Gold-backed cryptocurrencies are a subset of stablecoins whose value is tied to physical gold reserves. Each token represents fractional ownership of gold bars or coins stored by the token issuer or custodians. This provides token holders with convenient exposure to gold prices without dealing with directly owning bullion.

In this article, we will explore some of the most prominent gold-backed cryptocurrency projects including Tether Gold, PAX Gold, and Perth Mint Gold Token. Examining their unique features, benefits, and risks can help investors understand if these digital gold options are right for their portfolios.

Blending Old and New: Gold-Backed Cryptocurrencies

The volatility inherent to standalone cryptocurrencies has led many to explore ways of infusing digital assets with a form of intrinsic value. This sparked the creation of gold-backed cryptocurrencies – digital tokens directly pegged to physical gold reserves. Each coin or token represents fractional ownership of a set quantity of gold bars or bullion stored in secured vaults and custodian facilities.

In this model, cryptocurrency serves as a digitized proxy for direct ownership of scarce physical gold – a modern reimagining of currencies backed by gold reserves. The value of the token derives from and stays tethered to the underlying precious metal. This helps mitigate the wild price swings to which non-asset-based cryptos are prone. It provides a level of stability and a counterweight against inflation lacking in decentralized cryptocurrencies like Bitcoin.

Yet gold-backed crypto retains the 24/7 trading, rapid settlement speeds, and fractional ownership that makes digital currency so appealing. Tokens can readily be subdivided into tiny fractions of an ounce for accessible investing and transactions. By fusing the enduring, tangible value of gold with the flexibility of blockchain-based assets, gold-backed currencies aim to offer investors the best of both worlds. They present an intriguing hybrid – both a new way to own and transfer gold, and a stable gateway into the expanding universe of digital assets and decentralized finance.

How Gold-Backed Cryptocurrencies Work

The first step in creating a gold-backed cryptocurrency is for the issuing entity to obtain a sufficient reserve of physical gold. This is typically done by an asset management firm or a cryptocurrency startup. The gold is then third-party verified and stored with recognized custodial vaults and depositories to ensure its existence and safety.

Popular locations include insured vaults in Switzerland, London, Singapore, and Canada that meet high security and auditing standards. The gold reserves must be large enough to fully back the number of tokens to be put into circulation. The issuing entity also defines the token’s pegged backing ratio – for example, 1 token equals 1 gram or 1 troy ounce of gold.

Tokenization

With the reserves in place, software engineers build, audit, and deploy smart contracts on a blockchain like Ethereum to mint and manage the gold-backed tokens. Each token represents a proportional claim on the underlying physical gold. The tokens are then made available for purchase through cryptocurrency exchanges and trading platforms.

To keep the gold-backed tokens’ value closely tied to gold’s market price, the issuing entity facilitates ongoing price discovery and arbitrage. The company also oversees transparent accounting of the reserves to prove that enough gold exists to redeem every token in circulation.

Periodic professional audits provide further validation. Reserves are replenished when needed by purchasing additional gold bars. Some platforms even provide live video feeds of their vault inventory for real-time public monitoring.

Buying and Selling

From the investor’s perspective, purchasing a gold-backed token is similar to buying any other cryptocurrency. Here are the steps:

- Open an account on a supporting exchange,

- Verify your identity,

- Deposit fiat currency,

- And submit a buy order for the desired tokens.

The exchange holds custody of the tokens in your virtual wallet. Like other cryptocurrencies, it is essential to choose the best crypto wallet to keep your gold-backed tokens in a safe and secure condition.

Selling simply reverses this process – submitting a sell order that credits your account with the fiat value of redeemed tokens. Some platforms also allow redeeming tokens directly for physical gold bullion delivery.

Gold-backed cryptocurrency provides several advantages over direct physical gold ownership. As digital assets, the tokens are divisible into tiny fractional amounts, enabling smaller-scale investing and transactions. Transfers between parties are near-instant, inexpensive, and not dependent on armored couriers. Storage and security costs are largely eliminated as well, with the gold safely held in insured third-party vaults. Read more about digital gold vs physical gold to discover which one is a better investment for you.

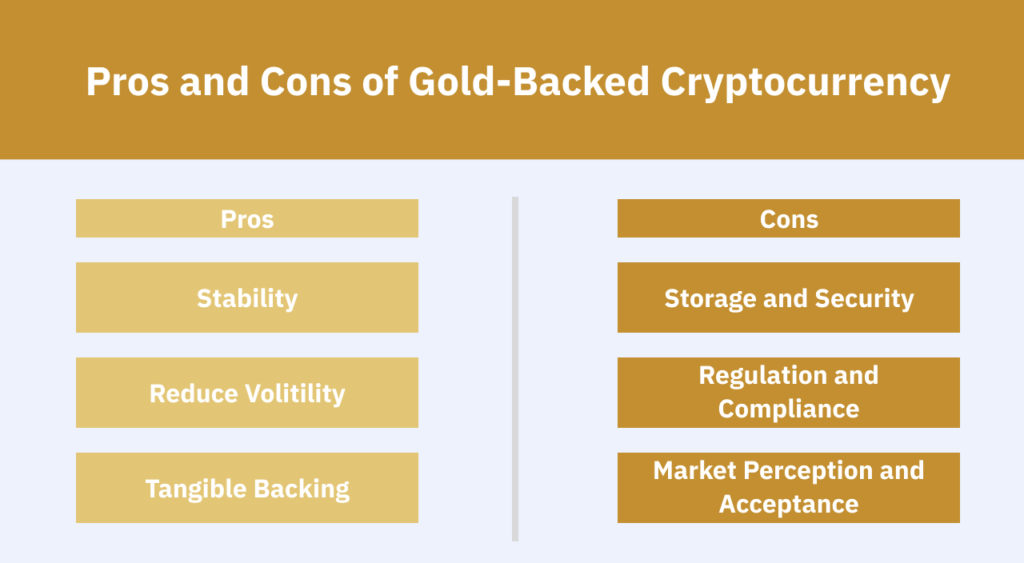

The Opportunities and Risks of Investing in Gold-Backed Crypto

Gold-backed cryptocurrencies offer several compelling benefits for investors. Their value is stabilized by being pegged to gold prices, providing protection from volatility compared to unbacked cryptos. This also makes them an effective inflation hedge unlike government-issued currencies.

Owning gold-backed tokens provides easy exposure to precious metals without the hassle of physical storage and security—instead, the gold reserves sit safely in insured vaults while tokens trade digitally. This opens up global liquidity and fractional gold ownership starting from low dollar amounts.

For those interested in blockchain and decentralized finance but wary of standard cryptocurrencies, asset-backed options present an appealing way to participate outside of traditional banking. However, several potential downsides also exist.

- Reliance on stable gold prices is not guaranteed.

- Questions around reserve auditing and accuracy persist in the industry.

- Compared to speculative cryptos, their limited upside may disappoint those hoping for outsized returns.

- Low trading volumes can also make tokens harder to buy and sell versus more standard assets.

- Regulatory uncertainty also looms over all cryptocurrencies.

- While asset backing reduces some risk, gold-backed cryptos may still underperform direct gold or diversified holdings in rougher markets.

Careful research is advised before significant investment.

Leading Players in the Gold-Crypto Market

In the following section, we will take a closer look at some of the most prominent gold-backed cryptocurrency projects in today’s market. Highlighted will be details about each token’s gold reserves, partnering institutions, and current trading platforms. Learning about the approach and infrastructure of leaders in this niche space can help provide context around both the opportunities and challenges involved with digital currencies backed by real precious metals.

1- Tether Gold (XAUT)

Tether Gold (XAUT) is a gold-backed cryptocurrency issued by Tether, the company behind the popular stablecoin USDT. XAUT was launched in early 2020 as a way to tokenize ownership of physical gold on the blockchain.

Each XAUT token represents ownership of one troy ounce of gold held in Tether’s reserves. The gold bars are stored in secured vaults in Switzerland and meet the London Bullion Market Association’s standards for trading. XAUT offers token holders direct exposure to gold prices and the ability to redeem tokens for physical gold bars.

Pros:

- Trusted issuer – Tether has significant experience with asset-backed tokens.

- High liquidity – Can be easily traded on cryptocurrency exchanges.

Cons:

- Centralized model – Tether controls the token supply and reserves.

- High minimum purchase – Buying directly from Tether requires 50+ tokens.

2- DigixGlobal (DGX)

DigixGlobal is one of the earliest and most well-known gold-backed cryptocurrencies. It was launched in 2016 after being funded by an initial coin offering (ICO). DigixGlobal wanted to tokenize gold on Ethereum to make it more accessible and tradable.

Each DGX token represents 1 gram of gold cast into bars by approved refiners like PAMP. The gold bars are securely stored in vaults in Singapore and Canada. Digix provides quarterly audits by third party companies to verify its gold reserves match the supply of DGX tokens.

Pros:

- Transparent reserves publicly verifiable on the blockchain.

- Relatively low fees compared to other gold investment options.

Cons:

- Concerns previously about company jurisdiction and governance.

- As an older project, DGX has lower liquidity than newer gold tokens.

3- Perth Mint Gold Token (PMGT)

The Perth Mint Gold Token (PMGT) was launched in 2020 and is backed 1:1 by GoldPass certificates issued by the Perth Mint. The Perth Mint is operated by Gold Corporation, which is wholly owned by the Government of Western Australia.

PMGT provides a simple way to gain exposure to Perth Mint gold products. Tokens can be redeemed for cast bars, minted coins, and even LBMA London Good Delivery gold bars. The gold reserves are guaranteed by the government, providing users assurances on the token’s backing.

Pros:

- No storage, transaction, or management fees for users.

- Gold reserves are publicly verifiable through the Perth Mint’s published accounts.

Cons:

- Tokens only redeemable through Perth Mint after undergoing KYC.

- Limited primarily to Australian investors initially.

4- PAX Gold (PAXG)

PAX Gold (PAXG) is a regulated digital gold token created by Paxos Trust Company in late 2019. PAXG is an ERC-20 token pegged 1:1 with a troy ounce of London Good Delivery gold bars stored by Paxos.

The gold reserves backing PAXG are kept in professional vaults globally and are audited monthly by top accounting firms. PAXos is regulated by the New York State Department of Financial Services. This provides assurances for users on the legitimacy of PAXG’s gold reserves.

Pros:

- Trusted issuer with regulatory oversight.

- No storage fees charged to users.

Cons:

- High minimum direct purchase of 0.01 PAXG.

- Availability limited to supported exchanges so far.

5- Meld Gold by Algorand (MCAU)

Meld Gold is a gold-backed cryptocurrency hosted on the Algorand blockchain. It was launched in 2021 by Australian company Meld as a way to tokenize gold ownership. Each MCAU token represents 1 gram of gold stored by Meld in certified vaults across Australia.

The Algorand blockchain allows for features like atomic swaps between MCAU and other cryptocurrencies. Users can also redeem tokens through Meld’s website in exchange for gold certificates or bullion.

Pros:

- Smooth redemption process directly with Meld.

- Supports decentralized features of Algorand blockchain.

Cons:

- As a new project, MCAU has lower liquidity and exchange support.

- Limited public information on gold reserves and audit processes.

6- GoldCoin (GLC)

GoldCoin is one of the earlier gold-backed cryptocurrency projects, initially launched in 2013. It utilizes a proof-of-work mining structure similar to Bitcoin. Each GLC token represents 1/1000 ounce of gold.

GoldCoin has built a strong community base over the years. It offers some unique features like the ability to purchase GLC tokens directly through GoldCoin ATMs using cash.

Pros:

- Low cost per token makes accumulation easy.

- Strong community support and development.

Cons:

- Lower exchange adoption leads to limited liquidity.

- Less transparency than newer gold-backed options.

7- AurusGOLD (AWG)

AurusGOLD (AWG) is a gold-backed cryptocurrency developed by Aurus. Each AWG token represents 1 gram of LBMA-accredited gold held in Aurus’ vaults. The gold is sourced from approved refineries that meet London Good Delivery standards.

Holding AWG tokens provides a convenient way to accumulate gold without dealing with storage and physical possession. The tokens can be easily traded or transferred to other cryptocurrency wallets. Aurus handles securing the underlying physical gold reserves.

Pros:

- Gold backing by LBMA-approved refineries provides trusted sourcing.

- Tokens make accumulating small gold amounts affordable.

Cons:

- Limited exchange support results in lower adoption so far.

- High minimums required for redeeming tokens for gold bullion.

8- Kinesis Gold (KAU)

Kinesis Gold (KAU) is a digital token issued by Kinesis Money based in the Cayman Islands. Holders of KAU own the rights to an allocated amount of physical gold securely stored by Kinesis.

The Kinesis blockchain allows KAU transactions to be completed rapidly, with typical settlement times of around 3 seconds. KAU can be highly divided down to 0.001 grams of gold per token.

Pros:

- Innovative yield-bearing fee structure for holding KAU.

- Fast transaction settlement times on blockchain.

Cons:

- KYC required for buyers, concerns over audit transparency.

- Tokens are only redeemable directly through Kinesis.

Other Notable Gold-Backed Cryptocurrencies

In addition to the major projects covered, there are other emerging gold-backed cryptocurrencies like CACHE Gold (CGT), AABBG Gold token, and Euro Gold (EUG). While details vary, they provide tokenized gold ownership and similar benefits like easy divisibility and transfers.

However, lower liquidity and unproven backing make them higher risk options currently. As the market matures, leading projects will likely solidify while sketchier options get weeded out.

Conclusion

Cryptocurrencies with fractional gold reserves backing offer a compelling fusion of the reliability of tangible assets and the convenience of digital currencies. They provide a more stable haven from crypto volatility and inflation compared to fiat currencies. But risks around transparency and auditing should be evaluated thoroughly when choosing a gold-backed token.

While regulatory uncertainty persists in the crypto industry as a whole, high compliance standards and ties to physical gold help mitigate concerns. As blockchain finance continues maturing, gold-backed cryptocurrencies are poised to gain increasing traction among investors who appreciate the enduring history and utility of gold.

FAQs

Gold-backed crypto is considered relatively safer compared to standalone cryptocurrencies like Bitcoin due to its stability from being pegged to gold. However, all cryptocurrencies carry risks from volatility, lack of regulation, and cybersecurity issues. Gold-backed tokens have lower risk profiles than non-asset linked coins, but do your own due diligence before investing.

Some gold-backed cryptocurrencies allow redeeming tokens for physical gold bullion, while others only offer redemption into fiat currency. Investigate the redemption terms before purchasing any gold-backed crypto. For example, Pax Gold (PAXG) tokens are redeemable for London Good Delivery gold bars directly from Paxos Trust.

The physical gold reserves that collateralize gold-backed cryptos are stored in professional vaults and depositories around the world. These facilities meet stringent security and auditing standards, like being fully insured Lloyd’s of London policies and ISO certified. Storing reserves in geopolitically stable locations like Switzerland, London, and Singapore also enhances protection.