What is Digital Gold?

We all know gold physically; it’s a shiny and precious metal most people buy to turn their money into a valuable thing or an investment. However, there are some problems with storing physical gold, from the risks of theft to requiring a space! That’s why the concept of digital gold has emerged.

Digital gold is a mode of buying and selling gold digitally without storing it physically. They can be bought and sold online through various platforms, such as mobile e-wallets, brokers, or banks. The value of digital gold you buy online equals physical gold of 24 karat purity.

In fact, you are buying that gold, but you don’t store it in your treasury. Furthermore, you can request to deliver the physical gold equivalent to digital gold whenever possible. Let’s check out some of its advantages.

Digital Gold Advantages

- Digital gold allows investors to buy and hold gold electronically. It’s often backed by physical gold reserves and offers convenience and liquidity.

- It can be purchased in small denominations, making it obtainable to more investors.

- Digital gold is often seen as a more convenient way to invest, with features like easy storage, no concerns about security, and quick transactions.

Digital Gold Disadvantages

- Any authority, such as RBI or SEBI, does not regulate it. It may face legal or compliance issues in the future.

- For some people, buying gold that they can’t physically own is still risky.

- Some lenders or merchants may not accept it as collateral or payment.

What is Physical Gold?

Physical gold refers to actual gold bars, coins, or jewelry. Owning physical gold provides tangible ownership of the metal.

It’s a traditional store of value and a hedge against economic instability. Physical gold can be held, displayed, or passed down as a physical asset. However, physical gold requires safe storage, may incur additional costs (like insurance and secure storage), and can be less liquid than digital gold.

Physical Gold Advantages

- Physical gold is not dependent on any third party or intermediary to maintain its value or validity. This precious asset has a long history of being a store of value that can retain its purchasing power over time.

- When it comes to investing, physical gold can protect you from inflation, deflation, currency devaluation, hyperinflation, or market crashes.

- Unlike other assets or transactions requiring personal information, identification, or verification, physical gold can be bought or sold with cash or anonymously.

Physical Gold Disadvantages

- Buying physical gold usually comes with additional costs, such as fabrication, transportation, storage, insurance, and dealer commissions. These costs can reduce your profit margin when you sell your physical gold.

- You must find a secure place to store the physical gold, which may come with costs, like buying a safe box or renting a vault.

- Storing physical gold comes with risks of being stolen, lost, or damaged.

Which One is a Better Investment? Digital Gold or Physical Gold?

While both have pros and cons, digital gold is believed to offer some clear advantages over its physical counterpart. However, the choice between digital and physical gold ultimately depends on individual preferences and investment goals.

Here are just a few of the advantages that digital gold has over physical gold:

Convenience and Flexibility

It’s easy to buy digital gold at the convenience of your home. You don’t need to be physically available while buying it. Furthermore, you can easily keep track of your assets as you can see up-to-date prices and account balances in real-time.

Security

Although none of them is 100% secure, when it comes to security, digital gold wins the game. Digital gold is stored securely in the cloud, so you won’t have to worry about it getting stolen or damaged like you would with physical gold. It’s also protected by various layers of encryption technology, making digital gold one of the safest investments.

Low Fees

As mentioned, buying and trading physical gold comes with extra expenses, making your investment less profitable than buying it online. With digital gold, you get to skip all the extra costs associated with physical gold investing, as trades are typically executed almost instantaneously without any fees.

Accessibility

Digital gold is globally accessible, allowing you to purchase and trade it from anywhere in the world. Furthermore, digital gold can be easily converted to other currencies.

So, if you’re looking for a secure and convenient way to invest in gold – digital gold is definitely worth considering! It’s easy to use, highly secure, incredibly flexible and comes with low fees. Plus, it’s accessible from anywhere worldwide – making it an ideal option for savvy investors who want to diversify their portfolios.

Digital gold is a great way to invest in gold without worrying about storage and transport costs. With its convenience and wide range of features, digital gold has become one of the hottest commodities on the market. So don’t hesitate to try it- you might be pleasantly surprised!

How to Buy Digital Gold?

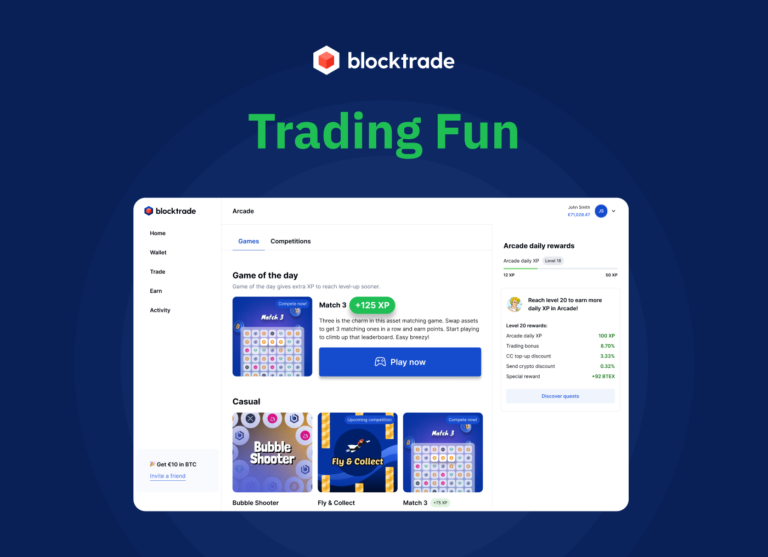

You can easily buy digital gold on Blocktrade via Pax Gold, a stablecoin with equal value to gold. Follow these steps to buy digital gold safely:

- Sign up on Blocktrade and search for digital gold (PAXG) on the panel. You can either buy this coin with other cryptocurrencies you have or pay in Euro.

- You can either keep your digital gold at Blocktrade platform or choose a safe and secure wallet to keep them. In this case, it’s essential to know how to choose a crypto wallet to select the one most suitable for what you want to do, and keep your public and private keys secure to avoid any theft.

What is Pax Gold?

To make gold more tradeable in the digital world, the creators of Paxos Standard (PAX) launched a gold-backed cryptocurrency called Pax Gold (PAXG), which is an ERC-20 token with a value equal to physical gold. PAXG allows investors to buy indefinitely small amounts of gold through cryptocurrency.

Each PAXG token is linked to one fine troy ounce of gold stored in LBMA vaults in London. PAXG gives you ownership of Paxos Trust Company’s physical gold in custody.

You should note that the Paxos Trust Company has another stablecoin equal to the US dollar, called USDP. PAXG and USDP are different coins with different use cases.

Conclusion

When investing in gold, there’s no denying that digital gold has emerged as a superior option. It’s incredibly convenient, highly secure, and offers investors leverage and great returns. So, if you’re looking for an investment option that will help you maximize your wealth – digital gold is the way to go.

So what are you waiting for? Get started on your journey towards a more profitable portfolio today with digital gold! You won’t regret it!