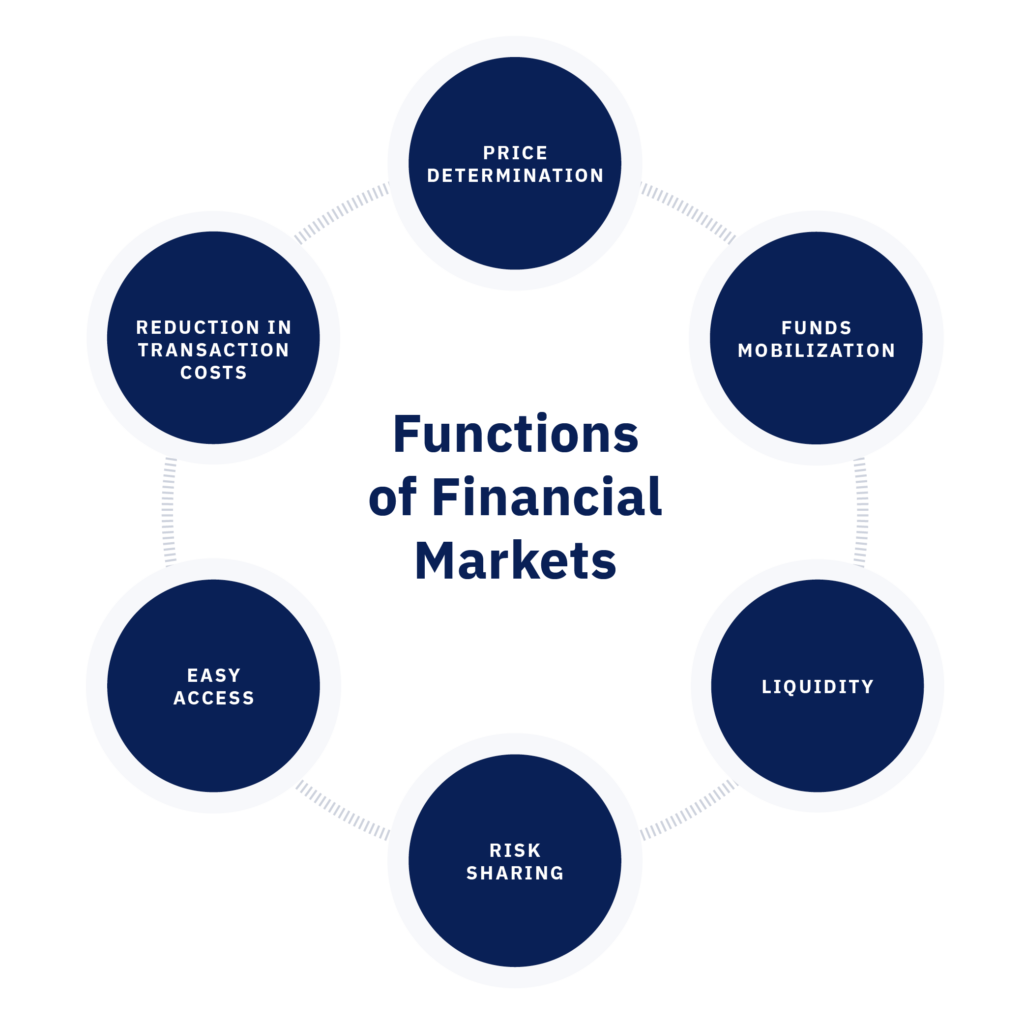

6 Functions of Financial Markets

There are 6 important functions that all financial markets serve.

Price Determination

Financial markets ascribe a value to the securities that are traded on it which are a function of the supply and demand of the associated security. We call this the “market price” since it is the market forces that drive a change in the price.

Funds Mobilization

The market also determines what return investors require for their invested funds. This, again, is a function determined by the borrowers and lenders of these funds. Those who are seeking funds are incentivized by the rate of return the investor expects. This, in a way similar to supply and demand, dictates what the rate of return should be in a way that efficiently mobilizes the lenders’ funds.

Liquidity

Liquidity plays an important function, readily allowing the exchange for assets and instruments for money at its market value during any time of a market’s trading hours. Without liquidity, investors are forced to retain their securities/instruments until the conditions needed for their sale are met (or if an instrument matures and a sale is obligatory), which entails risk.

Risk sharing

A financial market spreads the risk among its agents, which profits all parties involved and ultimately the economy itself. When risk is concentrated, far-reaching events such as the 2008 financial crisis can ensue.

Easy Access

The accessibility a market brings is valuable for investors with excess capital that want to invest quickly and easily. For parties raising funds, it is an easy way to find such investors and raise the capital they need.

Reduction in Transaction Costs

Usually, a lot of information is needed to carry out deals. Yet, financial markets make information about supply, demand and pricing transparent and accessible, thereby enabling a more efficient flow of trade. This translates into less time and lower costs of spent on transactions.

Overview of Financial Market Types and their Functions

In this section, we are going to discuss the 7 types of financial markets, what they trade in, the parties they bring together and how they function. Before that, however, we need to differentiate the two ways financial markets can work: exchange trading markets and Over-The-Counter (OTC) trading markets.

2 Ways of Organizing Trading

Exchange trading markets

This type of market is centralized through a single exchange with a concrete location through which all trading takes place. The operator of the centralized exchange serves as a trusted intermediary through which transactions between buyers and sellers are coordinated and settled. In exchange for their service, centralized exchanges typically charge transactional fees.

OTC trading markets

An over-the-counter (OTC) market is a decentralized market—meaning it does not have physical locations, and trading is primarily conducted in electronic form—in which market participants trade securities, currencies or other financial products directly between two parties without a broker. Generally, companies that trade on OTC markets are smaller than those that trade on primary markets, as OTC markets require less regulation and are cheaper.

7 Types of Financial Markets

The 7 main types of financial markets are (in no particular order)

Stock market

The stock market refers to the collection of markets and exchanges where buying, selling, and issuance of shares of publicly held companies take place. Such financial activities are conducted through institutionalized formal exchanges or OTC marketplaces which operate under a defined set of regulations.

Stocks can be traded without the use of an exchange OTC, in which case they are referred to as unlisted stocks. There may be multiple stock trading venues in a single region which allow transactions in stocks and other forms of securities. The New York Stock Exchange is by far the largest stock exchange in the world with a total market capitalization of more than $30 trillion.

Bond market

A bond is a security in which an investor loans money for a defined period at a pre-established interest rate. It is essentially an agreement between the lender and borrower that contains the details of the loan and its payments. Bonds are issued by corporations as well as by municipalities, states, and sovereign governments to finance projects and operations. Most bonds are traded through broker-dealers OTC. The bond market sells securities such as notes and bills issued by the United States Treasury, for example. The bond market also is called the debt market, credit market, or fixed-income market.

Commodity market

A commodity market is a physical or virtual marketplace for buying, selling, and trading raw or primary products. Hard commodities are typically naturally extracted resources, such as gold, oil, and rubber, and soft commodities are livestock or agricultural goods, such as pork, soy, and sugar.

Generally speaking, there are two parties trading commodities: investors speculating on the price looking to make a profit, and commercial/institutional users of the commodities. The most common way of ‘buying’ or ‘trading’ commodities is using futures contracts. This allows investors to speculate on the future value of commodities without the goods actually being exchanged. Because of this, most commodities are traded on a regulated exchange.

Money market

Typically, the moneymarkets trade in products with highly liquid short-term maturities (of less than one year) and are characterized by a high degree of safety and a relatively low return in interest – meaning high risk aversion. At the wholesale level, the money markets involve large-volume trades between institutions and traders. At the retail level, they include money market mutual funds bought by individual investors and money market accounts opened by bank customers. Individuals can also invest in the money markets for instance by buying short-term certificates of deposit (CDs), municipal notes, or U.S. Treasury bills.

Derivatives market

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index). Derivatives are secondary securities whose value is solely derived from the value of the primary security that they are linked to. Derivatives can be traded privately over-the-counter, but mainly, there are exchange-traded-derivatives that are traded through specific derivate exchanges or other exchanges.

Rather than trading stocks directly, a derivatives market trades in futures and options contracts, and other advanced financial products, that derive their value from underlying instruments like bonds, commodities, currencies, interest rates, market indexes, and stocks. An example would be a simple call option – the right to buy an underlying asset in the future at a pre-agreed price. It can be thought of as a bet, in a sense, with the bet pertaining to the future change in value of the underlying asset.

Consumer credit market

Consumer credit is a personal debt taken out very commonly by almost everyone at some stage in their life to purchase common goods and services. A credit card is a standard form of consumer credit. It is mostly issued through banks and institutions, and even though any type of personal loan could be labeled consumer credit, the term is usually used to describe unsecured debt that is taken on to buy everyday goods and services. A house, for example, is not usually considered to be a debt forming a part of this market since it is a long-term investment and is usually purchased with a secured mortgage loan.

Forex (foreign exchange) market

The forex (foreign exchange) market is the market in which participants can buy, sell, exchange, and speculate on currencies. As such, the forex market is the most liquid market in the world, as cash is the most liquid of assets. The currency market deals with more than $5 trillion in daily transactions. As with the OTC markets, the forex market is also decentralized, consisting of a global network of computers and brokers from all around the world. The forex market is made up of banks, commercial companies, central banks, investment management firms, hedge funds, and retail forex brokers and investors.

Mortgage market

The mortgage market can be split into the primary mortgage market and the secondary mortgage market.

The primary mortgage market is the market where borrowers can obtain a mortgage loan from a primary lender. Banks, mortgage brokers, mortgage bankers, and credit unions are all primary lenders and are part of the primary mortgage market. These are the ways in which prospective homeowners will consider taking out a mortgage.

The secondary mortgage market is where these primary mortgage loans and servicing rights are bought and sold between lenders and investors. A large portion of newly originated mortgages are sold by the lenders (usually a bank) who issue them into this secondary market, which allows them to issue further primary loans without running out of money. They are then packaged into mortgage-backed securities and sold to investors such as pension funds, insurance companies, and hedge funds.

Now that we have gained a basic understanding of the financial markets, their sub-sectors and functions, we are ready to dive into the digital asset revolution in part 2 of this series. Stay tuned!